Difference Between Lien And Foreclosure

Description

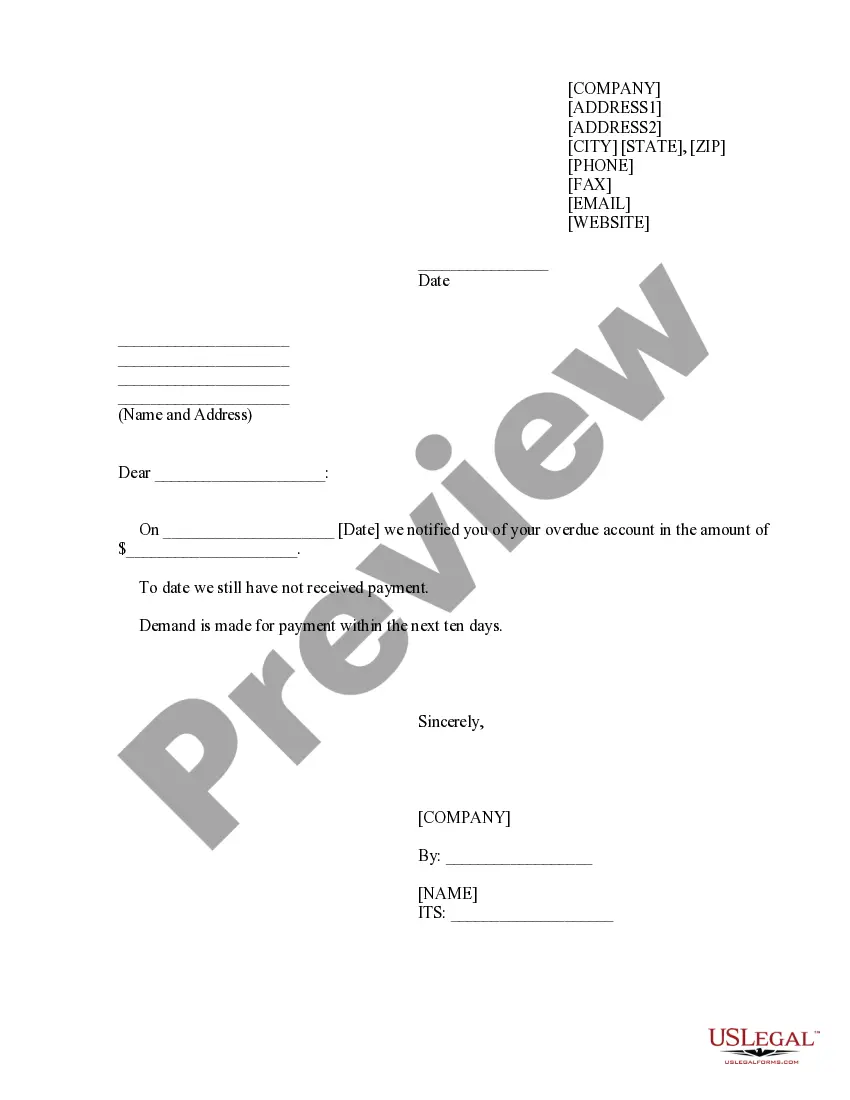

How to fill out Complaint Or Petition To Foreclose On Mechanic's Lien?

Legal administration can be exasperating, even for the most seasoned professionals.

When you seek to understand the Difference Between Lien And Foreclosure but lack the opportunity to invest time in locating the correct and current version, the tasks can be challenging.

Leverage a valuable reservoir of articles, manuals, and resources related to your circumstances and requirements.

Conserve time and effort in searching for the documents you require, and utilize US Legal Forms’ advanced search and Preview feature to locate the Difference Between Lien And Foreclosure and acquire it.

Make sure the template is accepted in your state or county. Choose Buy Now when you’re ready. Select a subscription plan. Decide on the file format you desire, then Download, complete, sign, print, and submit your documents. Enjoy the US Legal Forms online catalog, backed by 25 years of expertise and dependability. Revamp your everyday document management into a straightforward and user-friendly experience today.

- If you hold a membership, Log In to your US Legal Forms account, search for the form, and obtain it.

- Check your My documents section to review the records you have previously saved and to organize your files as you prefer.

- If it’s your first experience with US Legal Forms, create an account and gain unlimited access to all the features of the library.

- Here are the steps to take after downloading the form you need.

- Verify it is the correct document by previewing it and reviewing its description.

- Access state- or county-specific legal and business documents.

- US Legal Forms encompasses all requirements you might have, from personal to corporate paperwork, all in one place.

- Utilize advanced tools to complete and oversee your Difference Between Lien And Foreclosure.

Form popularity

FAQ

If the IRS tax lien is junior to the mortgage being foreclosed, the IRS tax lien will be foreclosed through the judicial sale and the lien on the property will be extinguished after the judicial deed is issued.

Liens have some disadvantages, such as: A lien applies only to the particular asset or property that it is attached to, so it does not protect other assets. A lien holder may not be able to recover the amount due if the asset or property attached to the lien is lost or damaged.

Pre-foreclosure is the time between your notice of default on mortgage payments and the loss of your property to your lender or a buyer. Foreclosure is the end of the road: your home is sold at auction or the bank repossesses it.

A general rule in property law says that whichever lien is recorded first in the land records has higher priority over later-recorded liens. This rule is known as the "first in time, first in right" rule.

Mortgages, car loans and secured personal loans are all examples of loans requiring collateral. When you take out a secured loan, you're giving the lender a right to claim the asset as payment for the loan. That claim to your property is the lien. On the other hand, unsecured loans don't require collateral.