Stipulation And Order For Adjournment Michigan

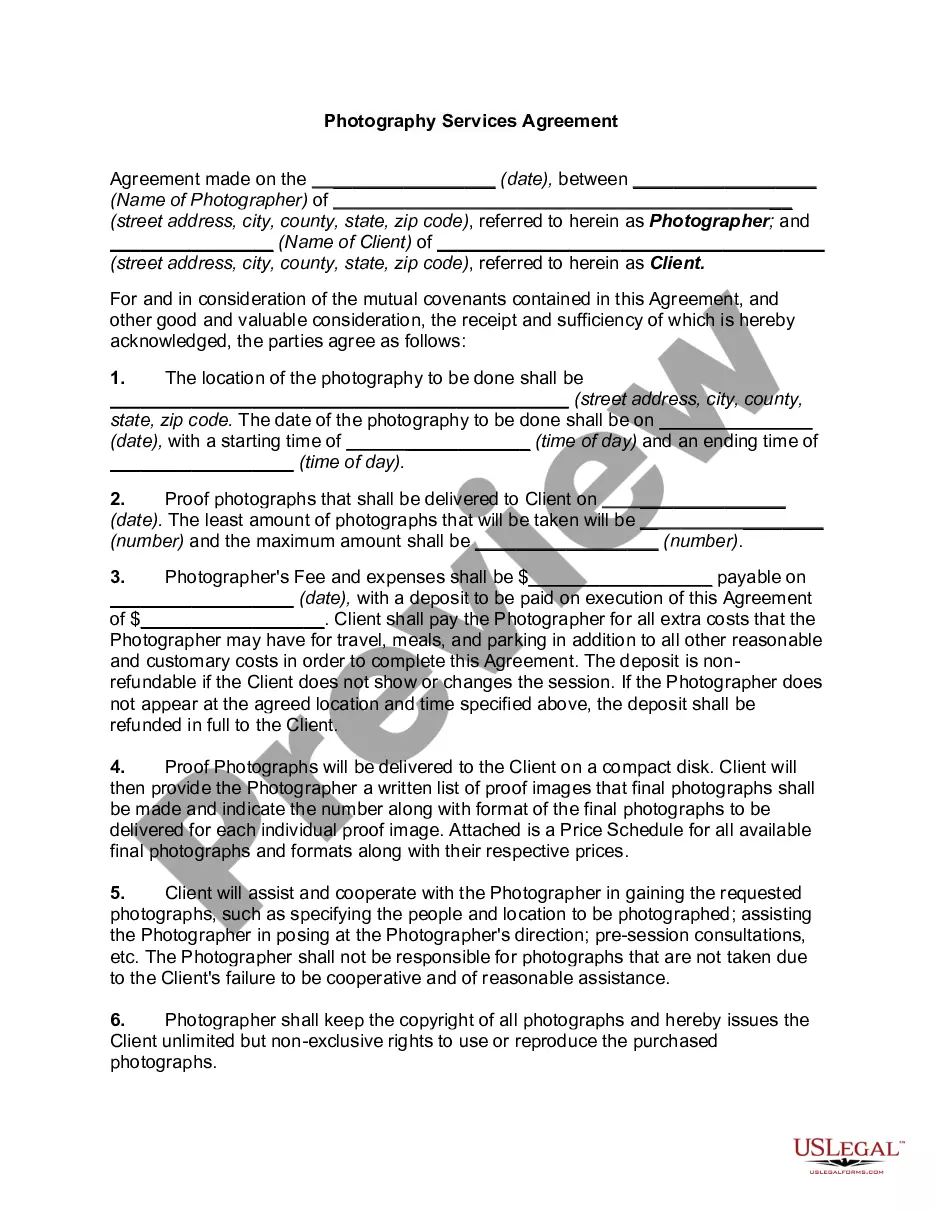

Description

How to fill out Stipulation For Dismissal?

It’s widely recognized that you cannot transform into a legal expert in a day, nor can you swiftly learn to draft Stipulation And Order For Adjournment Michigan without possessing a unique set of abilities.

Compiling legal documents is an extensive process that demands specialized training and expertise. So why not entrust the creation of the Stipulation And Order For Adjournment Michigan to the specialists.

With US Legal Forms, one of the most extensive legal document collections, you can discover anything from court papers to templates for internal business communications.

If you need any other form, start your search again.

Register for a free account and select a subscription plan to purchase the template.

- We understand the importance of compliance and adherence to federal and state regulations.

- This is why, on our platform, all forms are specific to their locations and current.

- Here’s how to begin with our platform and obtain the document you need in just a few minutes.

- Locate the document you require using the search bar at the top of the webpage.

- Preview it (if this option is available) and review the accompanying description to see if Stipulation And Order For Adjournment Michigan is what you’re seeking.

Form popularity

FAQ

Use the Tax Withholding Estimator on IRS.gov. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer a new Form W-4. They can use their results from the estimator to help fill out the form and adjust their income tax withholding.

The Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099. Once the form is completed, it may be filed electronically by clicking the Submit Electronically button or it may be downloaded, printed, and mailed to DOR at the address on the form.

No. 86?272, a Kentucky Unitary Combined. Corporation Income Tax and LLET Return (Form 720U) must. be filed by every corporation doing business in this state.

Every employee who can claim an exemption from Kentucky withholding tax must furnish their employer a signed withholding exemption certificate on Form K-4 by the start of employment.

You may be exempt from withholding for 2021 if both the following apply: ? For 2020, you had a right to a refund of all Kentucky income tax withheld because you had no Kentucky income tax. liability, and. ? For 2021, you expect a refund of all your Kentucky income tax withheld.

Form 720EXT grants an automatic 6-month extension of time to file Form 720. Kentucky State General Business S Corporation tax extension Form 720EXT is due within 4 months and 15 days following the end of the corporation reporting period.

year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a fullyear nonresident files Form 740NP.

Form K-5 is used to report withholding statement information from Forms W-2, W-2G, and 1099 and is completed online with two filing methods to choose from. It may be filed electronically by clicking the submit button or the completed form may be printed and mailed to the address on the form.