Whether your will should be in a safe deposit box at a bank or elsewhere, such as with your attorney, depends on what your state law says about who has access to your safe deposit box when you die. The recent trend in many states is to make it relatively easy for family members or the executor to remove the will and certain other documents (such as life insurance policies and burial instructions) from a deceased person's safe deposit box. In those states, it might be a good idea to leave your will in the safe deposit box. However, in some states, it may require a court order to remove the will, which can take time and money.

Safe Deposit Access With Bank

Description

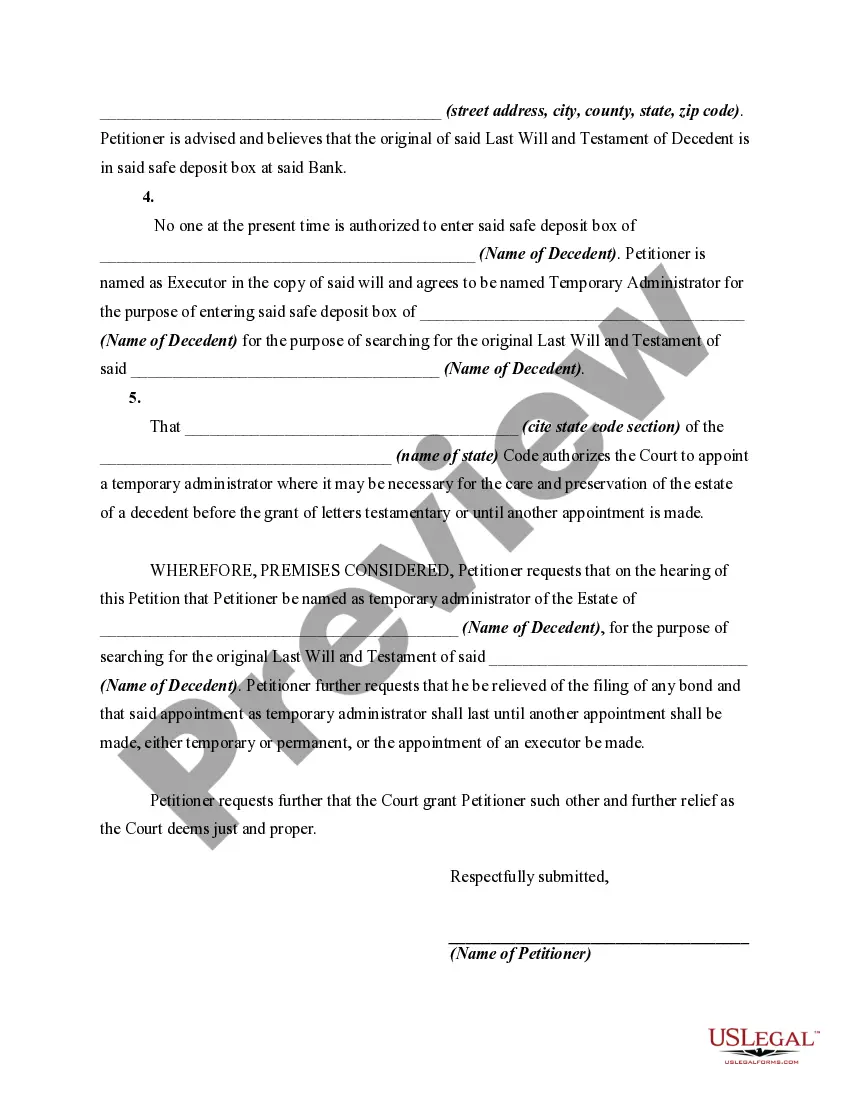

How to fill out Petition For Appointment Of Temporary Administrator In Order To Gain Access To Safe Deposit Box?

Whether for business purposes or for individual matters, everyone has to deal with legal situations sooner or later in their life. Filling out legal documents requires careful attention, starting with selecting the proper form sample. For example, if you pick a wrong edition of the Safe Deposit Access With Bank, it will be declined when you submit it. It is therefore important to get a reliable source of legal papers like US Legal Forms.

If you have to get a Safe Deposit Access With Bank sample, follow these easy steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Examine the form’s description to make sure it suits your case, state, and county.

- Click on the form’s preview to view it.

- If it is the wrong document, get back to the search function to locate the Safe Deposit Access With Bank sample you need.

- Download the file if it meets your needs.

- If you have a US Legal Forms profile, click Log in to gain access to previously saved documents in My Forms.

- In the event you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the proper pricing option.

