Trust Survives Grantor With No

Description

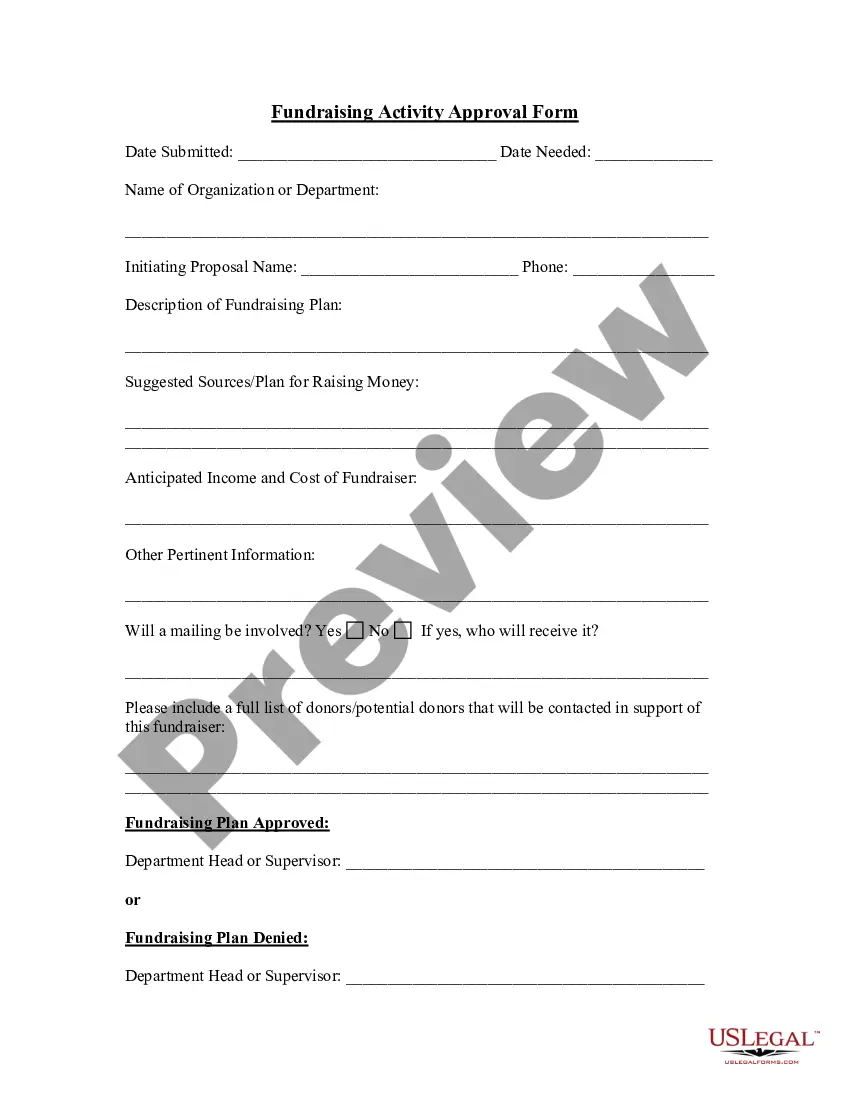

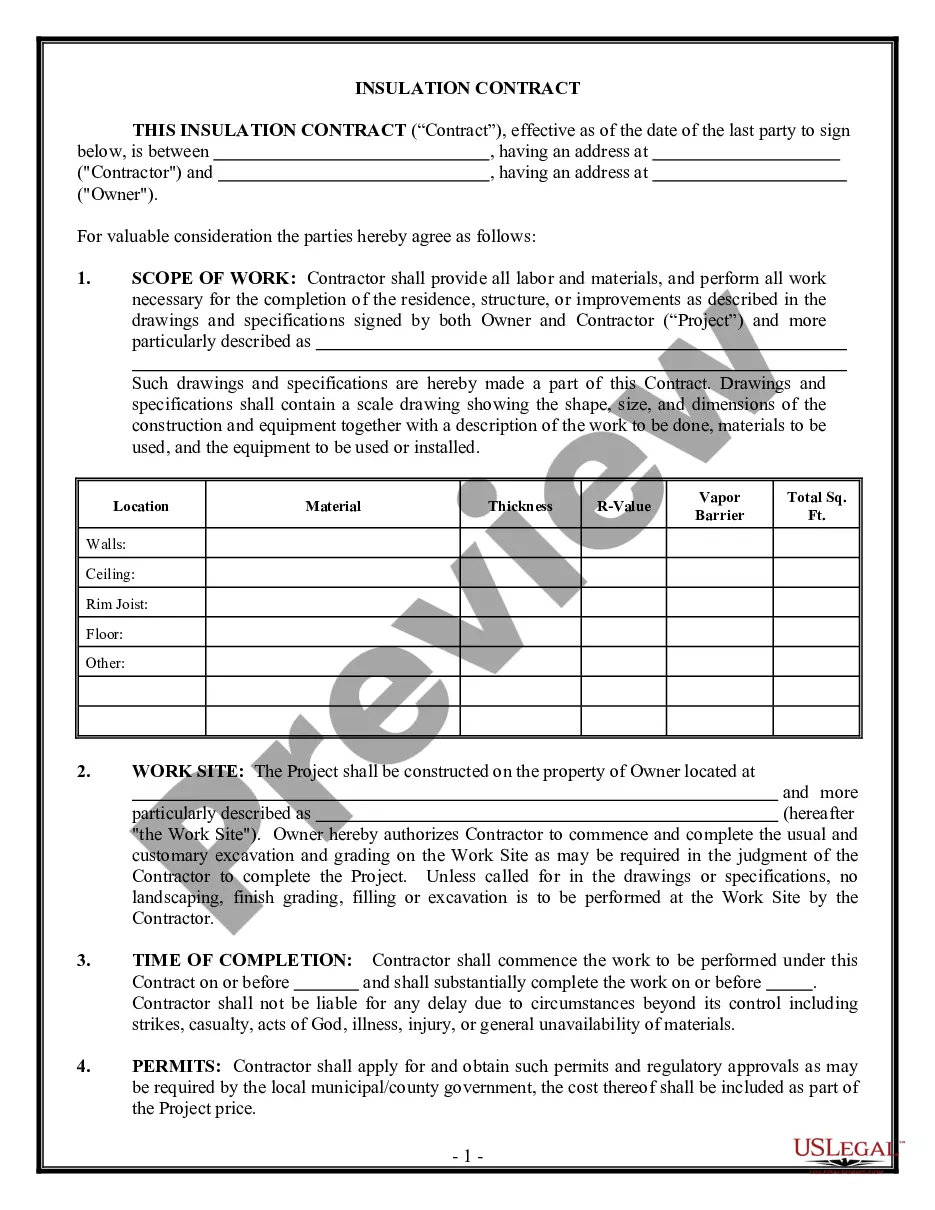

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

- Log in to your existing account. Ensure your subscription is active; if not, renew your plan to access your documents.

- Browse the extensive library to find your required form. Utilize the Preview feature to confirm that it meets your jurisdiction needs.

- If necessary, use the Search function to locate alternative templates that may be better suited for your requirements.

- Select your document by clicking the 'Buy Now' button, and choose a subscription plan that fits your needs. Create an account to access full resources.

- Complete your purchase by entering your payment details or using PayPal for convenience.

- Download the form directly to your device and save it for future access in the 'My Forms' section of your account.

US Legal Forms offers an unmatched selection of over 85,000 legal documents that are both fillable and editable. The platform stands out not only for its extensive collection but also for providing access to premium experts who ensure that your forms are legally sound.

Start simplifying your legal processes today with US Legal Forms. Don’t hesitate—explore the library and find the documents you need to protect your interests!

Form popularity

FAQ

One major mistake parents make is failing to fund the trust properly. If assets are not transferred into the trust, it may not function as intended, which could lead to complications down the line. Parents should also ensure that they review and update the trust periodically to reflect their current wishes. After all, trust survives grantor with no interruptions when managed correctly.

A family trust can require ongoing management and maintenance, which some families may find cumbersome. Setting up the trust can also involve initial costs and legal fees. Despite these factors, a well-structured family trust provides significant benefits, including control over the distribution of assets. Trust survives grantor with no loss of structure, making it a reliable choice for many families.

While trusts offer many benefits, they can come with some downsides. One issue might be the complexity involved in setting up the trust correctly, which can lead to legal issues later. Additionally, families may need to constantly update the trust to reflect changes in their assets or situations. However, trust survives grantor with no loss of control, provided the terms are clear.

When the grantor of a trust dies, the trust continues to operate as specified within its terms. The assets in the trust do not become part of the probate estate, allowing for a smooth transfer to beneficiaries. This means that heirs can receive their inheritance without the delays often associated with probate court. Trust survives grantor, providing peace of mind for both the grantor and the successors.

