Trust Accounting Form For Dummies

Description

How to fill out Qualified Income Miller Trust?

- Log in to your US Legal Forms account if you're a returning user. If your subscription is expired, renew it based on your payment plan.

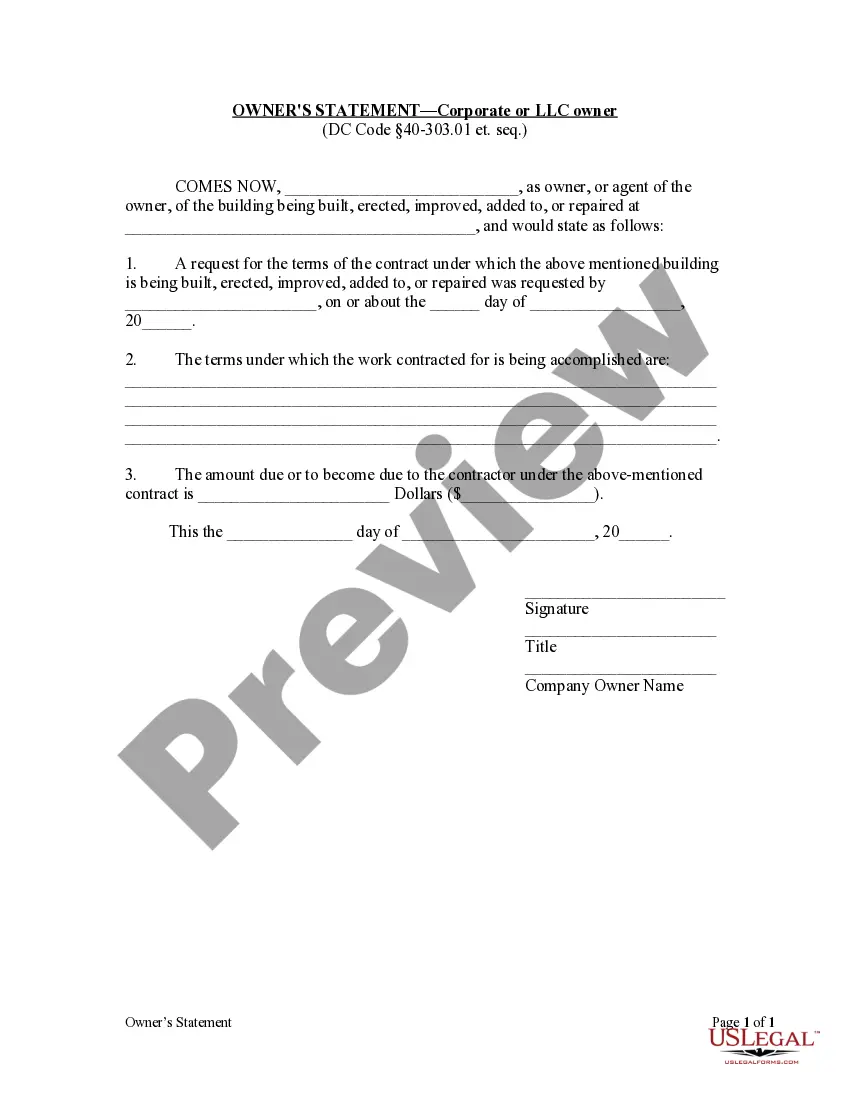

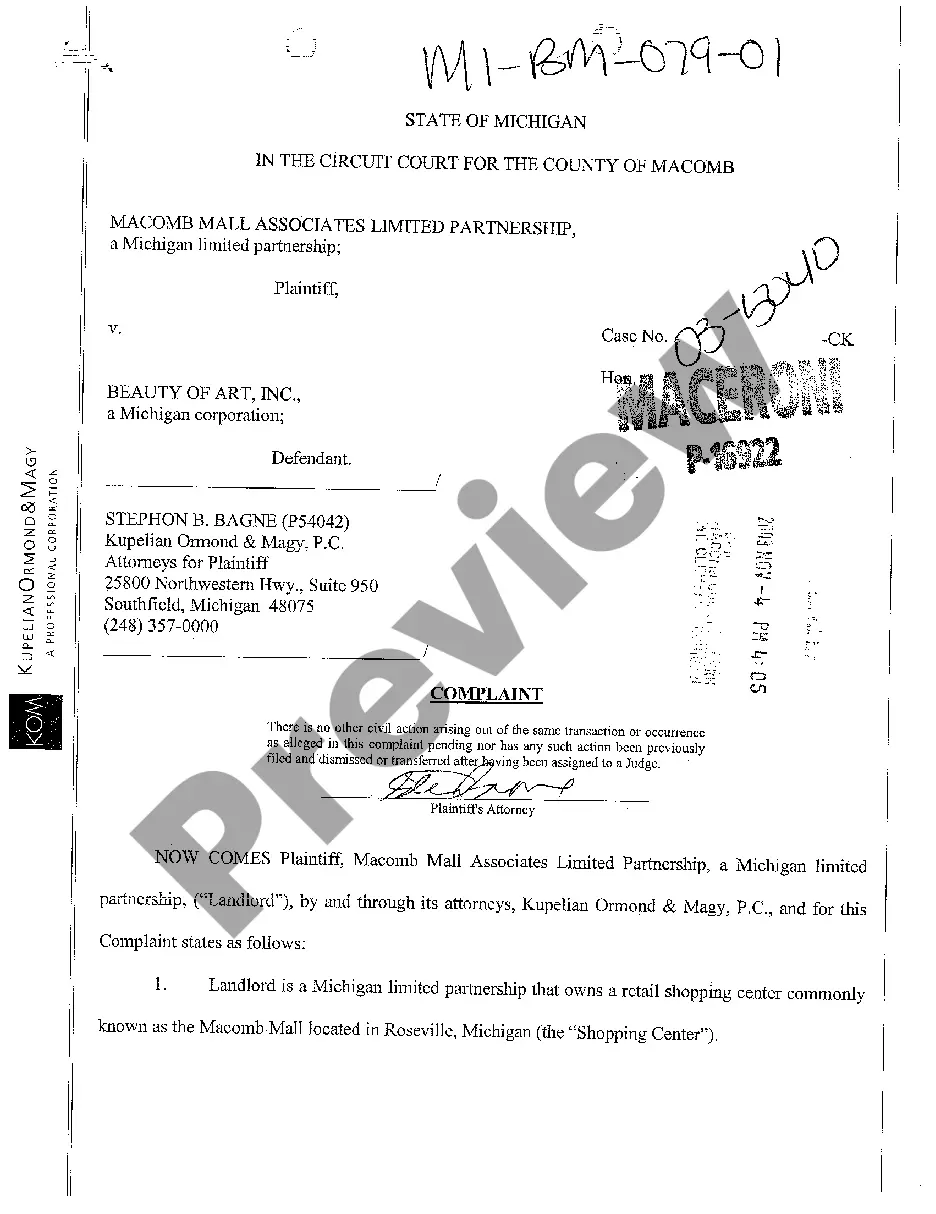

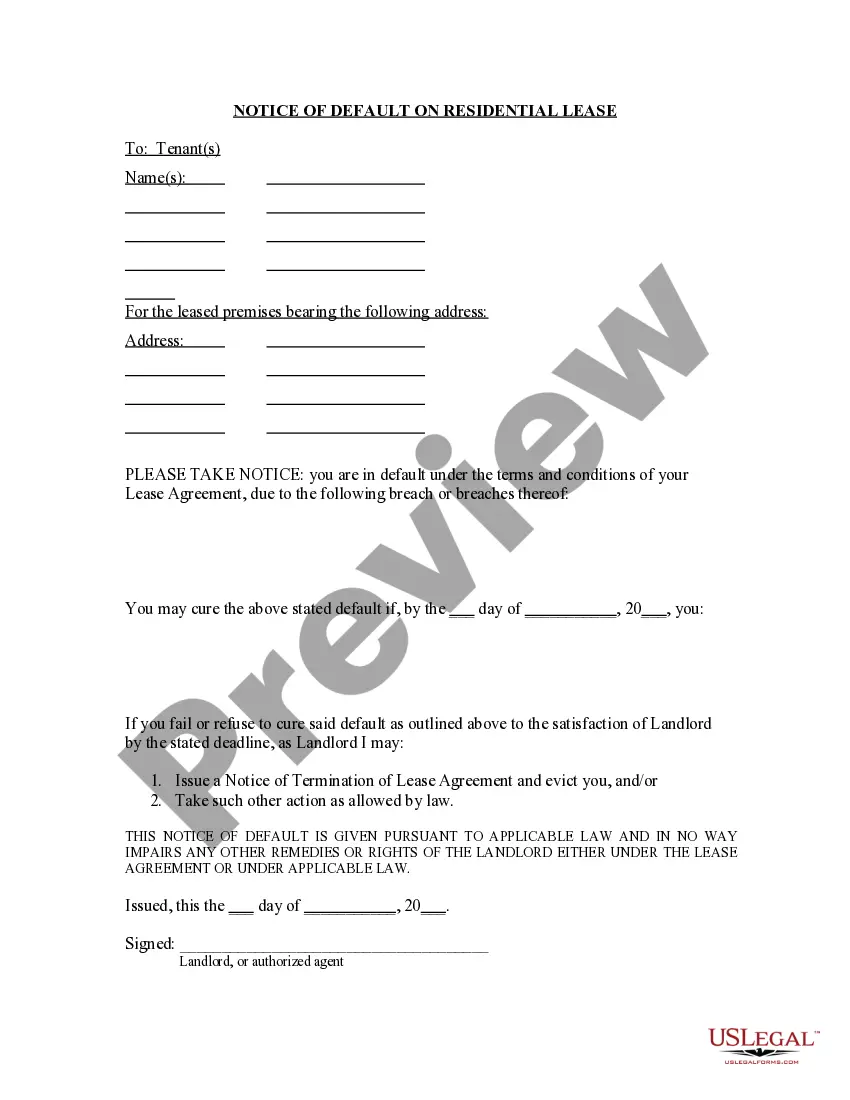

- In the Preview mode, review the form description carefully. Confirm that it matches your jurisdictional requirements.

- If the selected template doesn’t meet your needs, utilize the Search tab to find alternative forms.

- Once you find the right document, click on the Buy Now button and select your preferred subscription plan. You'll need to create an account to access the library.

- Enter your payment information using a credit card or PayPal to complete the purchase.

- Download your chosen form and save it to your device. You can access it later in the My Forms section of your profile.

In conclusion, US Legal Forms empowers users to efficiently obtain legal documents with its extensive library and supportive resources. By following these steps, you can confidently fill out and utilize your trust accounting form.

Don't hesitate to explore the available forms today and streamline your legal documentation process!

Form popularity

FAQ

The accounting standards for trusts are designed to ensure transparency and accountability. They require accurate reporting of income, expenses, and distributions. By following guidelines outlined in a trust accounting form for dummies, you can meet these standards while safeguarding beneficiaries' interests. This also promotes trust and compliance within your financial management.

