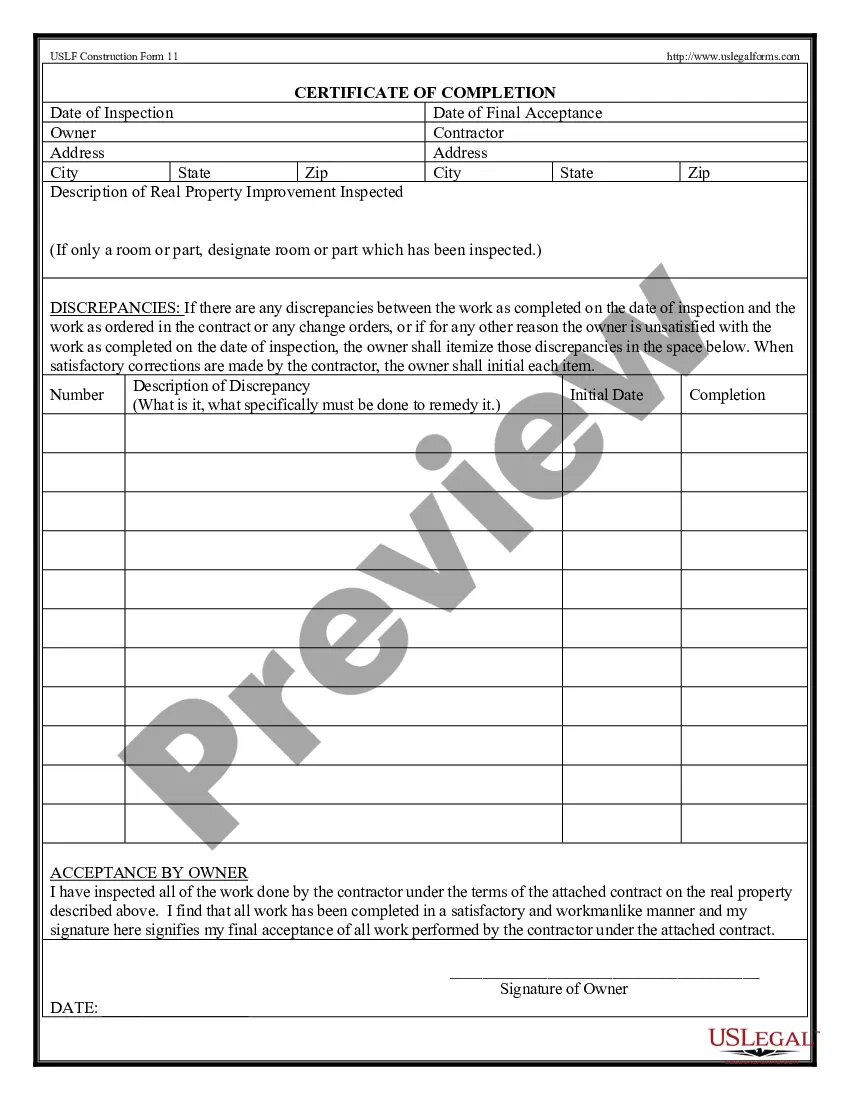

Completion Contractor Form For 1099

Description

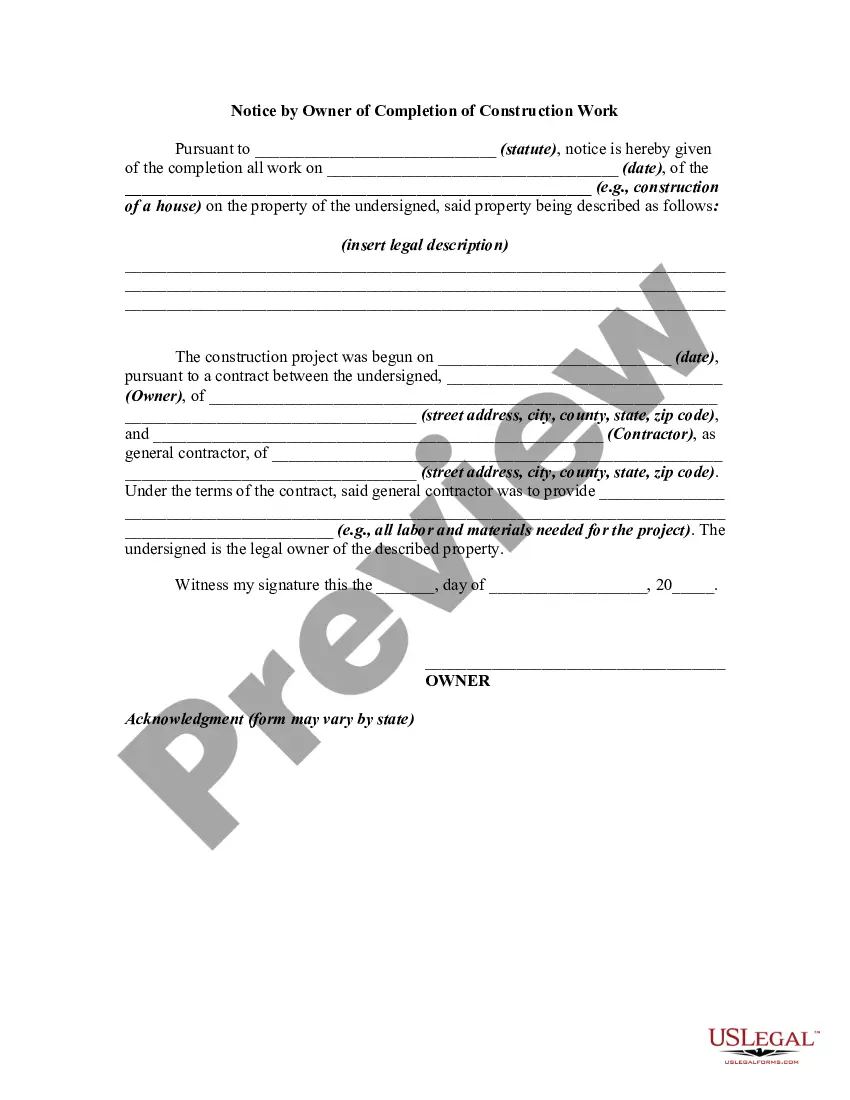

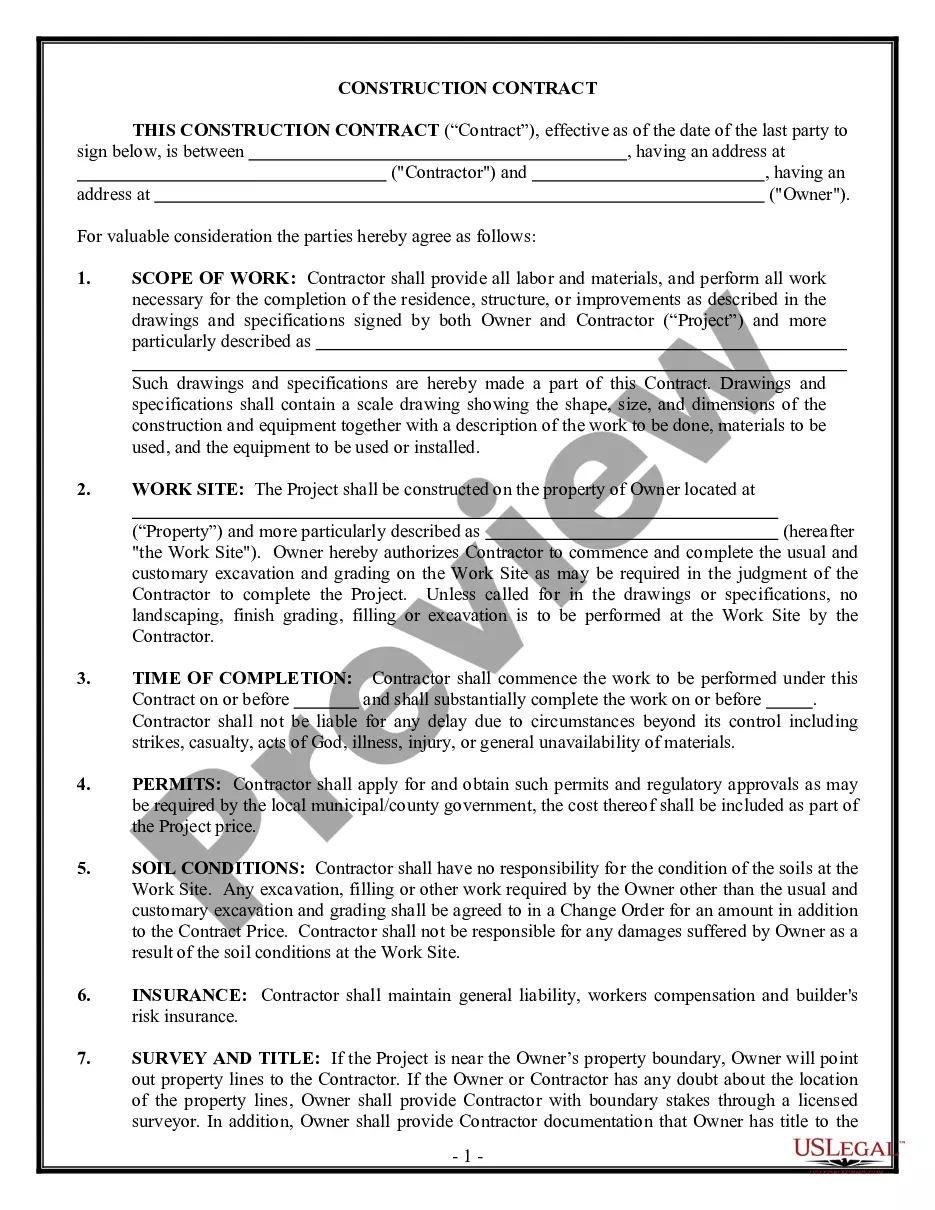

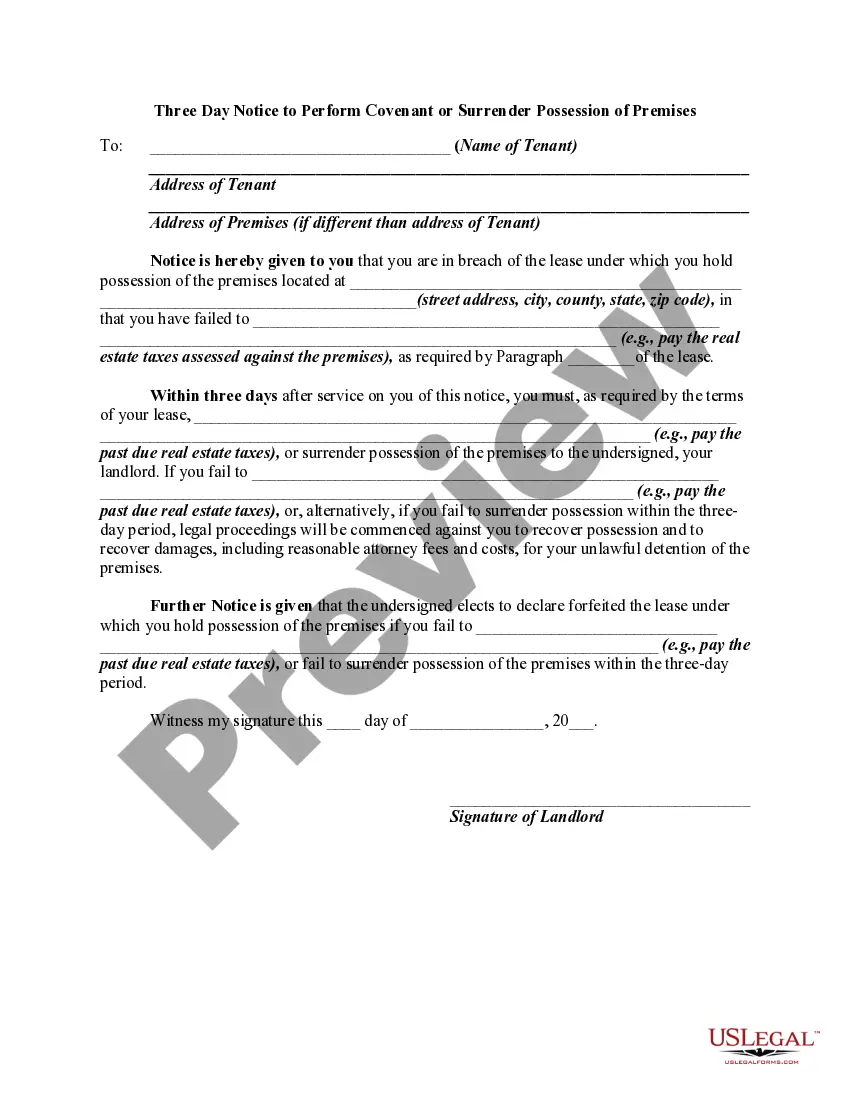

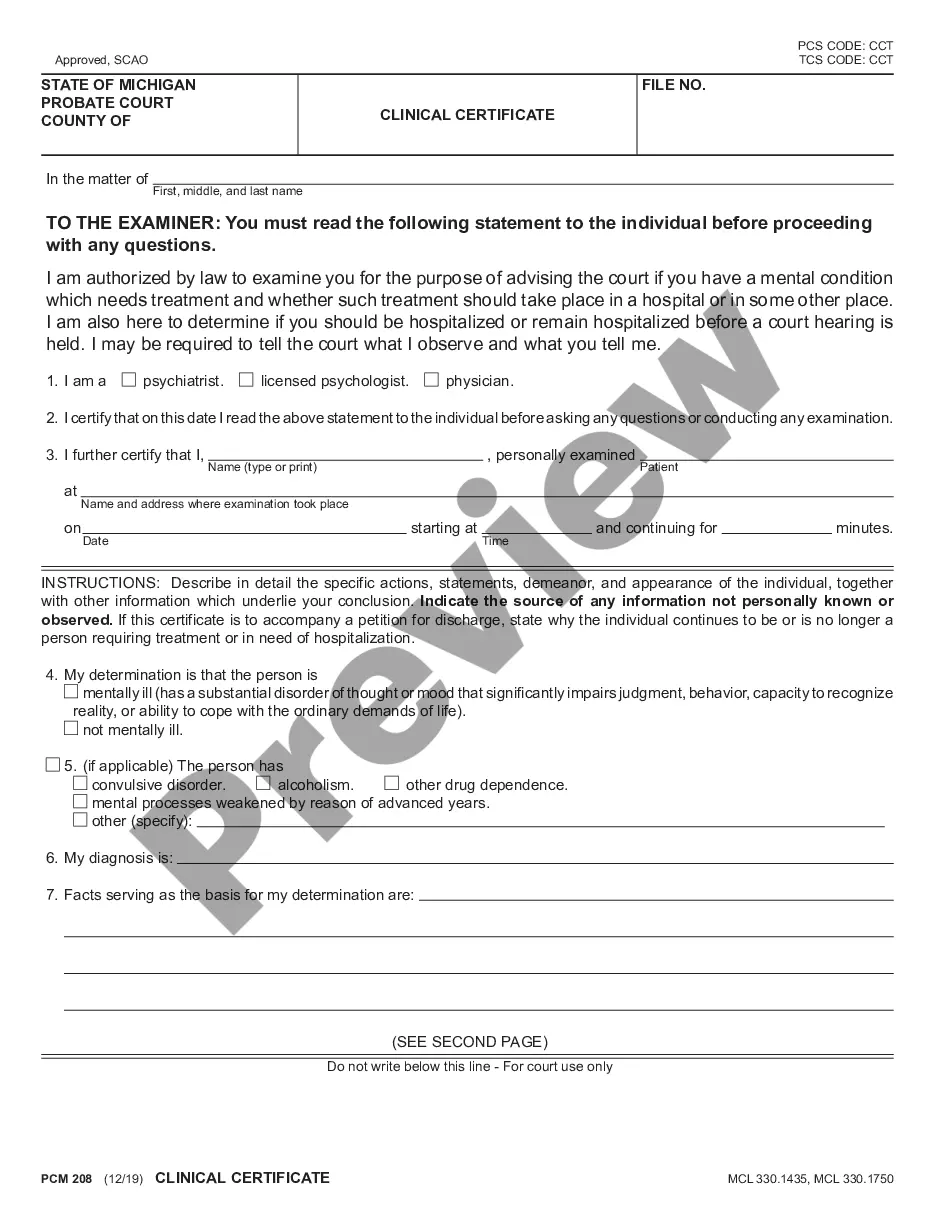

How to fill out Certification Of Completion By Contractor?

The Completion Contractor Document For 1099 presented on this page is a reusable official template crafted by expert attorneys in alignment with national and local laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and lawyers with more than 85,000 validated, state-specific documents for any business and personal situation. It is the quickest, easiest, and most reliable