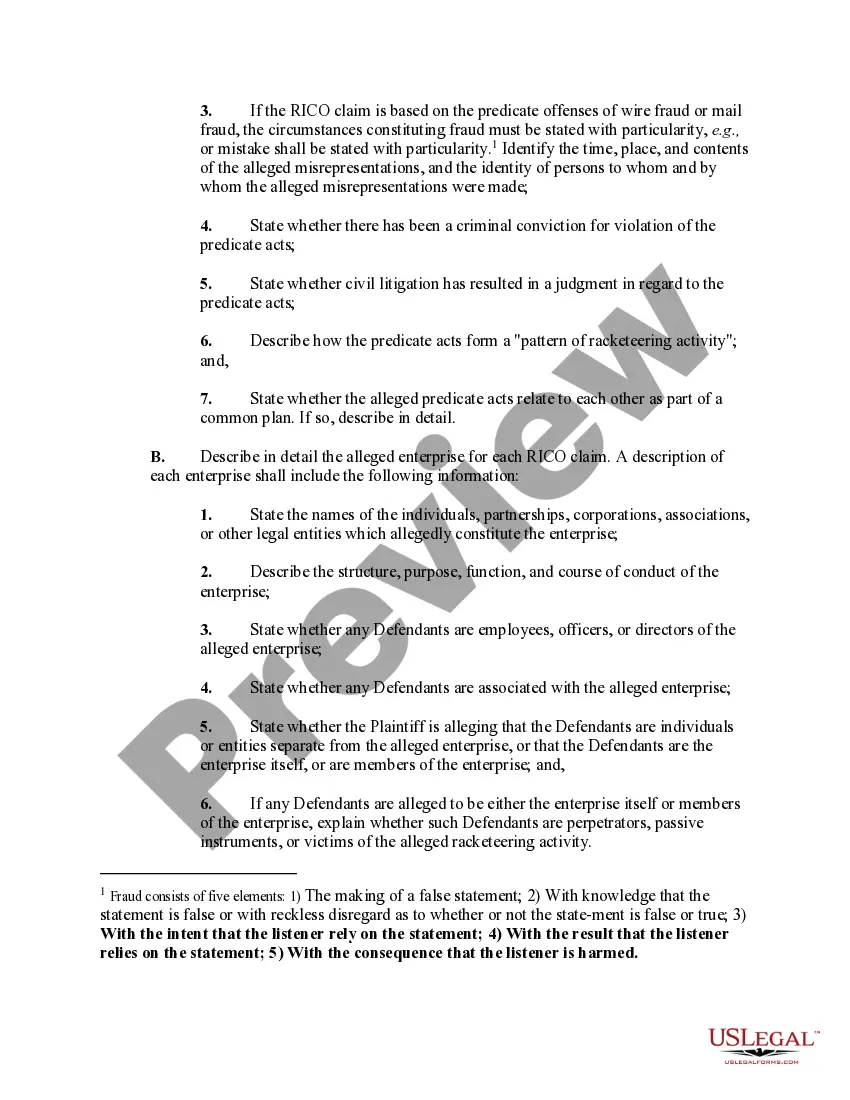

Under federal statutes, such as the Racketeer Influenced and Corruption Organizations Act (RICO) and the state versions of RICO, it is unlawful to obtain a business benefit by means of a threat of economic or physical loss to another or to use racketeering methods to acquire an interest in a legitimate business. A person injured as a result of a RICO violation can recover treble damages and reasonable attorneys' fees. In order to prove a RICO violation, the person must be able to show that he or she was injured by a person associated with an enterprise that has been engaging in a pattern of racketeering, which consists of at least two predicate acts during a ten-year period. The list of predicate acts includes such crimes as any act or threat involving murder, kidnapping, gambling, arson, robbery, bribery, extortion, dealing in obscene matter, or dealing in a controlled substance, mail fraud, relating to tampering with a witness or victim, and securities fraud.

