Irrevocable Trust Form Document For Nevada

Description

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren?

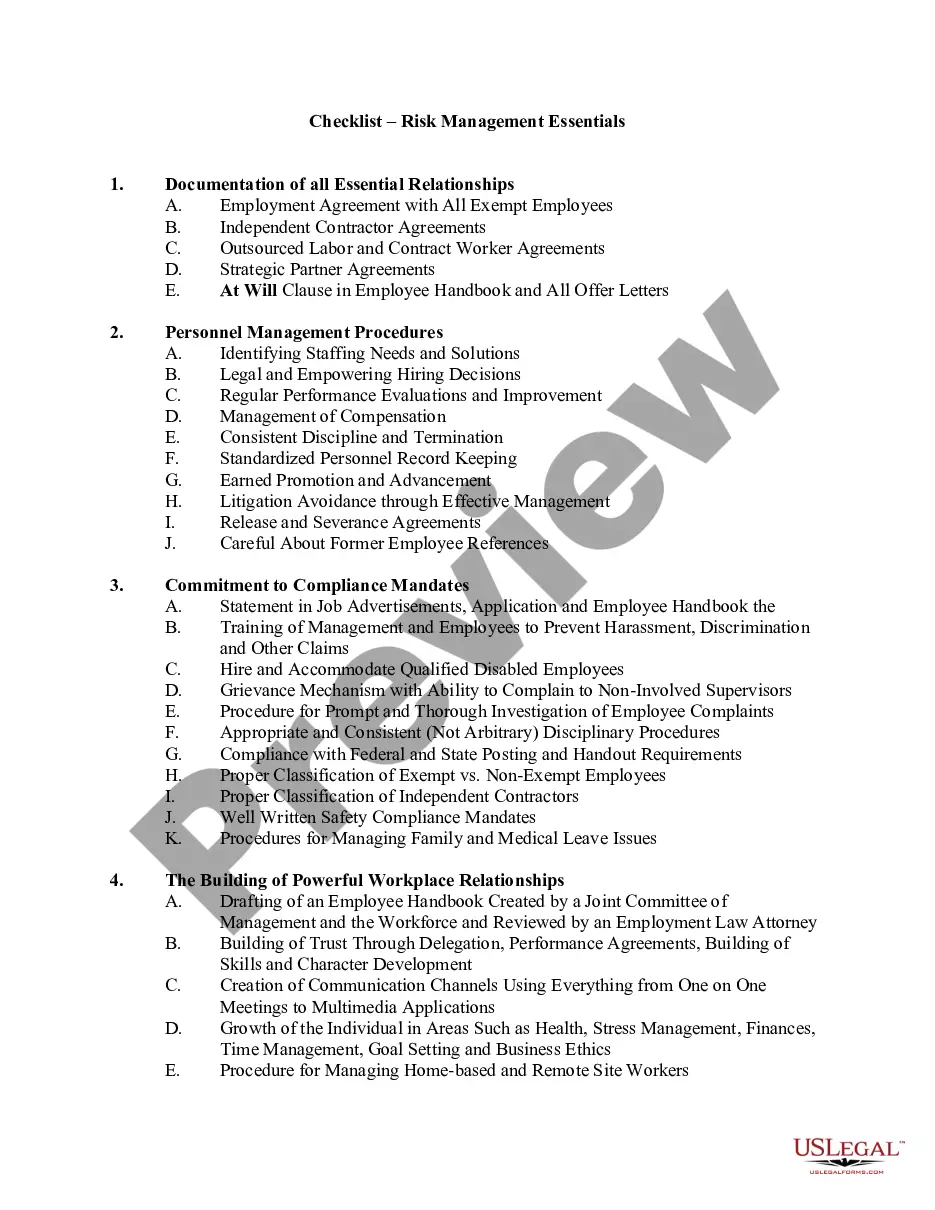

The Unchangeable Trust Form Document For Nevada you observe on this page is a versatile official template prepared by expert attorneys in alignment with federal and state regulations.

For over 25 years, US Legal Forms has delivered individuals, enterprises, and legal practitioners more than 85,000 validated, state-specific forms for various business and personal circumstances. It is the quickest, easiest, and most reliable method to acquire the documents you require, as the service assures bank-grade data security and anti-malware safeguards.

Enroll in US Legal Forms to have validated legal templates for all of life’s scenarios readily available.

