This form is a generic motion and adopts the "notice pleadings" format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Criminal Charges Filed With The Eeoc

Description

How to fill out Motion To Quash, Dismiss, Or Set Aside Criminal Charges For Failure To Prosecute?

Identifying a reliable source for obtaining the latest and pertinent legal templates constitutes a significant portion of navigating red tape. Locating the appropriate legal documents requires accuracy and meticulousness, which is why it is essential to procure samples of Criminal Charges Filed With The Eeoc exclusively from trustworthy providers, such as US Legal Forms. Utilizing an incorrect template can consume your time and delay the matter at hand. With US Legal Forms, you have minimal concerns.

You can access and review all the details regarding the document’s application and appropriateness for your case and in your locality.

Eliminate the complications associated with your legal documentation. Explore the extensive US Legal Forms library where you can discover legal templates, assess their appropriateness for your case, and download them immediately.

- Utilize the library navigation or search tool to locate your sample.

- Examine the form’s information to ensure it meets your state and regional requirements.

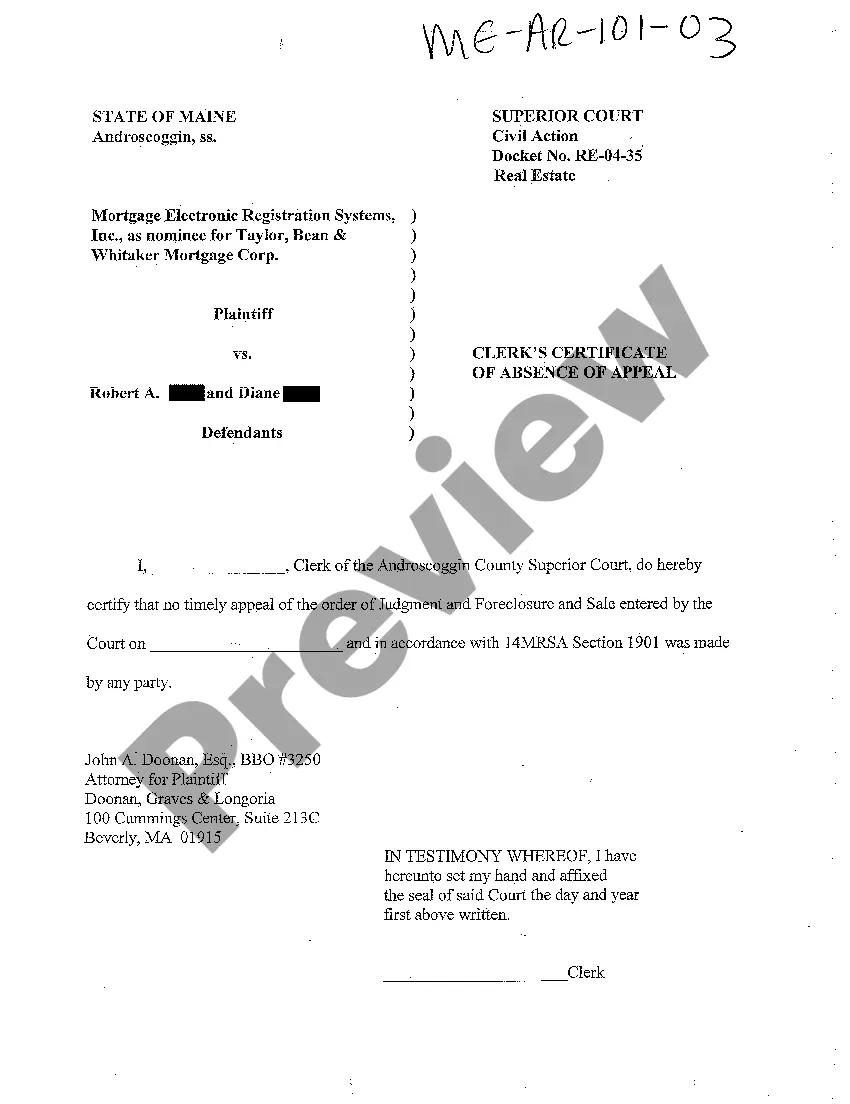

- View the form preview, if available, to verify that the template is what you need.

- Continue your search and find the correct document if the Criminal Charges Filed With The Eeoc does not satisfy your needs.

- If you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you are not yet a member, click Buy now to acquire the template.

- Choose the pricing plan that fits your requirements.

- Proceed to registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Criminal Charges Filed With The Eeoc.

- Once you have the form on your device, you can modify it using the editor or print it to fill out manually.

Form popularity

FAQ

The money you pay into a settlement account is yours! Money that a debt settlement company asks you to set aside in an ?escrow? or ?settlement? account belongs to you. You may cancel the account at any time, and the escrow company must refund all of your money minus any fees the settlement company legally earned.

When drafting a debt settlement agreement, it is essential to include the following: Necessary information about the loan agreement. The contact information of both parties. The date of the agreement. The terms of the agreement. The amount of debt.

Debt settlement involves offering a lump-sum payment to a creditor in exchange for a portion of your debt being forgiven. You can attempt to settle debts on your own or hire a debt settlement company to assist you. Typical debt settlement offers range from 10% to 50% of the amount you owe.

While debt settlement can eliminate outstanding obligations, it can negatively impact your credit score. Stronger credit scores may be more significantly impacted by a debt settlement. The best type of debt to settle is a single large obligation that is one to three years past due.

A debt settlement, in other terms, is a debt reduction arrangement signed between a creditor and a borrower. A debt settlement agreement is basically a formal written agreement between a lender and a borrower for the full settlement of the borrower's debt, together with the amount of interest that will be paid.

Similar to Chapter 7 bankruptcy, debt settlement can stay on your credit report for up to seven years. While this may seem like a long time, the impact of this event on your credit report will lessen over time.

Debt settlement, when you pay a creditor less than you owe to close out a debt, will hurt your credit scores, but it's better than ignoring unpaid debt. It's worth exploring alternatives before seeking debt settlement.

Removing a settled account from your credit report isn't easy, but it is possible with some effort and persistence. If the original creditor or collection agency won't agree to remove the account, file a dispute with one of the three major bureaus.