Trust Agreement Irrevocable With A Trustee

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

- Access the US Legal Forms platform if you're a returning user. Simply log in to your account and click the Download button for your needed template after ensuring your subscription is active.

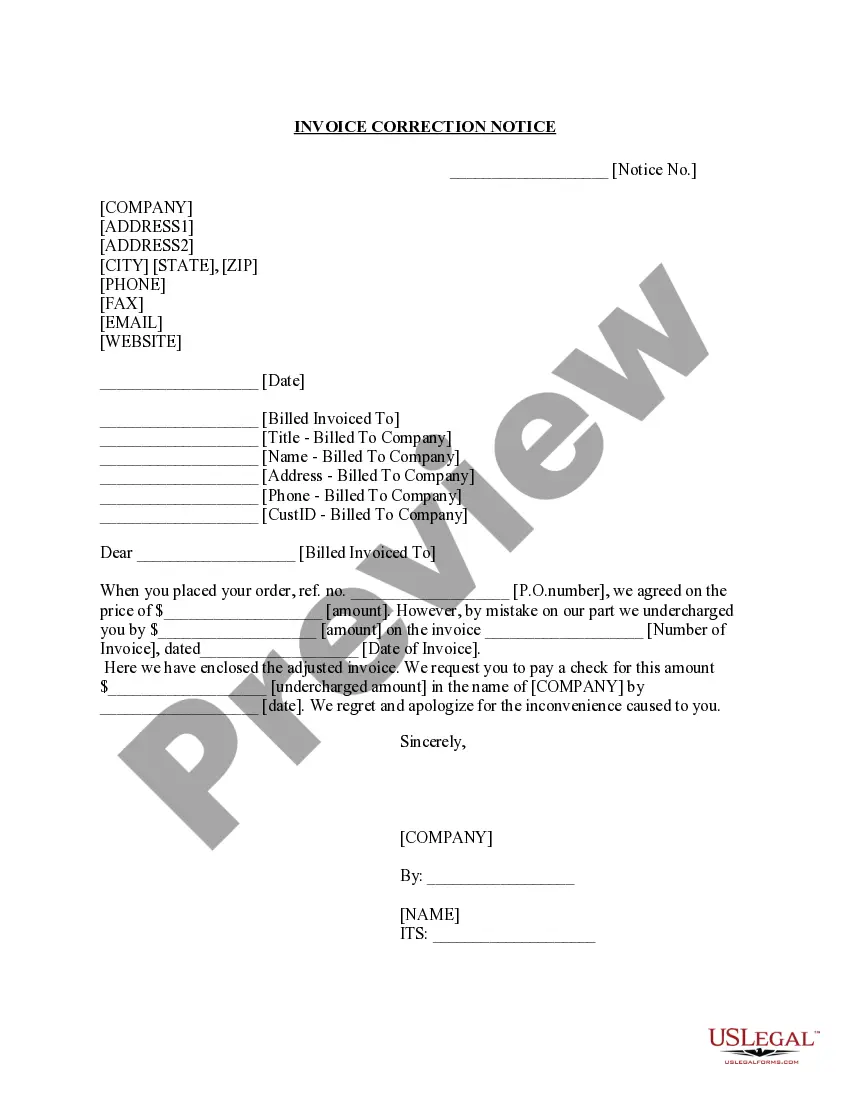

- If you're new to the service, start by browsing the Preview mode and read the form description carefully to ensure it's appropriate for your requirements and complies with local laws.

- If you need another template, utilize the Search tab to find the perfect matching document. Confirm its suitability before continuing.

- Select your document by clicking the Buy Now button and choose a subscription plan that fits your needs. Create an account for full access to the library.

- Complete your purchase by entering your credit card information or opting for payment via PayPal to secure your subscription.

- Download your irrevocable trust agreement template and save it onto your device for future completion. You can always access it again in your My Forms section.

US Legal Forms provides a robust collection of over 85,000 legal forms, enabling swift document execution. This means you can create legally sound agreements confidently and efficiently.

Take control of your legal needs today. Start using US Legal Forms and ensure your trust agreement irrevocable with a trustee aligns with your individual goals.

Form popularity

FAQ

A trustee of a trust agreement irrevocable with a trustee possesses various powers defined within the trust document. These powers typically include handling financial transactions, making investment decisions, and administering distributions to beneficiaries. Importantly, the trustee must execute these powers while prioritizing the interests of the beneficiaries and complying with all legal requirements. Understanding these powers can help you choose a well-suited trustee for your irrevocable trust.

A trustee is responsible for managing the assets held in a trust agreement irrevocable with a trustee. This includes overseeing investments, distributing funds according to the terms of the trust, and ensuring that the trust complies with legal obligations. The trustee acts in the best interest of the beneficiaries while adhering to the specific guidelines laid out in the trust document. A trustworthy and knowledgeable trustee can ultimately enhance the effectiveness of your irrevocable trust.

Choosing the right trustee for your trust agreement irrevocable with a trustee is crucial. You may prefer a trusted family member or friend who understands your financial situation and wishes for your beneficiaries. Alternatively, appointing a professional trustee, such as a bank or a trust company, can offer neutrality and expertise, helping to manage the trust effectively.

You can indeed write your own trust agreement irrevocable with a trustee, provided you understand the necessary legal requirements. However, it’s essential to be thorough and precise, as any oversight could lead to complications in the future. Consider using USLegalForms for templates and expert insights, ensuring your trust is legally sound and meets your specific needs.

One common mistake regarding trust agreement irrevocable with a trustee is failing to communicate intentions with heirs. Parents may not explain the purpose of the trust, leading to misunderstandings among family members. Another mistake involves not regularly reviewing the trust to ensure it aligns with current family dynamics and financial circumstances.

To draft a trust agreement irrevocable with a trustee, start by outlining the assets you wish to include and the beneficiaries you intend to help. Clearly define the roles and responsibilities of the trustee, ensuring compliance with state laws. Using platforms like USLegalForms can simplify this process, providing templates and guidance tailored to your needs.

When creating a trust agreement irrevocable with a trustee, avoid placing assets that you may need access to in the future, like your primary home or any personal items of significant sentimental value. Additionally, don't include retirement accounts or life insurance policies funded outside of the trust, as they may not provide the intended tax benefits. It's also wise to refrain from including debts, as this can complicate the trust's functionality.

Recently, changes in tax laws may affect how irrevocable trusts are treated, particularly concerning taxes on income generated by trust assets. These rules can have implications for both grantors and beneficiaries. It is important to stay updated on these changes, as they can influence the administration of a trust agreement irrevocable with a trustee. For detailed guidance, the US Legal Forms platform offers various resources that help you navigate the complexities of trust law.

An irrevocable trust is valid when it meets state laws, has a clearly defined purpose, and the grantor must relinquish control of the assets. All parties, including the trustee and beneficiaries, must agree to the terms set forth in the trust agreement irrevocable with a trustee. Additionally, the trust document must be executed according to legal requirements. Consulting with a legal professional can ensure that your trust is valid and enforceable.

The best trustee for an irrevocable trust is someone who is trustworthy, responsible, and understands fiduciary duties. You might consider a family member, friend, or a professional trustee like a bank or trust company. It is crucial that they are capable of managing the assets and adhering to the terms of the trust agreement irrevocable with a trustee. Evaluating their experience and motivation can help you make an informed choice.