Trust Accounting Form For Irs

Description

How to fill out Qualified Income Miller Trust?

- If you’re a returning user, log in to your account and download your required form template directly.

- Verify that your subscription is active. If it's expired, renew it based on your payment plan.

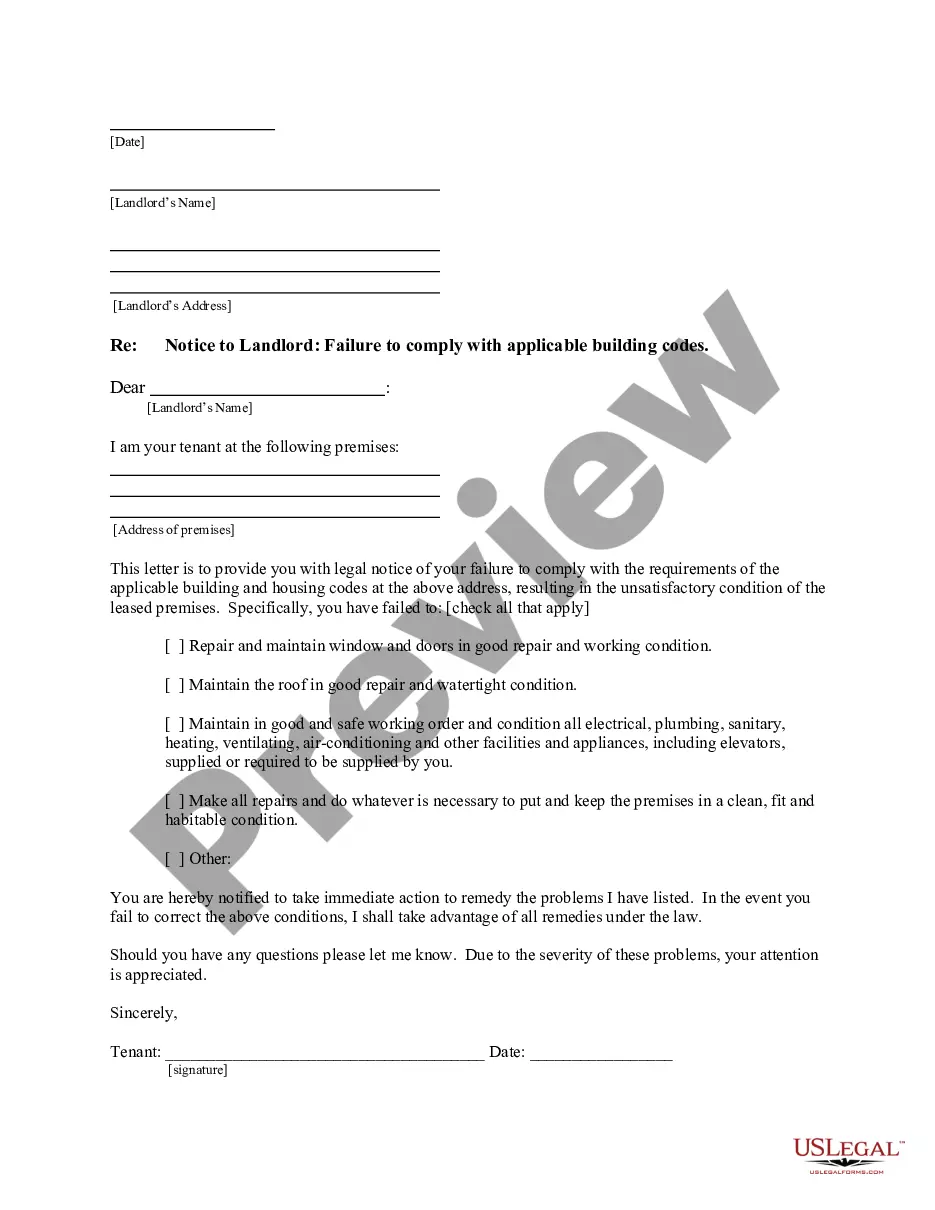

- For first-time users, start by reviewing the Preview mode and description of the selected trust accounting form. Ensure it aligns with your jurisdiction's requirements.

