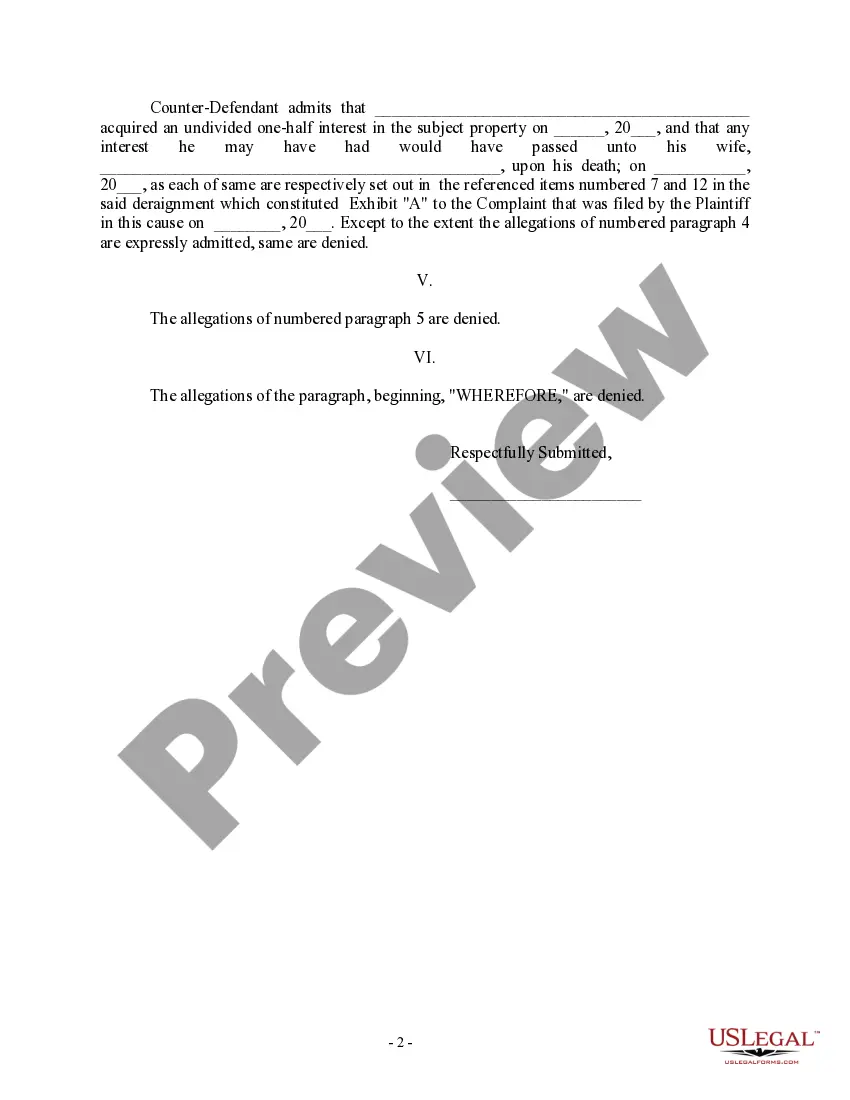

Counterclaim Paragraph Format

Description

How to fill out Answer To Counterclaim?

Managing legal documents can be overwhelming, even for the most experienced professionals.

When you are searching for a Counterclaim Paragraph Template and don’t have the time to invest in locating the suitable and updated version, the processes can be challenging.

Access a repository of articles, guides, and resources related to your situation and needs.

Save time and effort searching for the documents you require, and use US Legal Forms’ advanced search and Preview tool to locate the Counterclaim Paragraph Template and download it.

Utilize the US Legal Forms online catalog, supported by 25 years of experience and trustworthiness. Streamline your daily document management into a simple and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check the My documents section to view the documents you previously saved and manage your folders as desired.

- If it’s your first experience with US Legal Forms, create an account to gain unrestricted access to all platform benefits.

- Here are the steps to take after obtaining the form you need.

- Verify that it is the correct form by previewing it and reviewing its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms caters to any requirements you may have, from personal to business documentation, all in one location.

- Use cutting-edge tools to complete and manage your Counterclaim Paragraph Template.

Form popularity

FAQ

Idaho LLCs taxed as S-corp Like a regular LLC, the S-corp is taxed as pass-through entity, which means S-corps don't have to pay the usual corporate income tax. However, unlike regular LLCs, S-corps reduce amount of self-employment tax (15.3%) owed by making distributions (payments) to their members.

Form 42 is used to show the total for the unitary group. A schedule must be attached detailing the Idaho apportionment factor computation for each corporation in the group.

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

Form PTE-12 is the reconciliation schedule you include with the entity's Idaho income tax return (Form 41S, Form 65, or Form 66) as required by Idaho Code section 63-3036B. Include each owner's complete information whether the owner has Idaho distributable income or a loss.

A corporation filing as an S corporation for federal income tax purposes must file Idaho Form 41S if either of the following are true: You're doing business in Idaho. You're registered with the Idaho Secretary of State to do business in Idaho.

Choose a business name for your S corp. ... File articles of incorporation. ... Issue stock for your S corp. ... Elect a board of directors and appoint officers. ... Meet other S corp eligibility requirements. ... Obtain an employer identification number. ... Elect S corp status. ... Apply for state and local S corp business licenses.

Use Form 41S to amend your Idaho income tax return. Make sure you check the Amended Return box and enter the reason for amending. If you amend your federal return, you also must file an amended Idaho income tax return.

To form an Idaho S corp, you'll need to ensure your company has an Idaho formal business structure (LLC or corporation), and then you can elect S corp tax designation. If you've already formed an LLC or corporation, file Form 2553 with the Internal Revenue Service (IRS) to designate S corp taxation status.