way to acquire the papers you require, as the service ensures bank-level data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for all of life's circumstances readily available.

- Investigate the document you require and review it.

- Select the pricing option that suits you and set up an account. Utilize PayPal or a credit card for a swift transaction. If you already possess an account, Log In and verify your subscription to proceed.

- Retrieve the editable template.

- Fill out and endorse the documents.

- Access your files again.

Form popularity

FAQ

How is Form 1099-NEC completed? Obtain a copy of Form 1099-NEC from the IRS or a payroll service provider. Provide the name and address of both the payer and the recipient. Calculate the total compensation paid. Note the amount of taxes withheld if backup withholding applied.

If you are an independent contractor without a business, you will still need to fill out a W-9 as an individual, a sole proprietor, or a single-member LLC. Simply fill under your name and SSN to file form W-9 without a business.

Basic 1099-NEC Filing Instructions. To complete a 1099-NEC, you'll need to supply the following data: Business information ? Your Federal Employer ID Number (EIN), your business name and your business address. Recipient's ID Number ? The recipient's Social Security number or Federal Employer ID Number (EIN).

Here are the steps to follow to prepare a Form 1099-NEC. Collect personal information from independent contractors with a W-9 Form. All independent contractors need to complete Form W-9. ... Confirm payment amount. ... Complete the details submit Copy A to IRS. ... Provide Copy B to the independent contractor. ... Keep a copy for yourself.

How to fill out a W-9 form Download the W-9 form from IRS.gov. ... Provide your full legal name and business name. ... Describe your business structure. ... Exemption. ... Enter your mailing address. ... Add any account numbers. ... Provide your Social Security number or Employer Identification Number. ... See if you need to sign and date the form.