The Miller Trust With Texas

Description

How to fill out Qualified Income Miller Trust?

It’s well known that you can’t transform into a legal expert instantly, nor can you swiftly learn how to create The Miller Trust With Texas without possessing a specialized skill set.

Assembling legal documents is a lengthy endeavor that demands specific education and expertise. So why not entrust the drafting of The Miller Trust With Texas to the experts.

With US Legal Forms, one of the most extensive legal template collections, you can discover everything from court records to templates for internal communications.

You can regain access to your files from the My documents section at any time. If you’re a current client, you can simply Log In, and find and download the template from the same section.

Regardless of your document requirements—be they financial, legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the document you require using the search feature at the top of the webpage.

- Preview it (if this functionality is available) and examine the accompanying description to assess whether The Miller Trust With Texas meets your needs.

- Initiate your search once more if you require any additional documents.

- Create a complimentary account and choose a subscription plan to acquire the document.

- Click Buy now. Once the payment is processed, you can obtain The Miller Trust With Texas, complete it, print it, and dispatch it to the relevant individuals or entities.

Form popularity

FAQ

You might need a Miller trust to qualify for Medicaid while having income above the standard limits. This trust allows you to manage excess income in a way that makes you eligible for necessary long-term care. Additionally, it provides a structured approach to allocate funds precisely for medical expenses, ensuring that more of your resources go toward your healthcare needs. Consider how the miller trust with Texas can be an essential tool in your financial planning.

The first step to opening a Miller Trust is identifying all income in excess of the monthly Medicaid gross income limit. Once you determine the sources of excess income, an estate planning attorney will draw up a trust document.

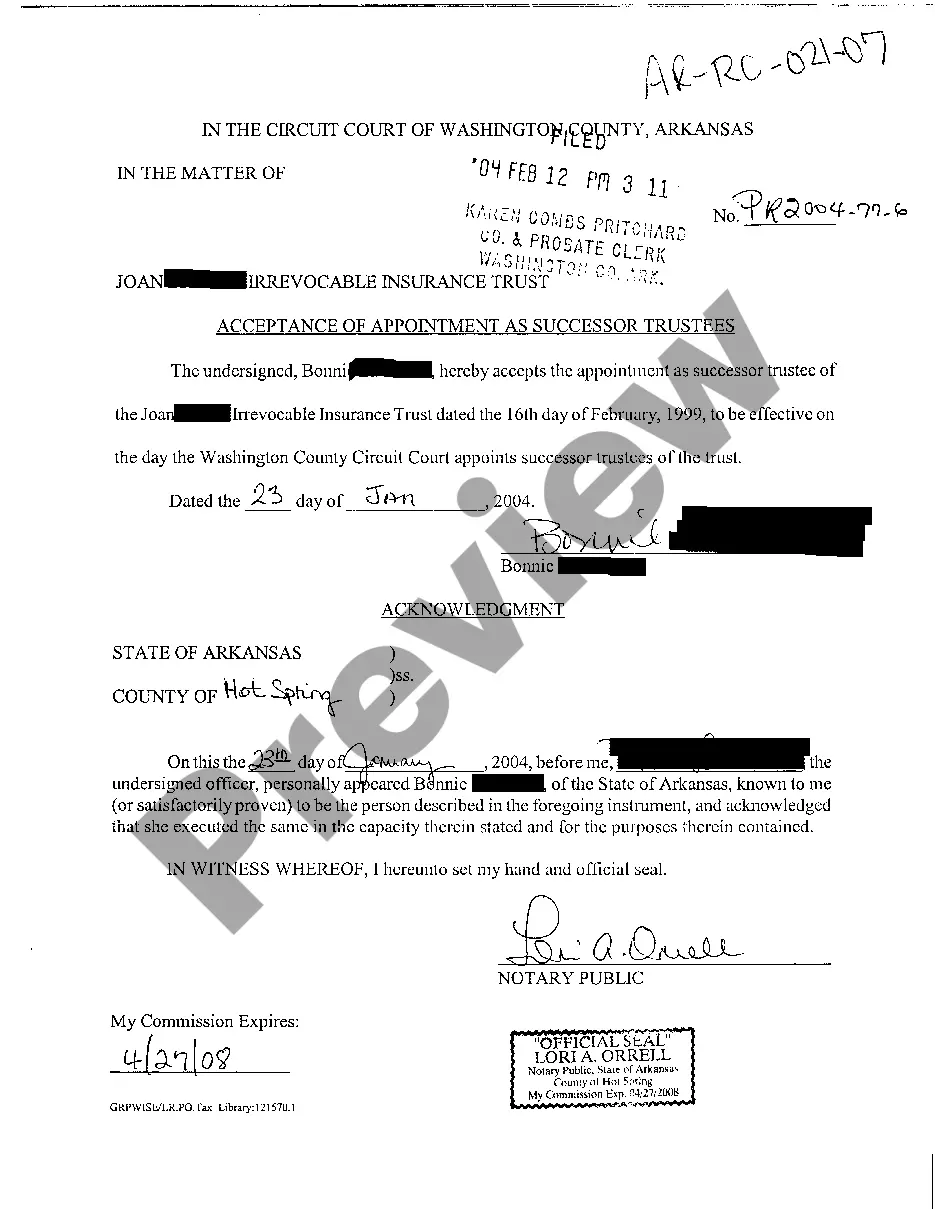

The state in which the Medicaid recipient will be receiving long-term care benefits must be named as the beneficiary, and upon the death of the individual, the state will receive any funds it paid into the Miller Trust that were unused. The trust is irrevocable, which means that it cannot be altered or cancelled.

A Miller Trust is specifically designed to qualify an individual for Medicaid benefits by diverting all income into the trust. Income diverted to the trust is not counted as income for purposes of Medicaid eligibility when attempting to qualify for nursing home care. A Miller Trust can only hold the applicant's income.

How do I set up a Qualified Income Trust? A lawyer creates the trust documents, which are then signed and notarized by both the settlor (beneficiary) or the settlor's (beneficiary's) agent under a power of attorney, and the trustee.

Medicaid Asset Protection Trusts are irrevocable living trusts that allow you to preserve your assets and give ownership to a designated beneficiary. Because you no longer own this property, Medicaid recovery efforts won't be able to touch these funds should you need long-term care assistance.