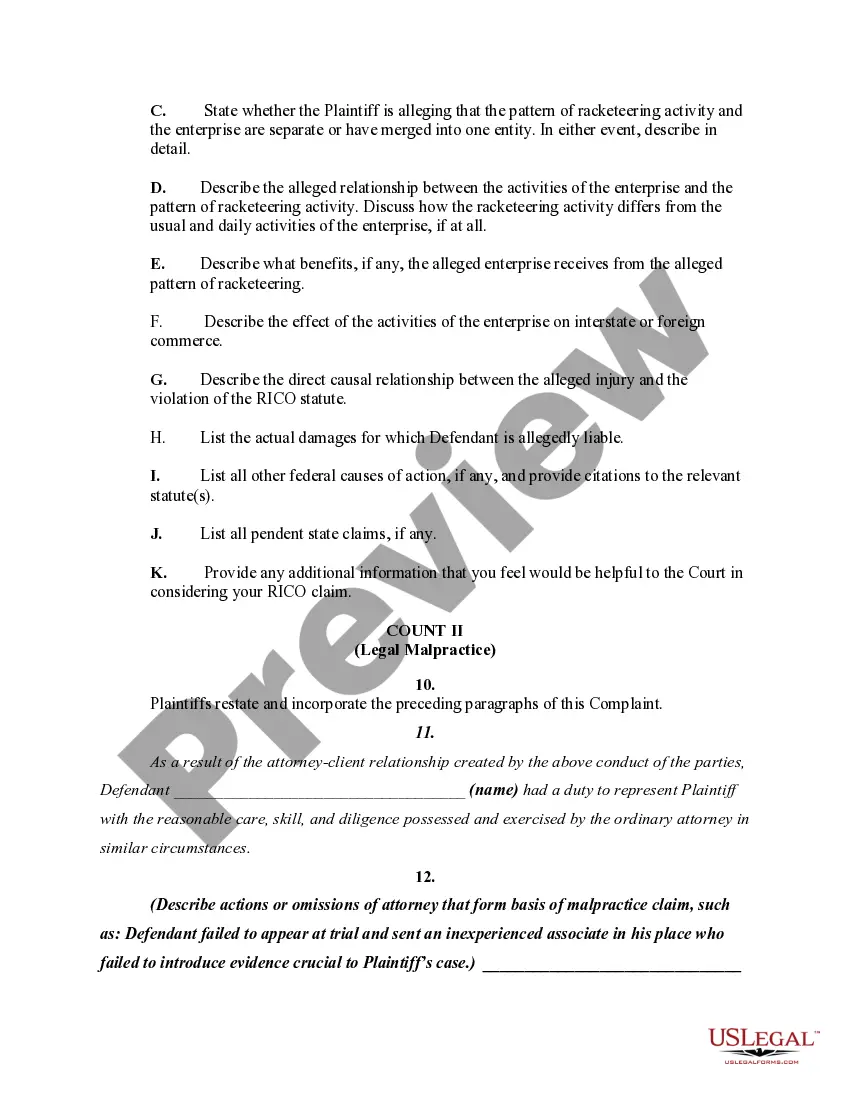

Legal malpractice is the failure of an attorney to follow the accepted standards of practice of his or her profession, resulting in harm to the client. Usually, proof of failure to comply with accepted standards of legal practice requires the testimony of someone with expertise in law practice. Some states have special evidentiary rules applicable to malpractice claims.

A civil conspiracy is a combination of two or more persons who engage in a concerted action to accomplish some criminal or unlawful purpose, or to accomplish some purpose by unlawful means, to the injury of another. The essence of the crime of conspiracy is the agreement. The essence of civil conspiracy is damages, i.e., actionable damage committed in furtherance of a conspiracy or resulting from it. Title 42 U.S.C. ?§ 1985 pertains to a conspiracy to interfere with civil rights, (1) to prevent an officer from performing a duty; (2) obstructing justice; intimidating party, witness, or juror; (3) or depriving persons of rights or privileges.