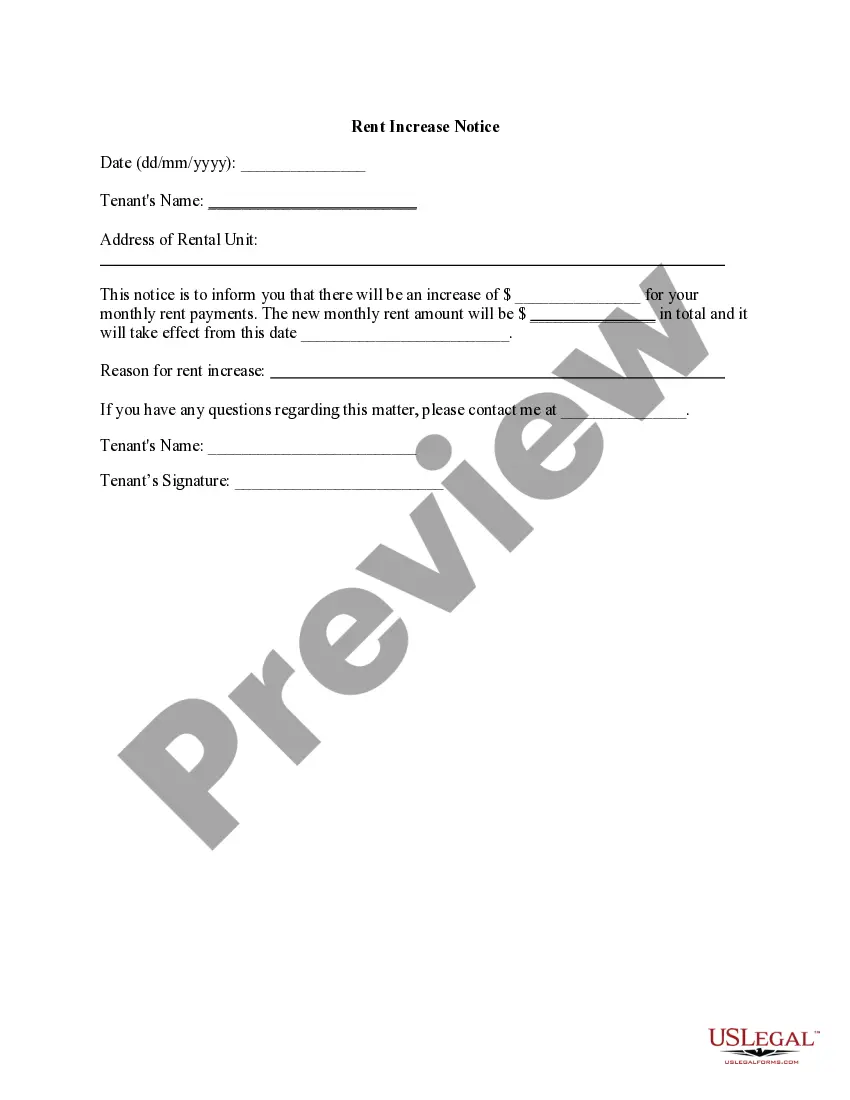

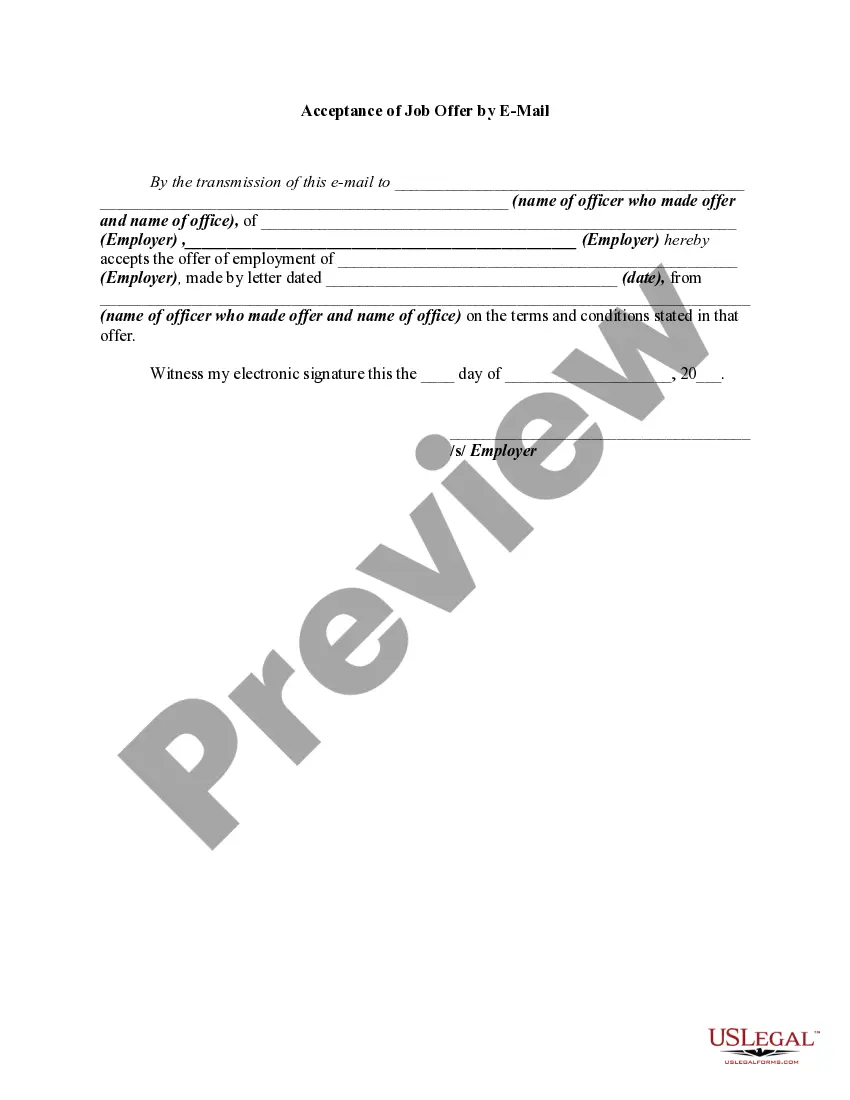

