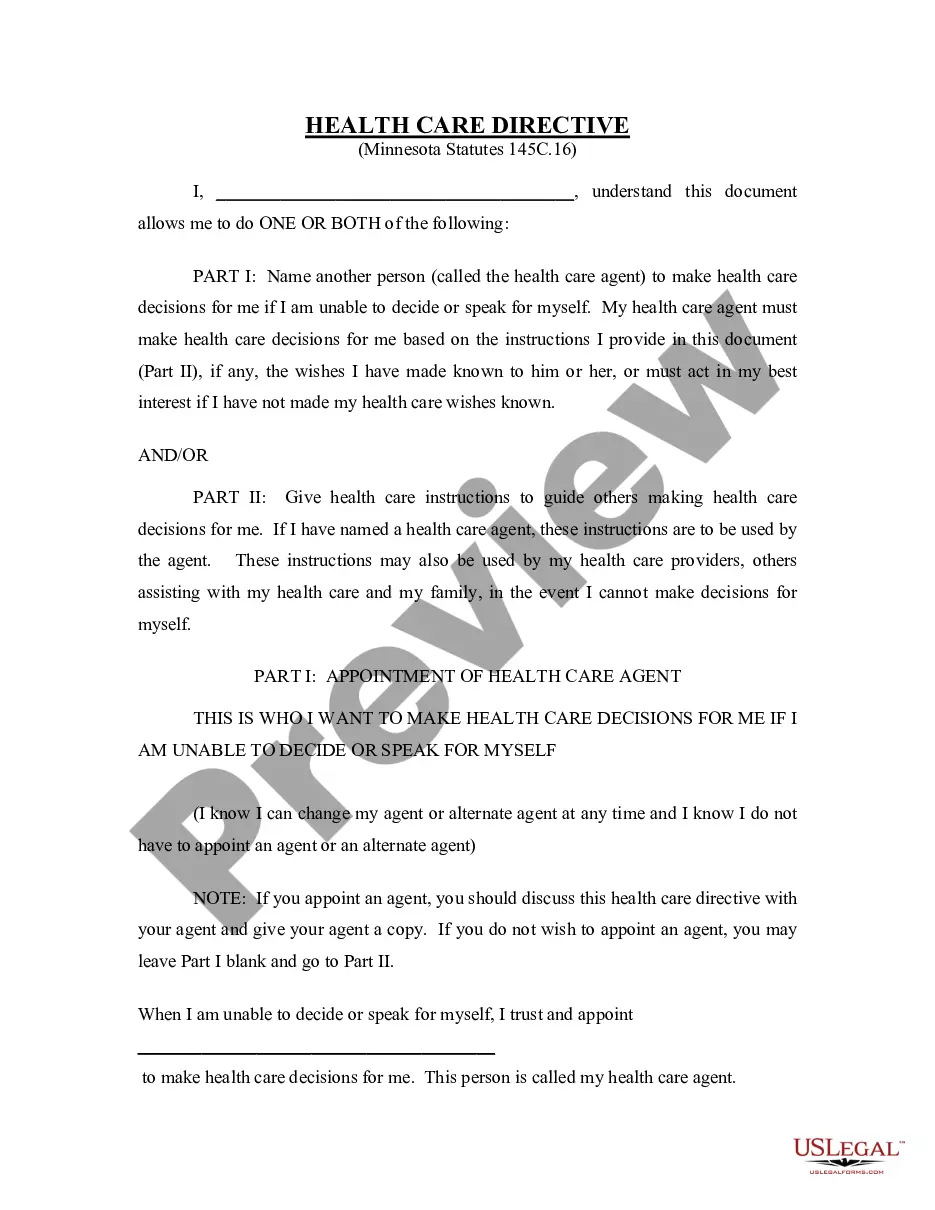

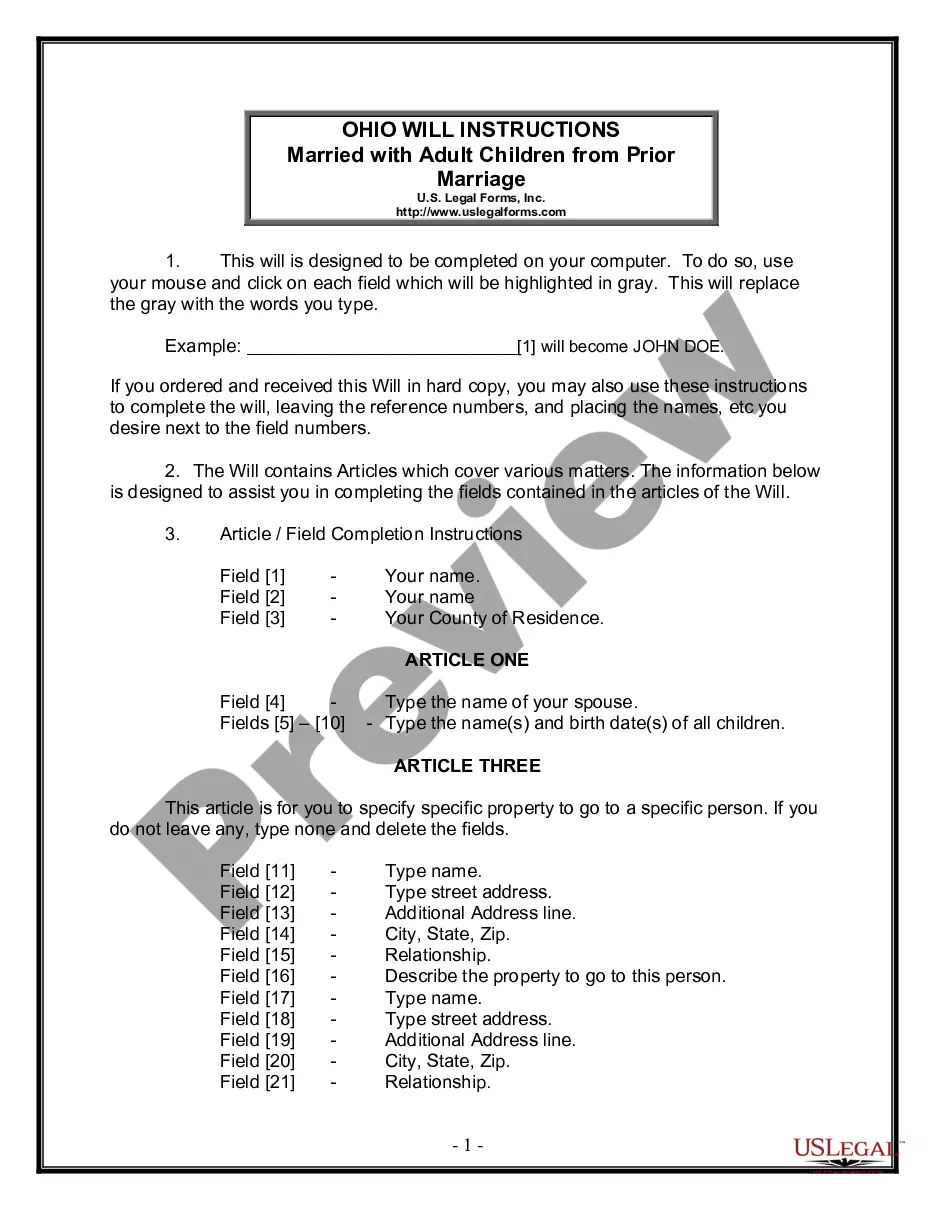

Personal Loan Agreement Letter is a legally binding document that outlines the terms and conditions under which an individual or entity lends money to another individual. This agreement establishes clear expectations and protects both parties involved in the loan transaction. Below, I will provide a detailed description of what a personal loan agreement letter entails, along with various types of personal loan agreement letters: 1. Basic Personal Loan Agreement Letter: A basic personal loan agreement letter includes essential information such as the names and addresses of both the lender and borrower, the loan amount, the interest rate, the repayment schedule, and the consequences of defaulting on the loan. This agreement ensures that both parties are aware of their rights and obligations and helps prevent misunderstandings and disputes during the loan term. 2. Secured Personal Loan Agreement Letter: A secured personal loan agreement letter is used when the borrower offers collateral, such as a vehicle or property, as security for the loan. This type of agreement provides additional protection to the lender in case the borrower fails to repay the loan as agreed. It specifies the rights of the lender to claim and sell the collateral to recover their funds if necessary. 3. Unsecured Personal Loan Agreement Letter: An unsecured personal loan agreement letter is used when the borrower does not provide any collateral. In this case, the lender relies solely on the borrower's creditworthiness and trustworthiness to lend the money. The agreement outlines the repayment terms and consequences of default, but it does not include provisions for collateral. 4. Family Loan Agreement Letter: A family loan agreement letter is designed for loans between close family members or friends. While these loans often have more flexible terms and lower interest rates, it is still crucial to have a written agreement in place to avoid misunderstandings or disputes that may strain the relationship. This letter may include provisions related to interest charges, repayment schedules, and consequences of nonpayment. 