Yes, a trust can exist without a grantor, but it typically refers to a type of trust created through legal statutes rather than an individual. Such trusts may be set up for specific purposes, such as charitable purposes or specific asset management scenarios. Understanding this concept can be complex, so using tools from uslegalforms may help clarify how a trust can survive grantor with no personal involvement.

Filling out a living trust involves several steps, starting with determining the assets you wish to include. Next, you will need to designate the trustee and beneficiaries clearly. After completing the trust document, ensure that you fund the trust by transferring ownership of your assets to it, thus making sure that the trust survives grantor with no gaps in asset protection. Consider using resources from the uslegalforms platform to simplify this process.

To apply for an EIN for a trust after the grantor has died, you must complete Form SS-4 and provide relevant information about the trust. You can do this online through the IRS website, or by fax or mail. This EIN is essential, as it allows the trust to conduct financial transactions and file taxes. Ensure you have all necessary details on hand, as managing a trust that survives grantor with no complications requires accuracy.

One downside to a living trust is the potential for higher upfront costs compared to a will. While living trusts allow for a smoother transfer of assets upon the grantor’s passing, they require careful setup and management. Furthermore, if you do not fund the trust properly, those assets may not be protected, which complicates what should be a straightforward estate transition. Remember, a trust survives grantor with no issues only if it is established correctly.

In a non-grantor trust, the trust itself is typically responsible for paying taxes on any income generated from its assets. Beneficiaries may also face tax implications when they receive distributions from the trust. This structure helps in asset protection and privacy while ensuring proper tax management. For more information on structuring your trust effectively, explore options available through uLegalForms.

An example of a non-grantor trust is an irrevocable trust, which cannot be altered by the grantor after its creation. This kind of trust separates the assets from the grantor’s estate, providing tax and asset protection advantages. Understanding how a trust survives grantor with no ties can help you consider this option effectively. Utilize uLegalForms for a clearer path to establishing a non-grantor trust.