Irrevocable Trust Trustors Sample With No Experience

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

Using legal templates that comply with federal and regional laws is crucial, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the right Irrevocable Trust Trustors Sample With No Experience sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by lawyers for any business and life case. They are simple to browse with all documents arranged by state and purpose of use. Our professionals stay up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a Irrevocable Trust Trustors Sample With No Experience from our website.

Getting a Irrevocable Trust Trustors Sample With No Experience is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, adhere to the instructions below:

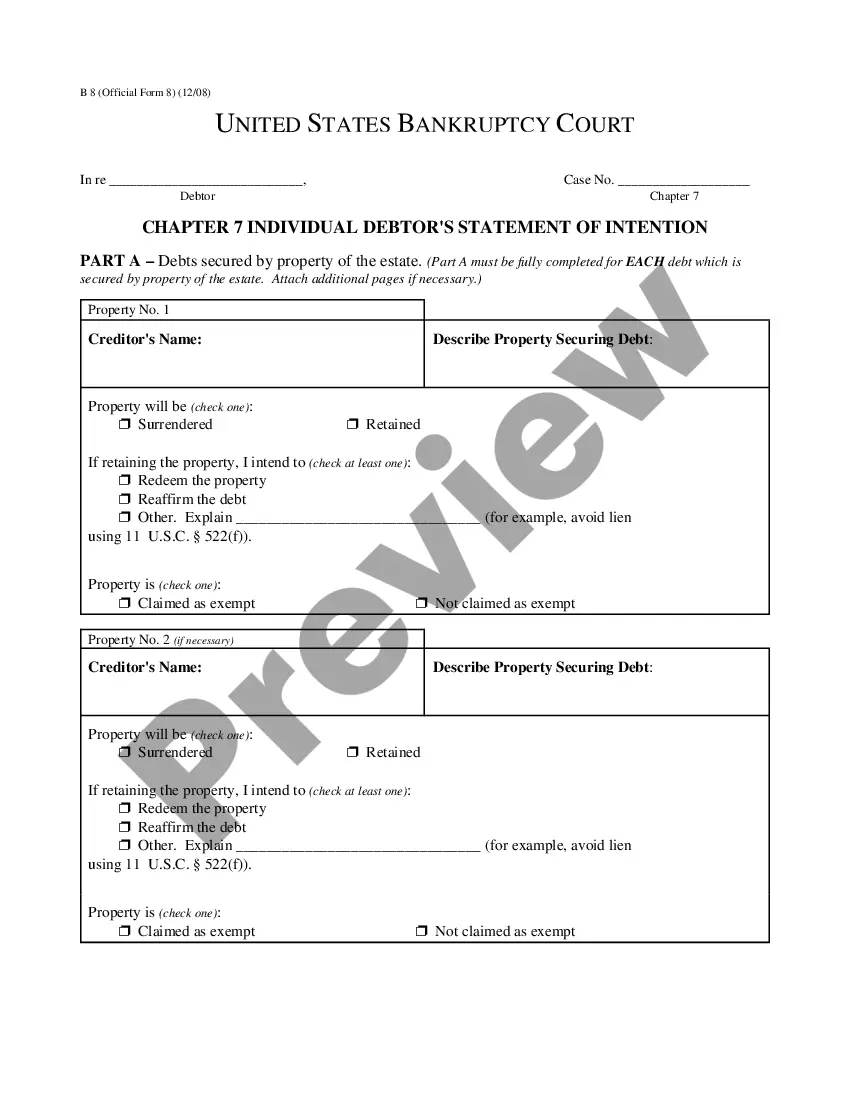

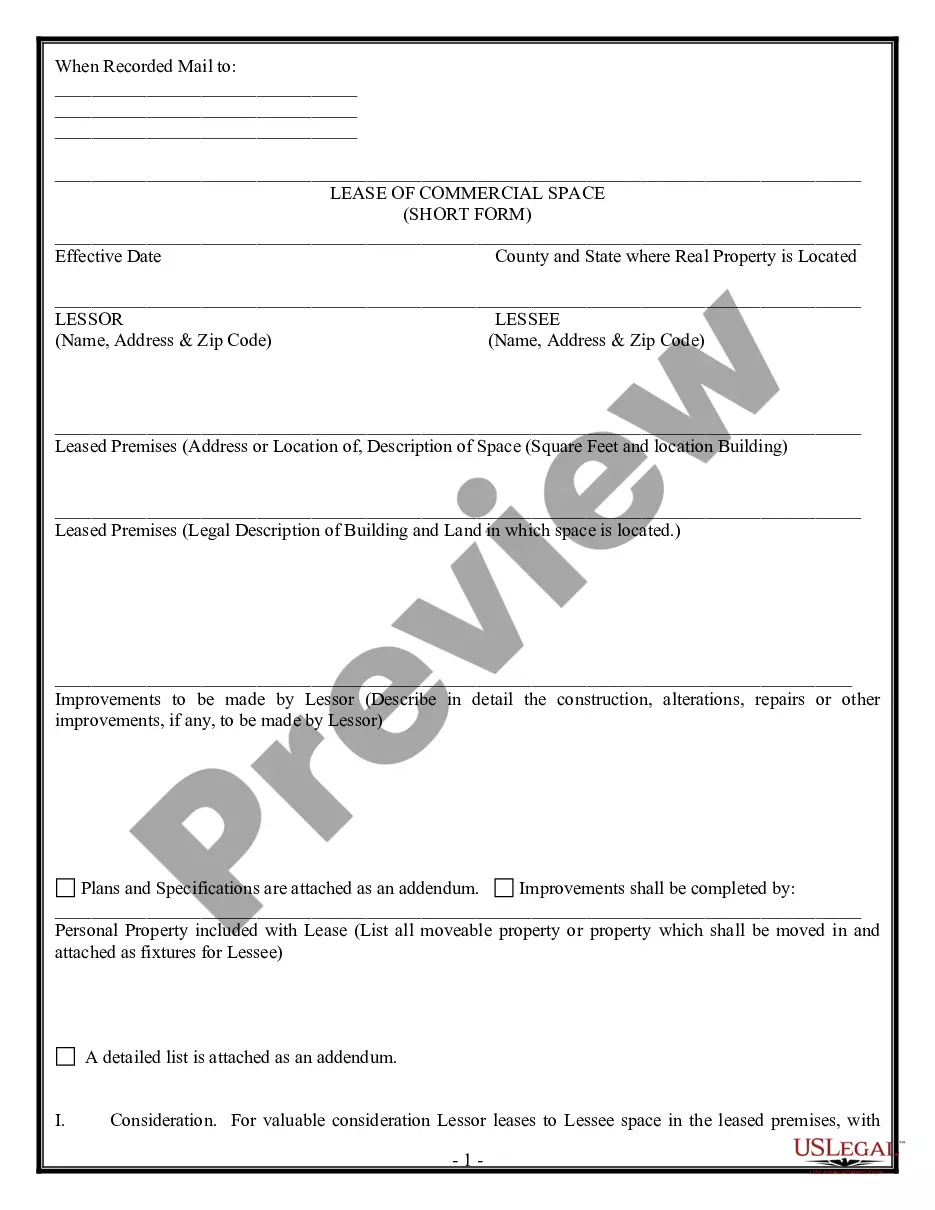

- Take a look at the template using the Preview feature or via the text outline to ensure it meets your requirements.

- Look for a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and select a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Irrevocable Trust Trustors Sample With No Experience and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and complete earlier obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Disadvantages of Irrevocable Trusts Fairly Rigid terms: They are not very flexible. Once the terms are established, they can be difficult to change. The Three-Year Rule: If you include life insurance in an irrevocable trust and pass away within three years, the proceeds return to your estate and become taxable.

Unlike a Revocable Trust, which allows for flexibility, you cannot change or revoke this type of trust. Like a Revocable Trust, however, an Irrevocable Trust should be set up with the assistance of a reputable estate planning attorney.

What Should I Avoid with My Irrevocable Trust? Use trust funds to pay for personal expenses. Use trust funds to pay for monthly bills, such as phone bills or utilities. Use trust assets to purchase vehicles. Gift assets from the trust to beneficiaries. Transfer assets into the trust without consulting your lawyer.

Types of Irrevocable Trusts Some living trust examples are: Irrevocable life insurance trust. Grantor-retained annuity trust (GRAT), spousal lifetime access trust (SLAT), and qualified personal residence trust (QPRT) (all types of lifetime gifting trusts)

IRS Form for Irrevocable Trust The legal name of the trust, the Trustee name and address must be given to the IRS. Next, the Trustee should file the Form 1041 ? ?U.S. Income Tax Return for Estates and Trusts? with the IRS ? if the Irrevocable Trust has more than $600 in taxable income generated annually.