Letter Accounting Client With Payroll

Description

Form popularity

FAQ

You can find employee payroll by consulting your accounting department or utilizing online payroll services. Many platforms, including our solution at UsLegalForms, offer tools to easily manage employee payroll and ensure compliance. Look for features that provide a comprehensive letter accounting client with payroll to simplify your process.

Acquiring accounting clients starts with building a solid reputation and network. Use client referrals and online reviews to enhance your credibility. Offering specialized services like the letter accounting client with payroll can differentiate you from the competition and attract more clients.

To determine a suitable payroll provider, consider your business size, budget, and specific needs. Research providers by checking their software integrations and customer reviews. Assess if their offerings include a letter accounting client with payroll, which can streamline your financial reporting processes.

Promoting payroll services can be effectively done through educational content, social media marketing, and referral programs. Produce guides or webinars that address common payroll concerns faced by businesses. By positioning your service as a reliable letter accounting client with payroll, you'll attract clients looking for trustworthy assistance.

Finding payroll clients requires a strategic approach, including identifying businesses that lack in-house payroll capabilities. You can also network at industry events or online forums where business owners seek payroll solutions. Offering value-added services, such as a professional letter accounting client with payroll, can make your offer more attractive.

Finding bookkeeping clients involves leveraging social media, local classifieds, and professional platforms. Create an engaging online presence to highlight your services, particularly the letter accounting client with payroll. Consider using targeted ads to reach small businesses in need of bookkeeping support.

To obtain bookkeeping clients, focus on networking and building relationships within your community. Attend local business events and join online platforms where potential clients seek professional services. Additionally, showcasing your expertise through content marketing can attract clients who need reliable letter accounting client with payroll services.

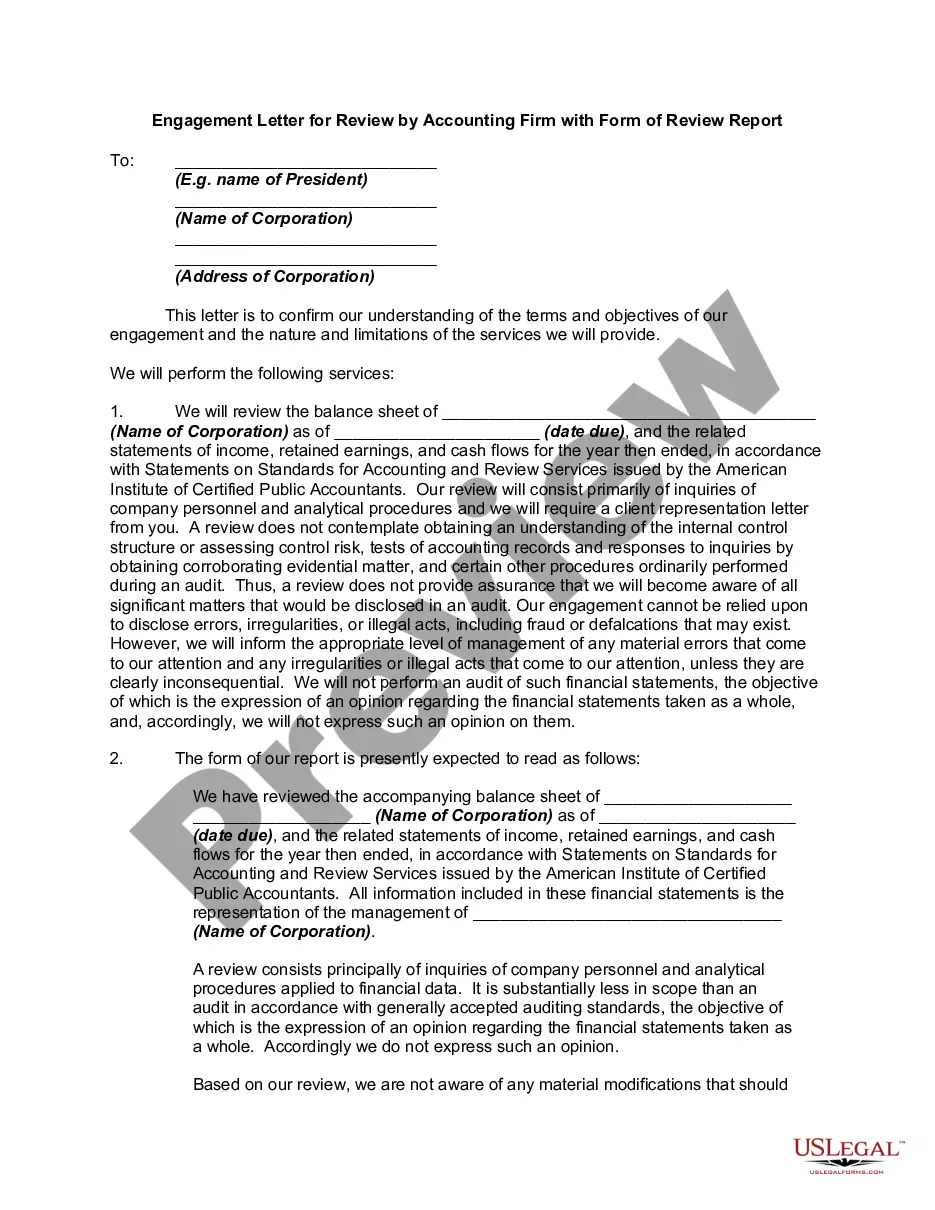

An engagement letter between an accountant and a client serves as a crucial document that establishes the foundation of their professional relationship. It details the specific accounting services, including payroll handling, that the accountant will perform. This letter not only protects both parties but also enhances service delivery by clarifying roles and responsibilities.

The agreement between an accountant and a client is a mutual understanding of services, fees, and responsibilities. This agreement typically takes the form of a letter accounting client with payroll, which specifies what the accountant will deliver. With this clear framework, both parties benefit from defined expectations, reducing misunderstandings.

An accountant's letter serves as a formal communication tool, often used to convey financial information or opinions related to a client’s accounts. These letters typically address the accuracy of financial statements, including payroll data. An effective accountant's letter helps build trust and transparency between the accountant and the client.