- Complete the profile registration form.

- Choose your transaction method: use a credit card or PayPal account.

- Choose the file format you want and download the Safe Deposit Access With Bank.

- When it is saved, you can fill out the form with the help of editing software or print it and complete it manually.

With a substantial US Legal Forms catalog at hand, you never have to spend time searching for the appropriate sample across the internet. Utilize the library’s easy navigation to find the right form for any occasion.

Form popularity

FAQ

For over a century, Chase and other major banks have offered customers secure storage for valuables and important documents. However, after conducting an in-depth review of safe deposit box operations, Chase found that costs had spiraled out of control while customer usage had severely declined over the past decade.

Safe deposit boxes are used to store valuable possessions, such as gemstones, precious metals, currency, marketable securities, luxury goods, important documents (e.g. wills, property deeds, or birth certificates), or computer data, which need protection from theft, fire, flood, tampering, or other perils.

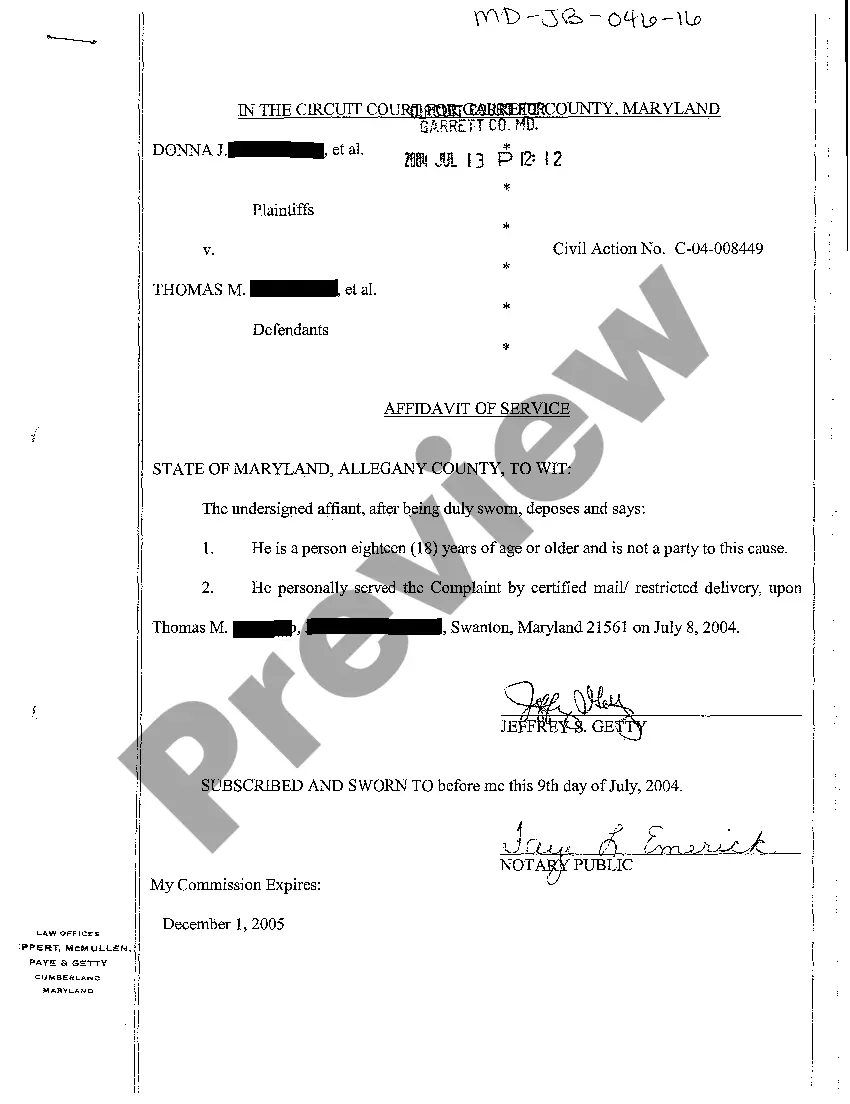

Dual control: Two people?usually a bank employee and the renter?are required to open the box. In this way, no one person can ever open the box and remove the contents. Authorized signature: When the safe deposit account is opened, all persons authorized to access the box sign a signature card.

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes. FDIC Consumer News Winter 2018 - Five Things to Know About Safe ... fdic.gov ? consumer ? news ? cnwin18 ? fiv... fdic.gov ? consumer ? news ? cnwin18 ? fiv...

The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.