Custodial Parent Under With Grandparent

Description

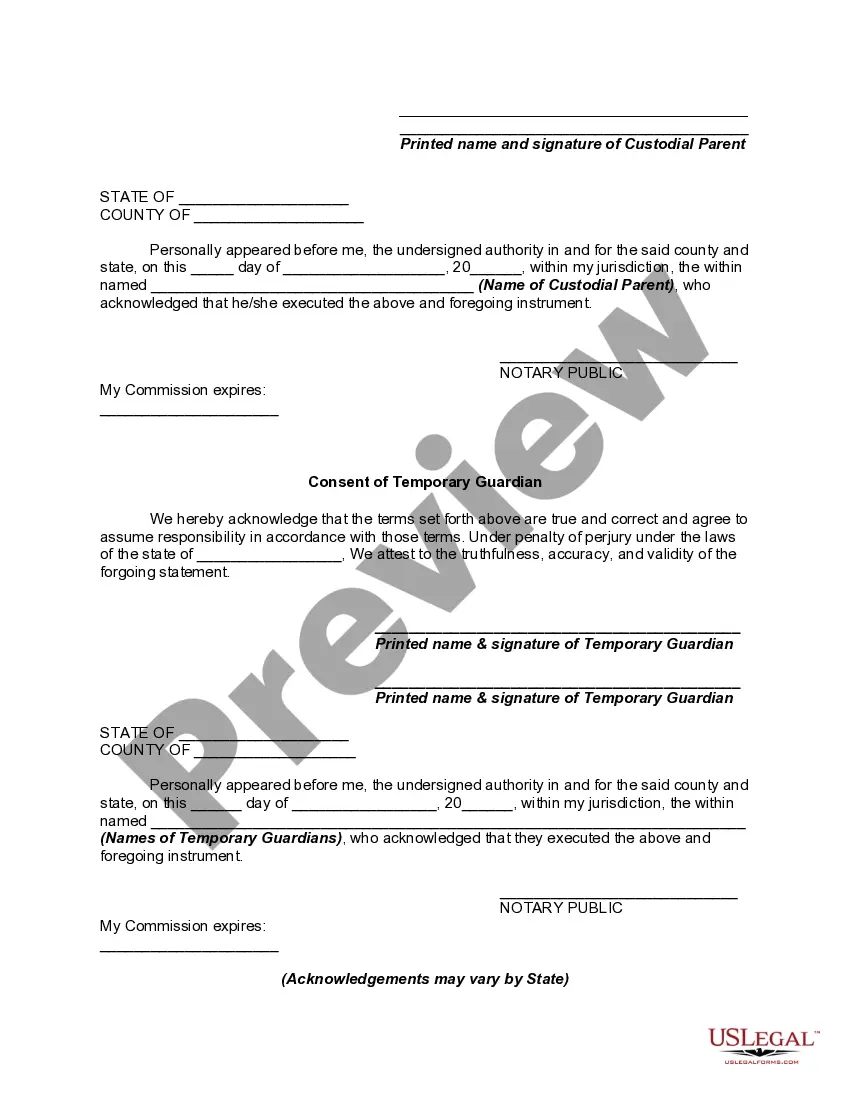

How to fill out Temporary Guardianship Agreement With Detailed Authorization Regarding The Acquiring Of Medical Care For Minor Children - Including Consent Of Temporary Guardians?

It’s clear that you cannot transform into a legal specialist instantly, nor can you discover how to swiftly prepare Custodial Parent Under With Grandparent without possessing a particular skill set.

Developing legal documents is a labor-intensive task necessitating specific training and expertise.

So why not entrust the crafting of the Custodial Parent Under With Grandparent to the professionals.

You can access your forms again from the My documents tab at any time.

If you’re a current customer, you can simply Log In and find and download the template from the same tab.

- Find the form you require by utilizing the search bar at the top of the page.

- View it (if this option is available) and read the accompanying description to determine if Custodial Parent Under With Grandparent is what you’re looking for.

- Begin your search anew if you require a different form.

- Create a free account and select a subscription plan to acquire the template.

- Click Buy now. Once the payment is processed, you can obtain the Custodial Parent Under With Grandparent, complete it, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

One of the biggest mistakes you can make in a custody battle is failing to prioritize your child's well-being. Courts look for a stable environment for children, which involves being cooperative and open to communication. If you create an adversarial atmosphere, it may harm your case as the custodial parent under with grandparent. Consider using resources like US Legal Forms to navigate these challenges effectively.

If the grandparent's AGI is higher than the AGI of any parent who can claim the child, the grandparent can claim the child as a qualifying child for the EITC if no parent of the child who can claim the child actually claims the child for any of the child-related tax benefits (an exception allows the noncustodial parent ...

The Child Will Gain Control at a Relatively Young Age Parents or grandparents must establish a minor child's custodial account under the applicable state Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA). Most states have UTMA regimes these days.

Grandparent alienation is a type of elder abuse, a term for the mistreatment of older people in a society. It occurs when grandparents are unreasonably denied meaningful opportunities to have a relationship and spend time with their grandchildren.

Custodial grandparents who are providing primary care and have legal responsibility for a child often become involved due to significant stresses, such as a parent's mental or emotional health concerns, physical illness or death, substance abuse difficulties or parental incarceration.

Once the minor reaches adulthood (which depends on the law of the state that governs the UGMA or UTMA), the custodian must turn over all the assets remaining in the account to the former minor. Any adult family member, court-appointed guardian, or organization can agree to act as custodian of the account.