Child Support Arrears Calculator With Interest

Description

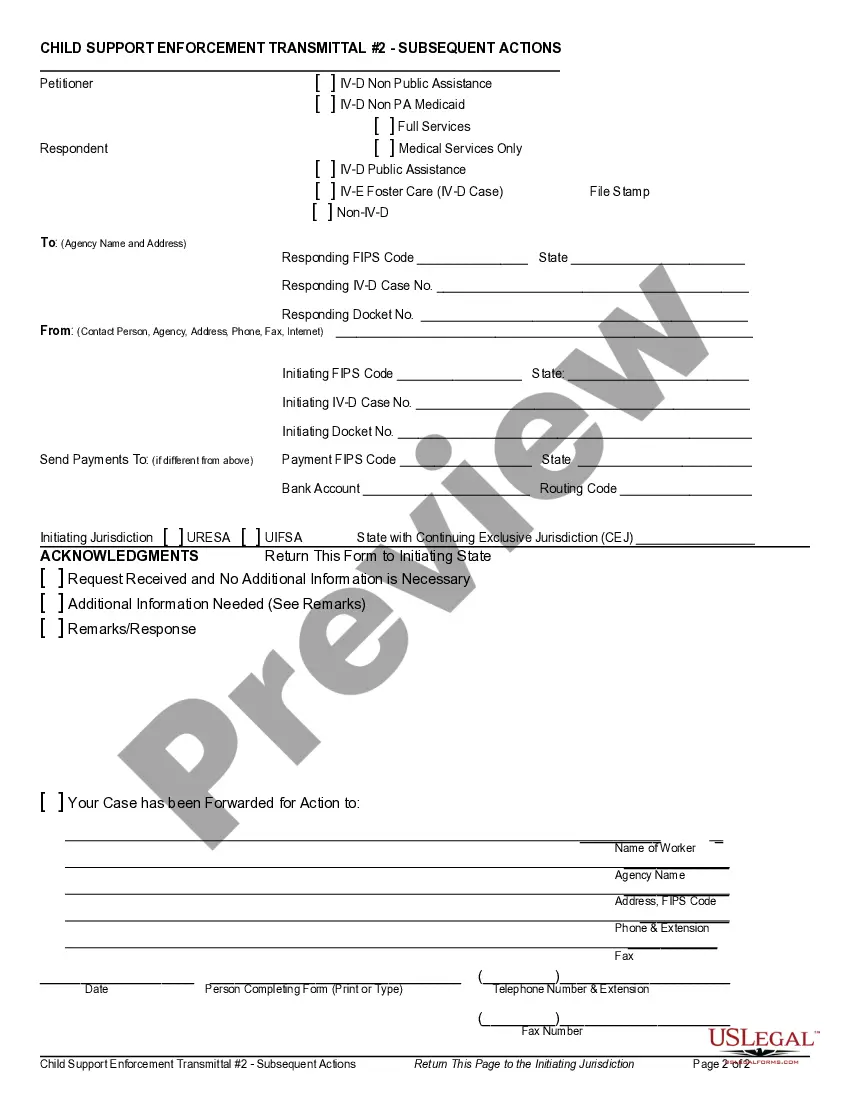

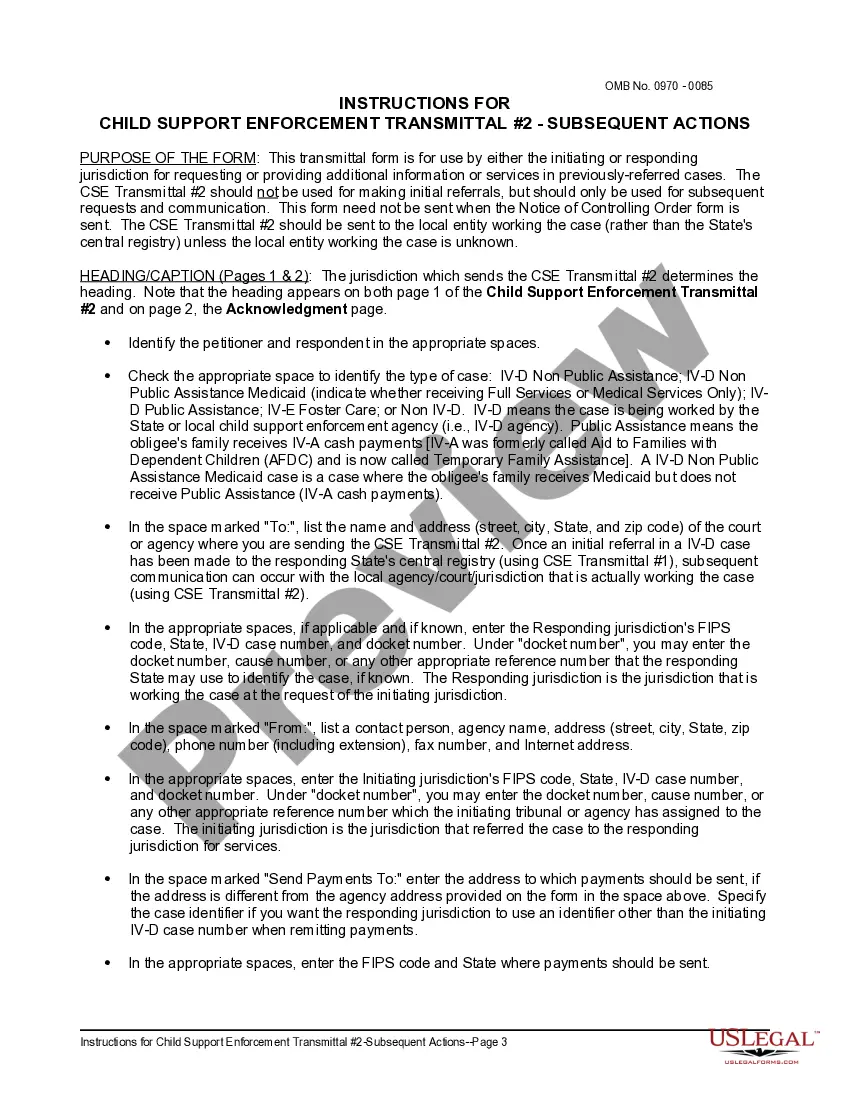

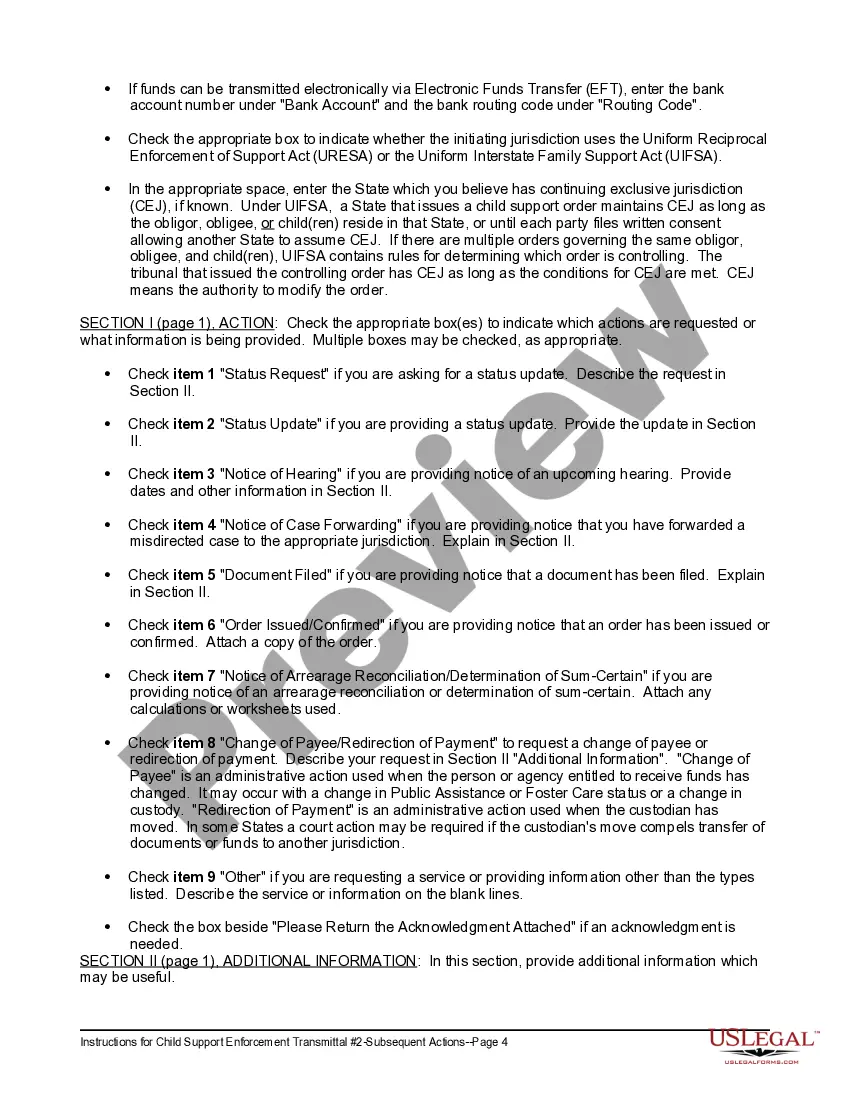

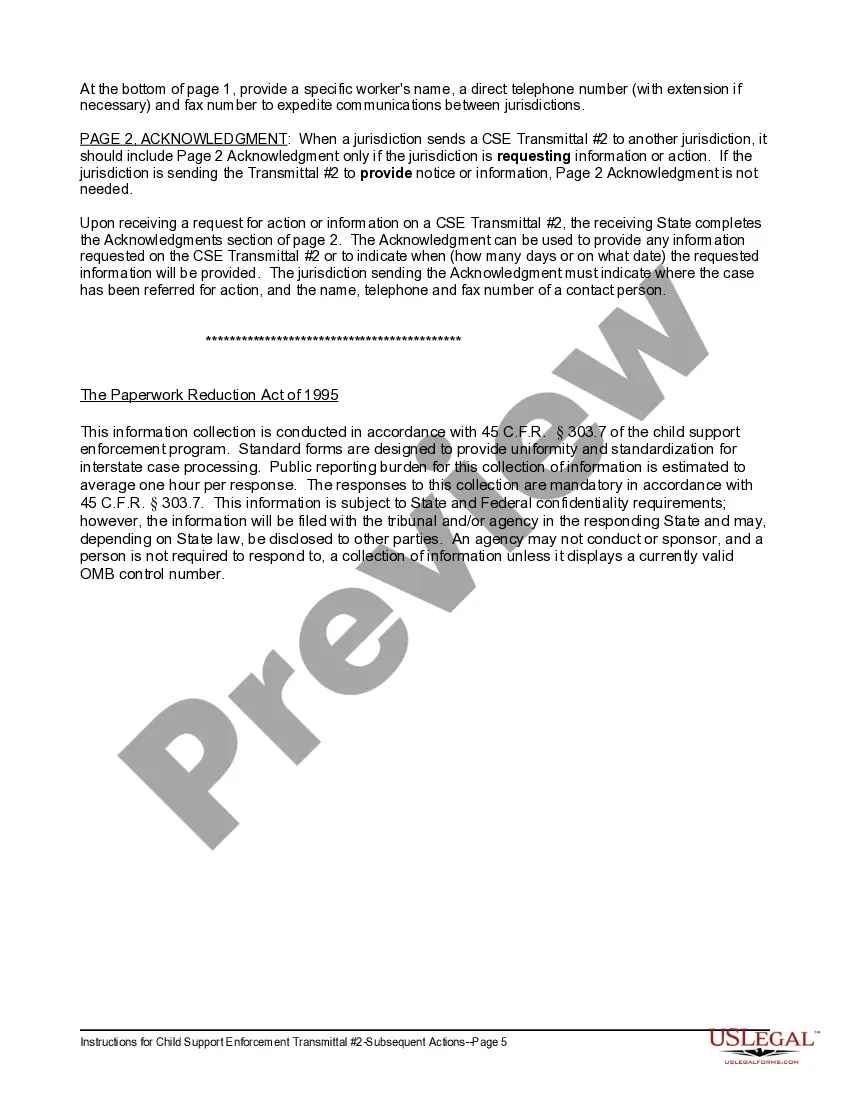

How to fill out Child Support Transmittal #2 - Subsequent Actions And Instructions?

Acquiring legal templates that adhere to national and local laws is essential, and the web provides numerous choices.

However, why squander time searching for the suitable Child Support Arrears Calculator With Interest example online when the US Legal Forms digital library already houses such templates in one location.

US Legal Forms is the largest online legal repository featuring over 85,000 editable templates created by attorneys for various business and personal situations.

Review the template using the Preview feature or through the text outline to confirm it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legislative updates, ensuring your form is current and compliant when obtaining a Child Support Arrears Calculator With Interest from our platform.

- Acquiring a Child Support Arrears Calculator With Interest is swift and straightforward for both existing and new customers.

- If you hold an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you are new to our site, follow the instructions below.

Form popularity

FAQ

It is not uncommon for courts to deny any credit for payments made that do not comply with the court's order. California law accrues interest on unpaid child support judgments at the rate of: 10% simple interest per year on amounts after January 1, 1983.

To calculate the interest due on a late payment, the amount of the debt should be multiplied by the number of days for which the payment is late, multiplied by daily late payment interest rate in operation on the date the payment became overdue.

Interest accrues on the delinquent child support at the rate of 6% simple interest per year from the date support is delinquent.

Ing to Texas Family Code (157.261), the State of Texas allows for interest to be charged on missed support payments. Interest accrues on the delinquent child support at the rate of 6% simple interest per year from the date support is delinquent.

Yes, Florida law does allow a Clerk of Court to impose interest on arrears.