Limited Liability Llc Form For Llc

Description

How to fill out Assignment Or Sale Of Interest In Limited Liability Company (LLC)?

Legal management can be overwhelming, even for knowledgeable professionals. When you are looking for a Limited Liability Llc Form For Llc and don’t get the time to spend trying to find the appropriate and up-to-date version, the processes may be stressful. A robust web form catalogue might be a gamechanger for anyone who wants to deal with these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you may have, from individual to enterprise paperwork, in one spot.

- Employ innovative resources to complete and control your Limited Liability Llc Form For Llc

- Gain access to a useful resource base of articles, instructions and handbooks and resources related to your situation and needs

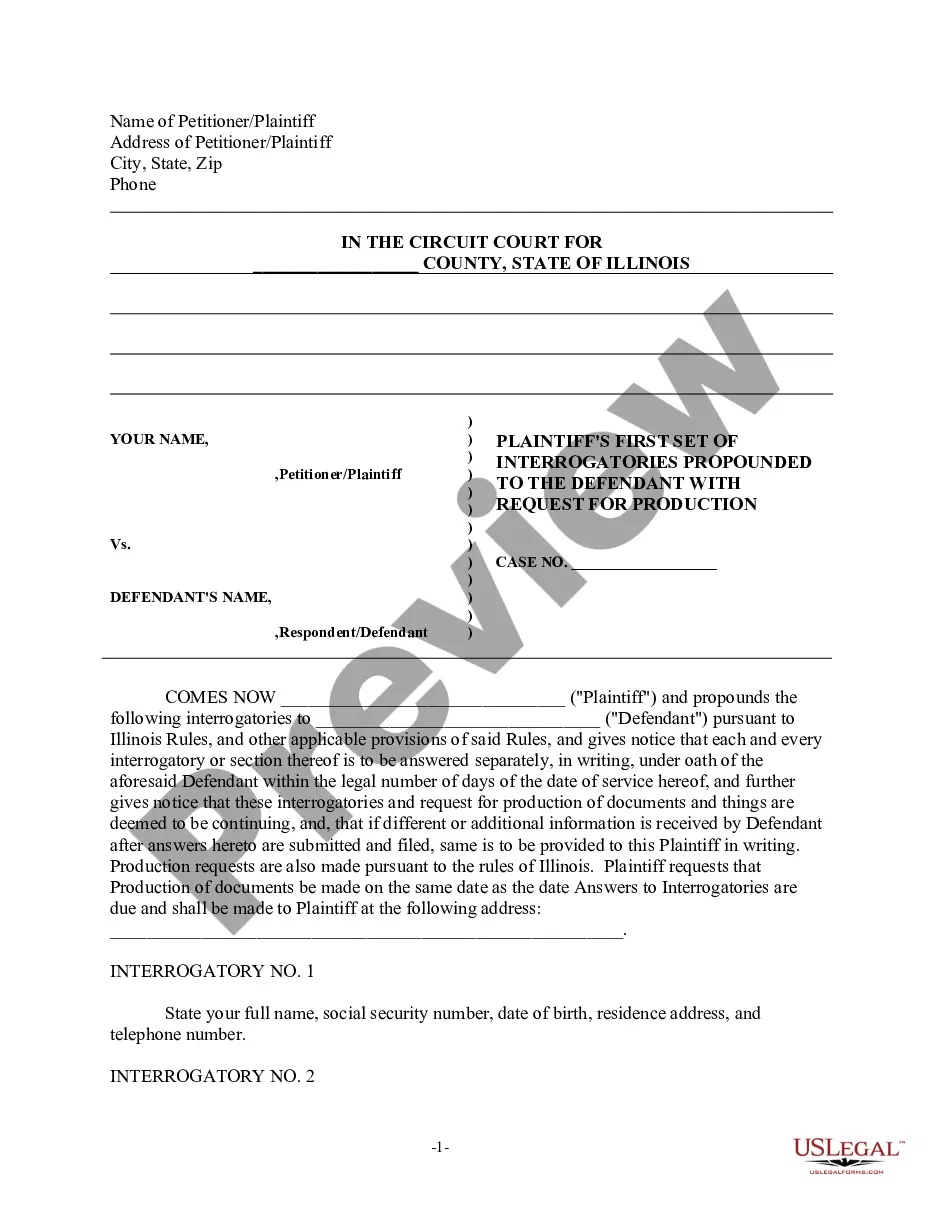

Help save time and effort trying to find the paperwork you will need, and employ US Legal Forms’ advanced search and Review tool to discover Limited Liability Llc Form For Llc and download it. For those who have a membership, log in to your US Legal Forms account, search for the form, and download it. Review your My Forms tab to view the paperwork you previously downloaded and to control your folders as you see fit.

Should it be the first time with US Legal Forms, register an account and acquire unlimited use of all advantages of the library. Here are the steps for taking after downloading the form you need:

- Validate it is the correct form by previewing it and reading through its description.

- Be sure that the sample is recognized in your state or county.

- Select Buy Now once you are ready.

- Select a subscription plan.

- Pick the format you need, and Download, complete, sign, print out and deliver your document.

Benefit from the US Legal Forms web catalogue, supported with 25 years of expertise and stability. Transform your day-to-day document managing in a smooth and easy-to-use process today.

Form popularity

FAQ

§ 501-LLC. (January 2022) Corporate Processing Service. A Non Government Agency. California Limited Liability Company Biennial Order Form.

Form LLC-12 helps the state to track changes in addresses, agents, managers, and members of Limited Liability Companies. The form, formerly called LLC-12R, is also known as the Statement of Information, or SOI, form. The California Secretary of State requires all LLCs to submit this form every two years.

A California LLC, like all entities in California, must pay the state's annual Franchise Tax. This tax is $800 for all California LLCs. The annual Franchise Tax is due the 15th day of the fourth month after the beginning of the tax year. You must file Form 3522 (LLC Tax Voucher).

Form 3522 is a form used by LLCs in California to pay a business's annual tax of $800. All LLCs in the state are required to pay this annual tax to stay compliant and in good standing. When a new LLC is formed in California, it has four months from the date of its formation to pay this fee.

In order to terminate the LLC, the LLC also must file a Certificate of Cancellation (Form LLC-4/7). 4. Read and Sign Below (Do not use a computer generated signature.) By signing, I affirm under penalty of perjury that the information herein is true and correct and that I am authorized by California law to sign.