Compiled financial statements represent the most basic level of service that certified public accountants provide with respect to financial statements. In a compilation, the CPA must comply with certain basic requirements of professional standards, such as having a knowledge of the client's industry and applicable accounting principles, having a clear understanding with the client as to the services to be provided, and reading the financial statements to determine whether there are any obvious departures from generally accepted accounting principles (or, in some cases, another comprehensive basis of accounting used by the entity). It may be necessary for the CPA to perform "other accounting services" (such as creating a general ledger for the client, or assisting the client with adjusting entries for the books of the client (before the financial statements can be prepared). Upon completion, a report on the financial statements is issued that states a compilation was performed in accordance with AICPA professional standards, but no assurance is expressed that the statements are in conformity with generally accepted accounting principles. This is known as the expression of "no assurance." Compiled financial statements are often prepared for privately-held entities that do not need a higher level of assurance expressed by the CPA.

Engagement Letter For Bookkeeping

Description

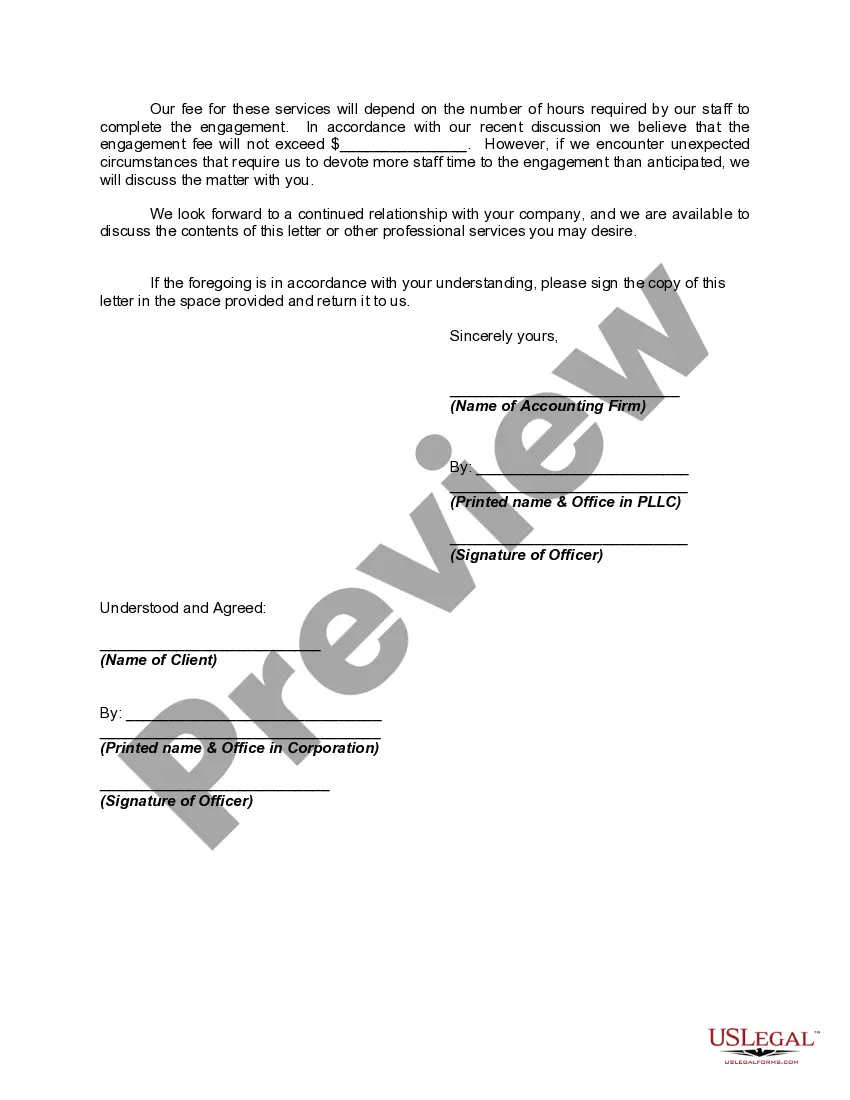

How to fill out Engagement Letter For Review Of Financial Statements And Compilation By Accounting Firm?

