Fcc Complaint Process

Description

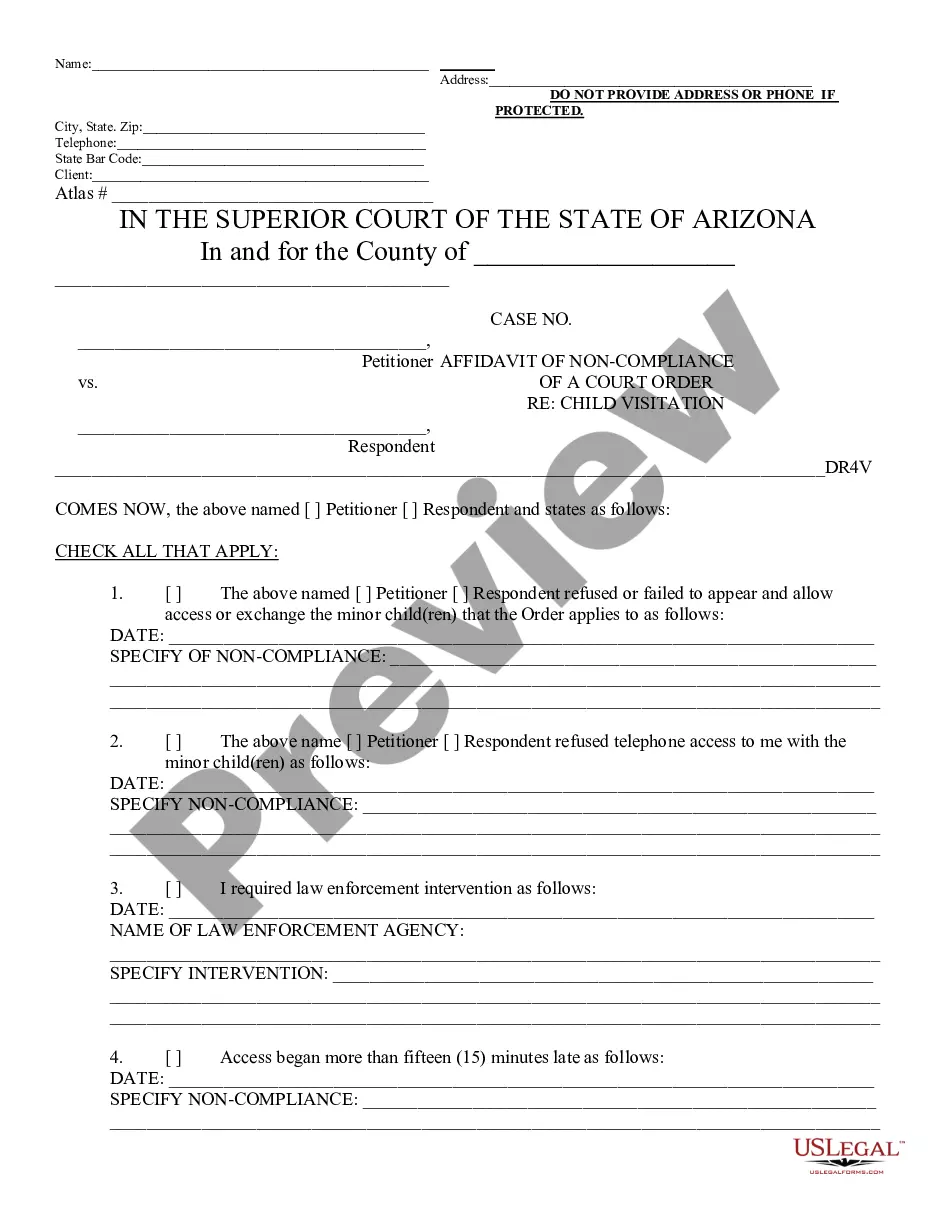

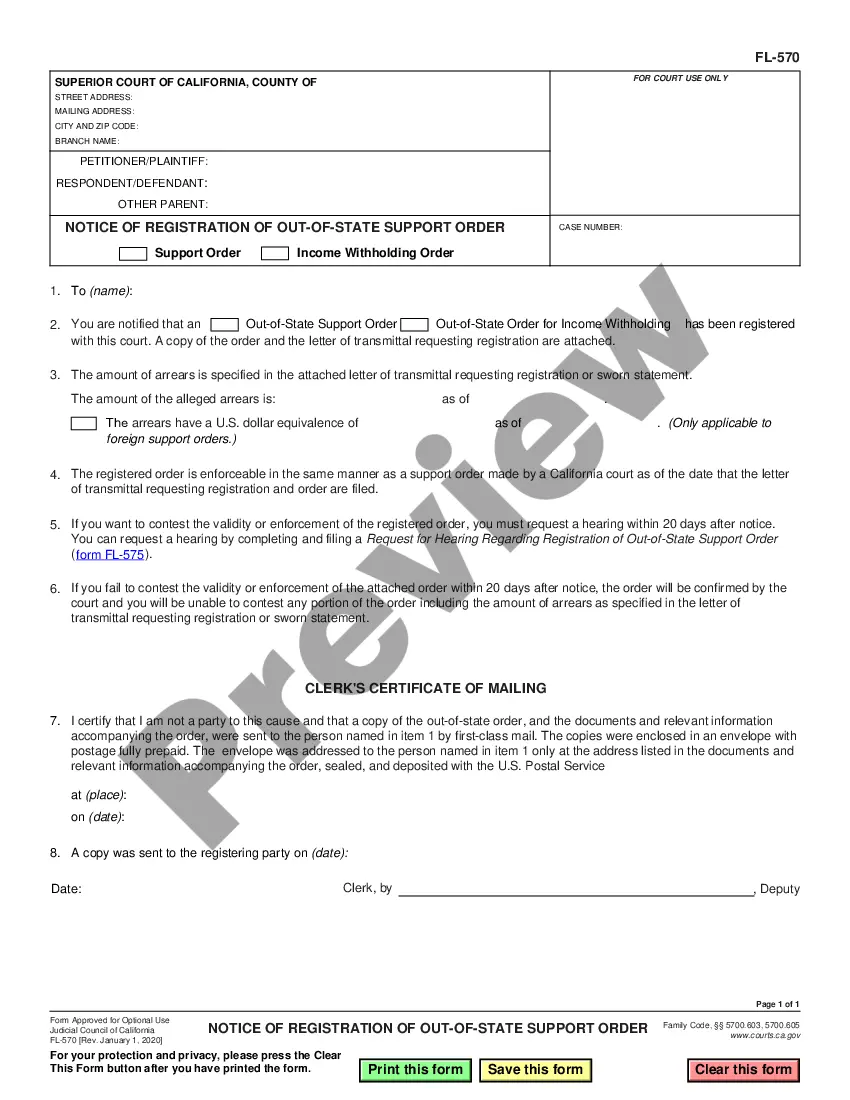

How to fill out Complaint For Malicious Prosecution?

Managing legal documents can be perplexing, even for the most experienced professionals.

If you're seeking a FCC Complaint Process and lack the time to search for the correct and current version, the procedures may become overwhelming.

Tap into a valuable collection of articles, guides, and manuals relevant to your circumstances and needs.

Save time and energy in locating the forms you require, and leverage US Legal Forms' sophisticated search and Preview functionality to find FCC Complaint Process documents and obtain them.

Benefit from the US Legal Forms online library, underpinned by 25 years of expertise and trustworthiness. Transform your daily document management into a seamless and user-friendly process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search the form, and download it.

- Check out the My documents tab to view the documents you've previously downloaded and organize your folders as needed.

- If it's your first time with US Legal Forms, create a free account and gain unlimited access to all the platform's benefits.

- Here are the steps to follow after downloading the necessary form.

- Verify that it is the correct form by previewing and reviewing its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to every requirement you may have, from personal to business files, all in one place.

- Utilize cutting-edge tools to complete and oversee your FCC Complaint Process.

Form popularity

FAQ

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

Uniform Commercial Code1 (UCC1) statement is a legal notice filed by creditors in an effort to publicly declare their right to seize assets of debtors who default on loans. UCC1 notices are typically printed in local newspapers, in an effort to publicly express a lender's intent to seize collateralized assets.

A UCC (Uniform Commercial Code) filing is a legal document that creates a public record of a creditor's security interest in personal property, such as inventory, equipment, or accounts receivable.

A Uniform Commercial Code filing, also known as a UCC filing, is a document that lenders use to establish their legal right to assets that a borrower uses to secure a loan. This notice allows the lender to seize the borrower's collateral in the case of default.

A UCC financing statement ? also called a UCC-1 financing statement or a UCC-1 filing ? is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

Typical collateral For example, if you take out a loan to buy new machinery, the lender might file a UCC-1 lien and claim that new machinery as collateral on the loan. You would, of course, work with your lender to designate what the collateral will be before you sign any documentation committing to the loan.