Trust Grandchildren Form For Tax Purposes

Description

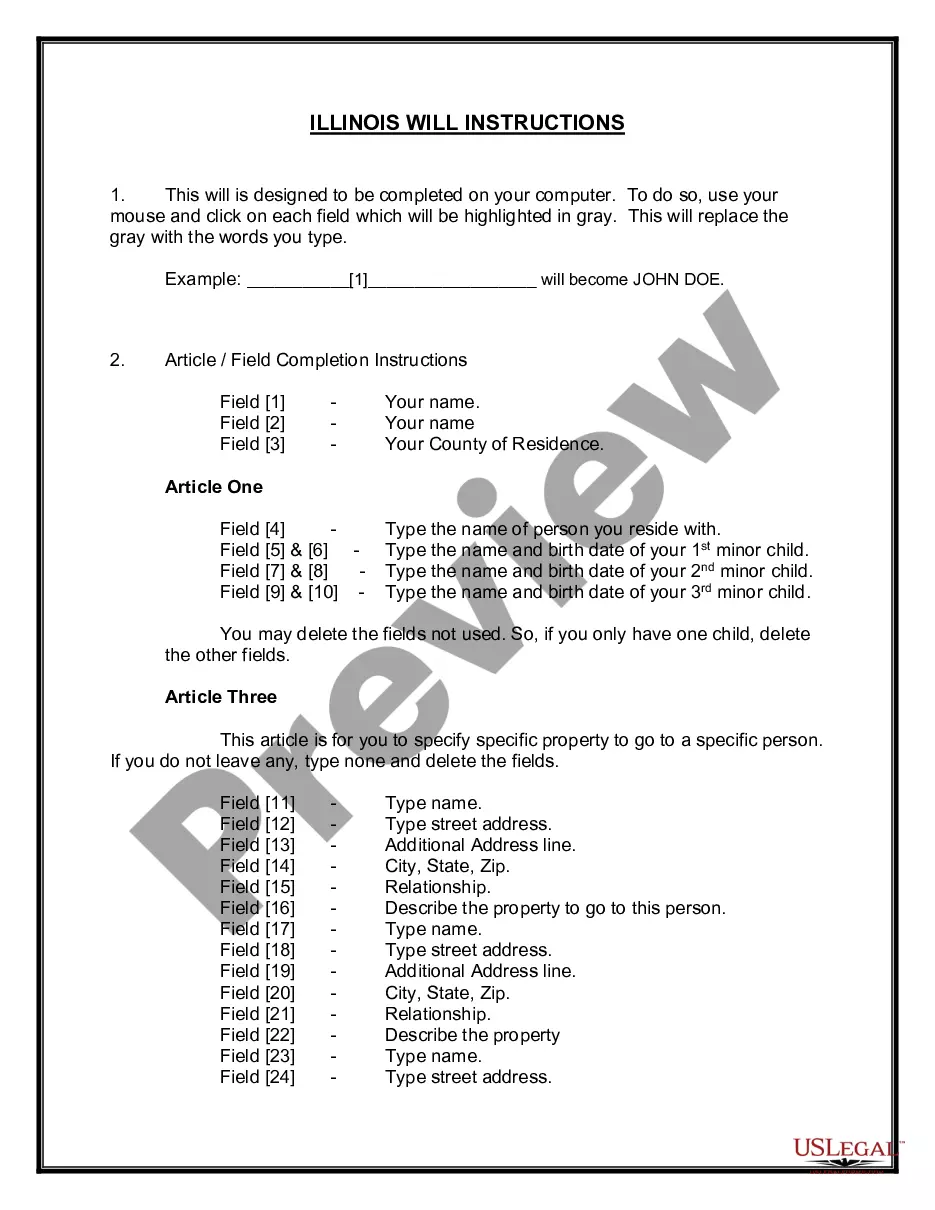

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

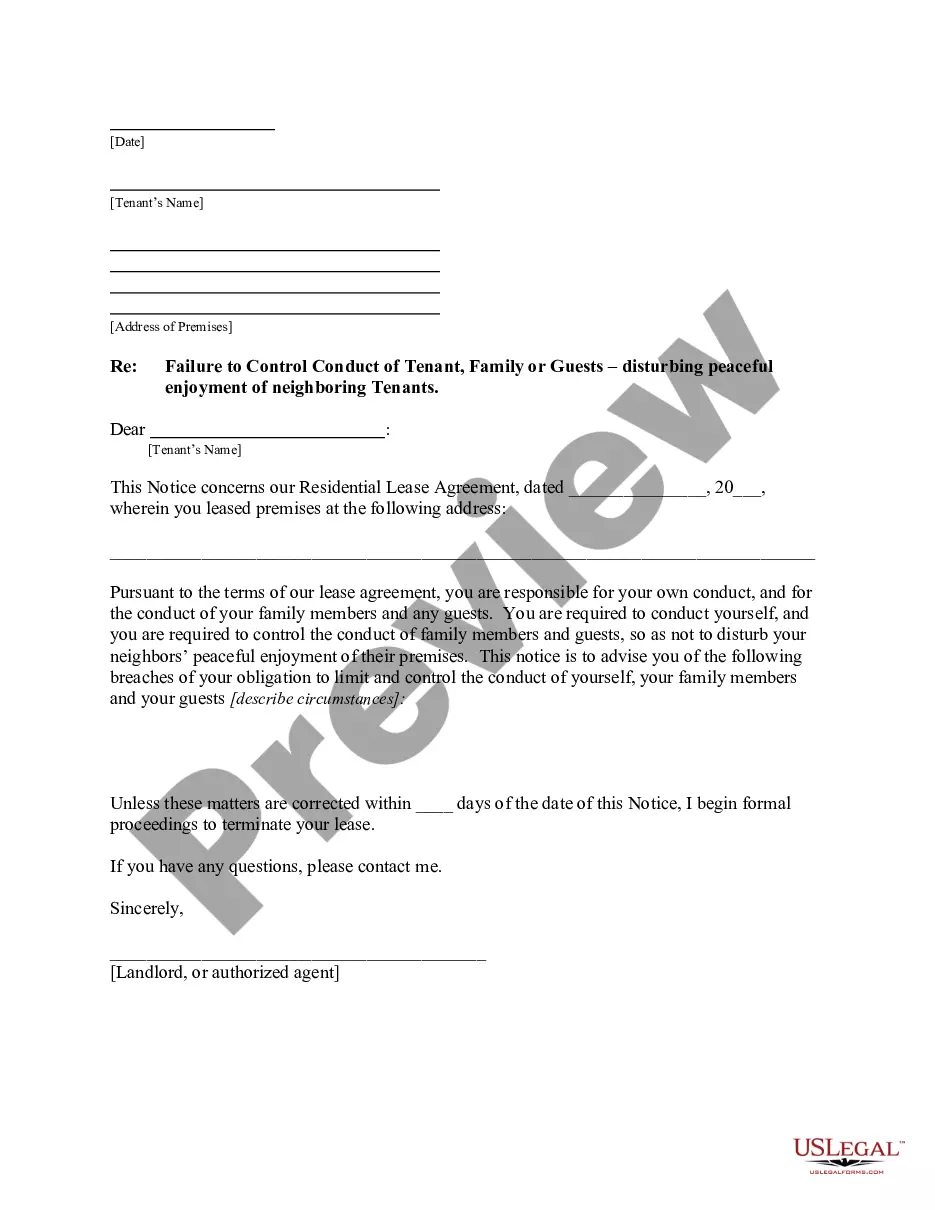

Drafting legal paperwork from scratch can often be intimidating. Some cases might involve hours of research and hundreds of dollars spent. If you’re looking for a a simpler and more cost-effective way of creating Trust Grandchildren Form For Tax Purposes or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of over 85,000 up-to-date legal documents addresses virtually every aspect of your financial, legal, and personal affairs. With just a few clicks, you can quickly get state- and county-compliant templates carefully put together for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can quickly locate and download the Trust Grandchildren Form For Tax Purposes. If you’re not new to our services and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it at any time in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and navigate the library. But before jumping directly to downloading Trust Grandchildren Form For Tax Purposes, follow these recommendations:

- Check the document preview and descriptions to ensure that you are on the the form you are looking for.

- Check if template you choose conforms with the requirements of your state and county.

- Choose the right subscription option to purchase the Trust Grandchildren Form For Tax Purposes.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

Form 709 is an annual return. Generally, you must file Form 709 no earlier than January 1, but not later than April 15, of the year after the gift was made.

First, complete the General Information section on part one of the form. Line 12 would also allow you to check off on whether you and your spouse made joint gifts for the tax year. If not, you may skip lines 13 through 18. Note that your spouse must also sign Form 709 in the appropriate spot if you made joint gifts.

Form 709 must be filed each year that you make a taxable gift and included with your regular tax return.

Establishing a trust Since trusts for grandchildren are legal structures, you'll work with an attorney to establish them. However, you may also want to discuss wealth planning and investment options with your contacts at Wells Fargo Private Bank before you finalize your plans, Sowell says.