Bookkeeping for a trust involves maintaining a detailed record of all transactions related to trust assets. You begin by organizing receipts, invoices, and bank statements. Utilizing a trust accounting form for dummies can streamline this process, ensuring that you capture all financial activities and adhere to trust laws. This approach helps avoid potential legal pitfalls.

Yes, QuickBooks can be an effective tool for trust accounting. It allows you to create specific accounts dedicated to trust funds, making it easier to monitor client balances. With a trust accounting form for dummies, you can navigate QuickBooks' features to ensure compliance and accurate reporting. This integration enhances your bookkeeping efficiency.

To record trust accounts correctly, start by using a reliable accounting system. Establish separate accounts for each client to ensure clear tracking of their funds. Utilize a trust accounting form for dummies to simplify your entries. This form will help you categorize transactions accurately and adhere to legal requirements.

When considering a trust accounting form for dummies, it’s important to know that certain assets may not be suitable for inclusion in a trust. For instance, personal property like vehicles or collections can complicate the trust's management. Additionally, retirement accounts such as 401(k)s and IRAs typically require specific beneficiary designations, making them less ideal for trust inclusion. It’s always wise to consult with a legal expert to evaluate your particular situation.

Calculating accounting income for a simple trust involves tallying all income generated from trust assets, such as interest or dividends, while deducting allowable expenses. You will need to maintain detailed records to determine net income accurately. Consider using a Trust accounting form for dummies, which facilitates this calculation by providing an organized format to track your entries.

The trust accounting process begins with collecting all financial information related to the trust. Next, you will categorize and log each transaction, followed by preparing a report summarizing the trust's financial status. Adopting a Trust accounting form for dummies helps simplify these steps, making the entire process more manageable.

Basic bookkeeping of a trust account involves recording all financial activities such as deposits, withdrawals, and distributions. This keeps a clear trail of where funds are sourced and how they are utilized. Using a Trust accounting form for dummies provides an easy structure to maintain these records accurately and efficiently.

To prepare a trust accounting, first, list all transactions chronologically, categorizing them into income and expenses. Ensure to document any distributions to beneficiaries accurately. Using a Trust accounting form for dummies can help you stay organized and make sure you are covering all essential elements without missing important information.

A trust accounting typically includes a detailed record of all income received, expenses incurred, and distributions made to beneficiaries. You should also include a balance sheet summarizing the trust's assets and liabilities. By following a Trust accounting form for dummies, you can ensure that you capture all necessary details in a clear format.