5. Promissory Note: Although not technically a personal loan agreement letter, a promissory note is a legally binding document often used in conjunction with a personal loan. It serves as a written promise to repay the borrowed amount, usually with specified interest, within a designated timeframe. Along with the personal loan agreement letter, a promissory note strengthens the enforceability of the loan terms. 6. Installment Loan Agreement Letter: An installment loan agreement letter is suitable for loans that require regular installment payments instead of a lump sum repayment. This letter outlines the loan's terms, including the number of installments, the due dates, the interest rate, and any penalties for late payments. It provides a structured repayment plan and ensures both parties understand their obligations. In summary, personal loan agreement letters come in various types to cater to different loan scenarios. Whether it's a basic agreement, a secured or unsecured loan, a family loan, or an installment loan, it is essential to have a written contract that clearly defines the terms and conditions. These documents protect both the lender and borrower and provide a legal recourse in case of noncompliance.

Example Of Personal Loan Agreement Letter

Description

How to fill out Example Of Personal Loan Agreement Letter?

Locating a reliable source to obtain the most updated and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the correct legal documents requires accuracy and careful consideration, which is why it is essential to acquire samples of Example Of Personal Loan Agreement Letter solely from reputable providers, such as US Legal Forms.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms library where you can discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the catalog browsing or search option to locate your template.

- Examine the form’s details to ensure it fulfills the criteria of your jurisdiction and region.

- Access the form preview, if available, to confirm that the template is the one you need.

- Return to your search and find the suitable document if the Example Of Personal Loan Agreement Letter does not meet your requirements.