- If the form doesn't meet your needs, use the Search option at the top to find an alternative.

- Once you find the right template, click the Buy Now button and select your preferred subscription plan. You’ll need to create an account to access the entire library of resources.

- Proceed to purchase by entering your credit card information or opting for PayPal to complete the transaction.

- Finally, download your trust accounting form directly to your device. You can access this document anytime through the My Forms section of your profile.

With US Legal Forms, users benefit from a robust collection of legal templates designed for affordability and reliability. The service not only provides access to a broad array of forms but also premium expert assistance to ensure accuracy.

Start simplifying your legal documentation process today! Visit US Legal Forms to explore the extensive library and efficiently handle your legal needs.

Form popularity

FAQ

Yes, trust tax returns can often be filed electronically, specifically using Form 1041 if it meets the e-filing requirements. E-filing this trust accounting form for IRS enhances accuracy and expediency, ensuring your submission is processed timely. Utilizing suitable software or platforms can make this process seamless. By taking advantage of technology, you streamline your tax responsibilities.

For a trust, you would typically use IRS Form 1041. This form functions as the trust accounting form for IRS, ensuring that income, deductions, and tax obligations are reported correctly. Depending on the trust's circumstances, additional schedules may also be required. Familiarizing yourself with this form can help you navigate trust taxation with confidence.

Certain IRS forms cannot be filed electronically, including some variations of the estate tax return and trust tax forms. It is crucial to verify which forms are eligible for e-filing to avoid complications. The trust accounting form for IRS is often subject to specific requirements, so always check the latest guidelines provided by the IRS. Staying informed can save you time and effort.

Currently, you cannot file an estate tax return electronically. The IRS requires Form 706, the estate tax return, to be submitted through paper filing. However, ensuring that you accurately fill out this form allows you to address all aspects of the trust accounting form for IRS effectively. Consider using USLegalForms to access templates that simplify the preparation process.

Any fiduciary of a trust or estate must file IRS Form 1041 if the trust has gross income of $600 or more. This form captures essential financial details and ensures accurate reporting. By understanding your responsibility concerning this trust accounting form for IRS, you can maintain compliance. It’s advisable to consult a tax professional if you have questions about your specific situation.

To obtain an IRS transcript for a trust, you can request it online or via mail. The transcript will provide necessary information about your trust accounting form for IRS, including income and deductions reported. This is particularly helpful for tracking compliance and preparing for future filings. Make sure to have your trust’s details ready to facilitate the process.

Yes, a charitable remainder trust can be e-filed. This option is available to ensure that your trust accounting form for IRS is submitted efficiently and securely. E-filing simplifies the process and often provides quicker confirmation from the IRS. Utilizing the right software can ensure that your form is filed correctly.

Yes, you can file Form 5227 electronically. The IRS allows for electronic submission of this trust accounting form for IRS, helping you streamline the filing process. By using e-filing, you can improve the accuracy and speed of your submission. Additionally, choosing this method reduces the chances of errors often associated with paper forms.

Yes, filing a tax return for a charitable remainder trust is necessary, as it often generates income that must be reported. You will typically file Form 1041 along with Form 5227 to fulfill all IRS requirements. Ensuring these forms are accurately completed helps maintain compliance while allowing for the appropriate deductions. Incorporating insights from the trust accounting form for IRS can simplify this reporting process.

If you maintain a charitable remainder trust, you generally need to file both a 1041 and a 5227. The 1041 reports the income generated by the trust, while the 5227 documents the trust's distributions. Filing both forms ensures compliance with IRS regulations regarding trusts. By keeping up to date with the trust accounting form for IRS, you can effectively manage your obligations.