Utilizing legal frameworks that comply with federal and local regulations is crucial, and the web presents numerous choices to choose from.

However, what’s the benefit in spending time searching for the appropriately crafted Engagement Letter For Bookkeeping example online when the US Legal Forms digital repository already houses such templates collected in one location.

US Legal Forms is the largest online legal archive with over 85,000 fillable documents created by lawyers for any commercial and personal situation.

Review the template using the Preview function or through the text outline to ensure it fulfills your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our professionals keep up with legal updates, so you can always trust your documentation is current and compliant when acquiring a Engagement Letter For Bookkeeping from our site.

- Obtaining a Engagement Letter For Bookkeeping is fast and straightforward for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document template you need in the desired format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

Yes, the AICPA recommends using engagement letters as a best practice for accounting services, including bookkeeping. They serve as a guideline for ethical and professional standards, ultimately enhancing trust between accountants and clients. While not legally binding, an engagement letter for bookkeeping helps fulfill the expectations set by the AICPA. By utilizing these letters, you can strengthen your client's confidence in your services.

To provide bookkeeping services, you need to have a solid understanding of accounting principles and relevant software tools. Additionally, you should gather necessary financial documents from your clients, including bank statements and invoices. An engagement letter for bookkeeping is also essential, as it sets the groundwork for your professional relationship. This letter ensures you have everything you need to effectively manage your client’s financial records.

Engagement letters are necessary because they provide clarity and set expectations for both the service provider and the client. They protect both parties by clearly defining the scope of work and the terms of service. Without an engagement letter for bookkeeping, misunderstandings can arise, leading to dissatisfaction and disputes. Thus, having this document is crucial for a smooth working relationship.

An accounting engagement letter is a formal document that outlines the responsibilities of both the accountant and the client. It clarifies the nature and scope of services provided, including details on fees and timelines. This letter acts as a legal agreement, ensuring both parties understand their commitments. Using an engagement letter for bookkeeping enhances communication and reduces misunderstandings.

Typically, the bookkeeper sends the engagement letter for bookkeeping to the client. This document serves as a formal agreement outlining the services provided and confirms what is expected from both parties. By initiating this process, the bookkeeper demonstrates professionalism and establishes a clear framework for the working relationship. It also offers an opportunity for clients to review and ask questions before beginning services.

You can start an engagement letter for bookkeeping by addressing the client and stating the purpose of the letter. Begin with a warm introduction, such as 'Thank you for choosing our bookkeeping services.' Then, clearly outline the services you are providing and the agreement terms. A strong opening sets a positive tone and encourages a collaborative relationship.

An effective engagement letter for bookkeeping should include essential elements such as the scope of services, payment details, and timelines. Additionally, it should clarify roles and responsibilities, confidentiality agreements, and terms for termination. Including these components ensures that both parties have a mutual understanding of the working relationship. Clear engagement letters foster transparency and trust between bookkeepers and clients.

Yes, a bookkeeper should have an engagement letter for bookkeeping to establish a formal agreement with the client. This document protects both the bookkeeper and the client by detailing the services to be performed and confirming the terms of the partnership. Furthermore, it helps to prevent misunderstandings regarding what each party is responsible for. Overall, an engagement letter is a valuable tool for successful collaboration.

An engagement letter for bookkeeping outlines the services a bookkeeper will provide to a client. Typically, it includes details such as the scope of work, payment terms, and deadlines. For instance, it may specify tasks like transaction recording, bank reconciliation, and monthly reports. By having this letter, both parties clarify expectations and responsibilities.

Typically, the service provider prepares the engagement letter, often in consultation with the client. This ensures that all services are accurately represented and aligned with the client's expectations. Once drafted, it is essential for both parties to review and agree on the contents before signing. By doing so, both sides acknowledge their responsibilities and the terms of engagement.