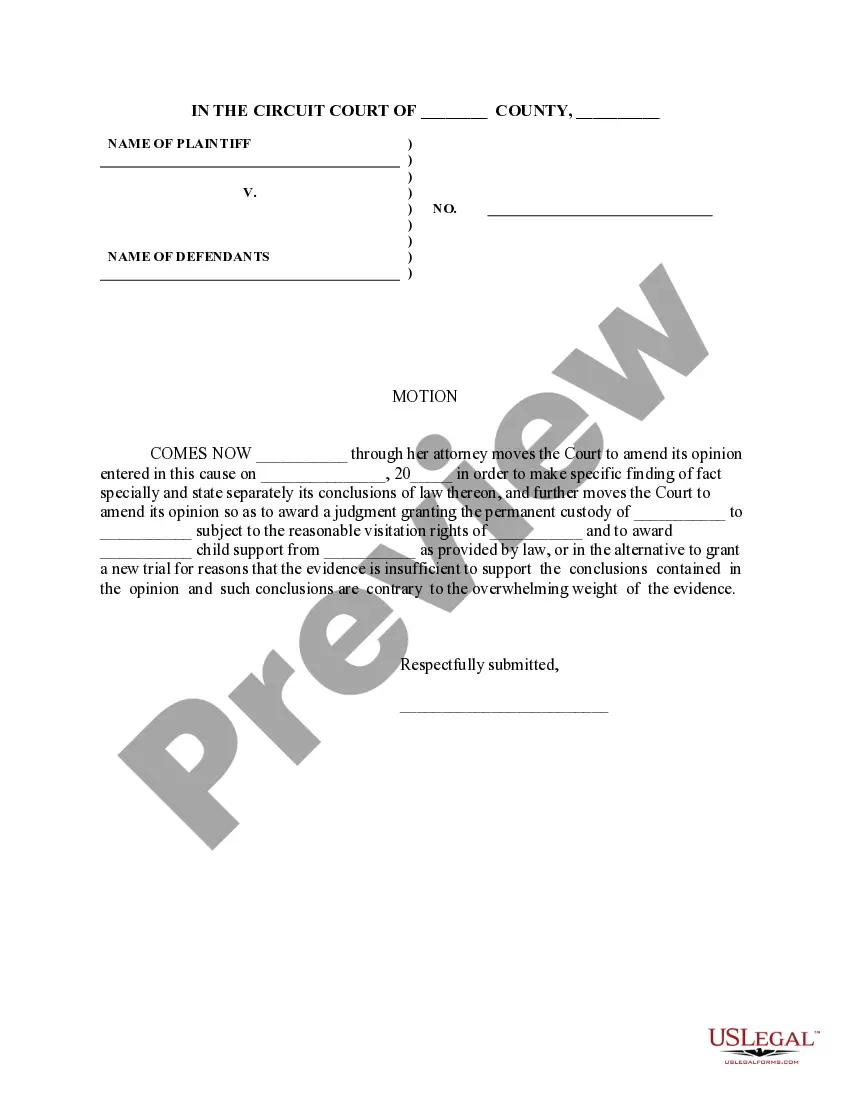

- Search for the document you need and verify it.