- If you are confident about the form’s applicability, download it.

- If you have a registered account, click Log in to verify your identity and access your chosen templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the template.

- Select the pricing option that best fits your needs.

- Move forward with the registration to finalize your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading Example Of Personal Loan Agreement Letter.

- Once you have the document on your device, you can edit it with the editor or print it and fill it out by hand.

Form popularity

FAQ

In South Carolina, state fees can vary depending on the type of entity you choose to form. ing to the South Carolina Secretary of State website, expect to pay roughly $50 - $350 to start a business in South Carolina.

How much does it cost to start a South Carolina corporation? At least $135. This includes the $110 fee to submit your Articles and the $25 fee to submit your Initial Report.

It will cost $110 ($125 online) to file formation paperwork to start your South Carolina LLC. Luckily, your business won't be on the hook for any annual report fees in South Carolina. However, you'll still have other expenses to consider while establishing your LLC.

1 Form must be included with the Articles of Incorporation. You must submit a total payment of $135 which includes the $25 fee for the CL1 Form. $110.00. CL1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue.

An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation.

South Carolina Articles of Organization FAQs The easiest way to do this is to fill out and submit a copy of South Carolina's Amendment Articles of Organization form. File the form online, in person, or by mail. The filing fee is the same regardless of the filing method you choose.

To make your LLC official in South Carolina, you need to file a form called articles of organization and pay a filing fee of $110. You can download the form from the Secretary of State's website, or you can enter the information online.

Education CostTimeIncorporation & Initial Report: $135Incorporation: ~7-10 business days by mail. ~1-2 business days online.