- Examine the sample you queried and preview it or assess the form description to confirm it meets your needs. If it doesn’t, use the search function to locate the appropriate one. Click Buy Now once you have found the template you need.

- Sign up and Log In.

- Select the pricing plan that fits you and create an account. Utilize PayPal or a credit card for rapid payment. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

- Choose the format you want for your Unchangeable Trust Form Document For Nevada (PDF, DOCX, RTF) and save the sample to your device.

- Finalize and endorse the documents.

- Print out the template to complete it manually. Alternatively, employ an online multi-functional PDF editor to swiftly and accurately fill out and sign your form with a legally-recognized electronic signature.

- Re-download your documents as needed.

- Utilize the same document again whenever required. Access the My documents tab in your profile to redownload any previously retrieved forms.

Form popularity

FAQ

In Nevada, a trust does not need to be recorded with the county or state. Specific assets, like real estate, may require separate documentation, but the Irrevocable trust form document for Nevada itself remains private. Keeping your trust document secure is essential, as it contains sensitive information. You can manage your affairs without unnecessary public exposure this way.

Yes, you can create your own trust in Nevada. By using an Irrevocable trust form document for Nevada, you can outline your terms and conditions easily. However, it's advisable to seek legal advice to ensure that your trust complies with all state laws. This approach gives you control over your estate planning while keeping costs down.

To file a trust in Nevada, you first need to create a valid trust document. You can use an Irrevocable trust form document for Nevada, ensuring that you meet state requirements. After drafting the document, you should sign it in front of a notary. Finally, while you do not need to file the trust with the court, you should keep it in a safe place for future reference.

The primary disadvantage of an irrevocable trust is that once you place assets into the trust, you lose ownership and control over them. This means you cannot make changes or terminate the trust without the consent of the beneficiaries. While this structure offers benefits like asset protection and tax advantages, it's essential to consider whether relinquishing control fits your overall financial strategy. Using a reliable service to create your irrevocable trust form document for Nevada can help facilitate a smoother process.

Certain assets may not be ideal for inclusion in an irrevocable trust. For example, personal items with sentimental value, such as family heirlooms, may be better kept outside the trust to maintain personal access. Additionally, assets that have high maintenance costs or liabilities could complicate the trust’s management. It's wise to carefully assess which assets to list on your irrevocable trust form document for Nevada to ensure alignment with your estate planning goals.

The irrevocable trust law in Nevada is designed to provide a flexible and secure framework for individuals looking to establish trusts. Under Nevada law, creating an irrevocable trust requires you to draft a formal irrevocable trust form document for Nevada and transfer your assets into it. Once established, the assets are no longer yours, which can limit your control but enhance protection and tax benefits. Knowing the laws is crucial, and consulting with a legal expert can provide clarity.

The benefits of an irrevocable trust in Nevada include asset protection, tax savings, and control over the distribution of your assets. Once you complete the irrevocable trust form document for Nevada and transfer your assets, they are generally protected from creditors and lawsuits. Additionally, some individuals may experience tax advantages, as the trust may not be subject to estate taxes. This structured approach allows you to determine how and when beneficiaries receive their inheritance.

In Nevada, you can write your own trust, including an irrevocable trust. However, understanding all state guidelines and legal requirements is crucial for a valid document. To simplify the process, US Legal Forms offers easy-to-use templates specifically tailored for Nevada, helping you create an effective irrevocable trust form document for Nevada with confidence.

When creating an irrevocable trust in Nevada, avoid including personal property that doesn’t have a clear valuation or assets that you may need to access directly. Additionally, refrain from placing assets that may incur significant tax penalties. Consulting resources or professionals, such as the templates provided by US Legal Forms, will help you determine the best items to exclude from your irrevocable trust form document for Nevada.

Yes, you can write your own irrevocable trust, but it requires careful attention to detail and legal requirements. It’s essential to use proper terminology and follow Nevada laws governing trust documents. While creating your own trust may save costs, using a platform like US Legal Forms can streamline the process and ensure your irrevocable trust form document for Nevada meets all legal standards.