Covered Loan For Hmda Reporting

Description

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

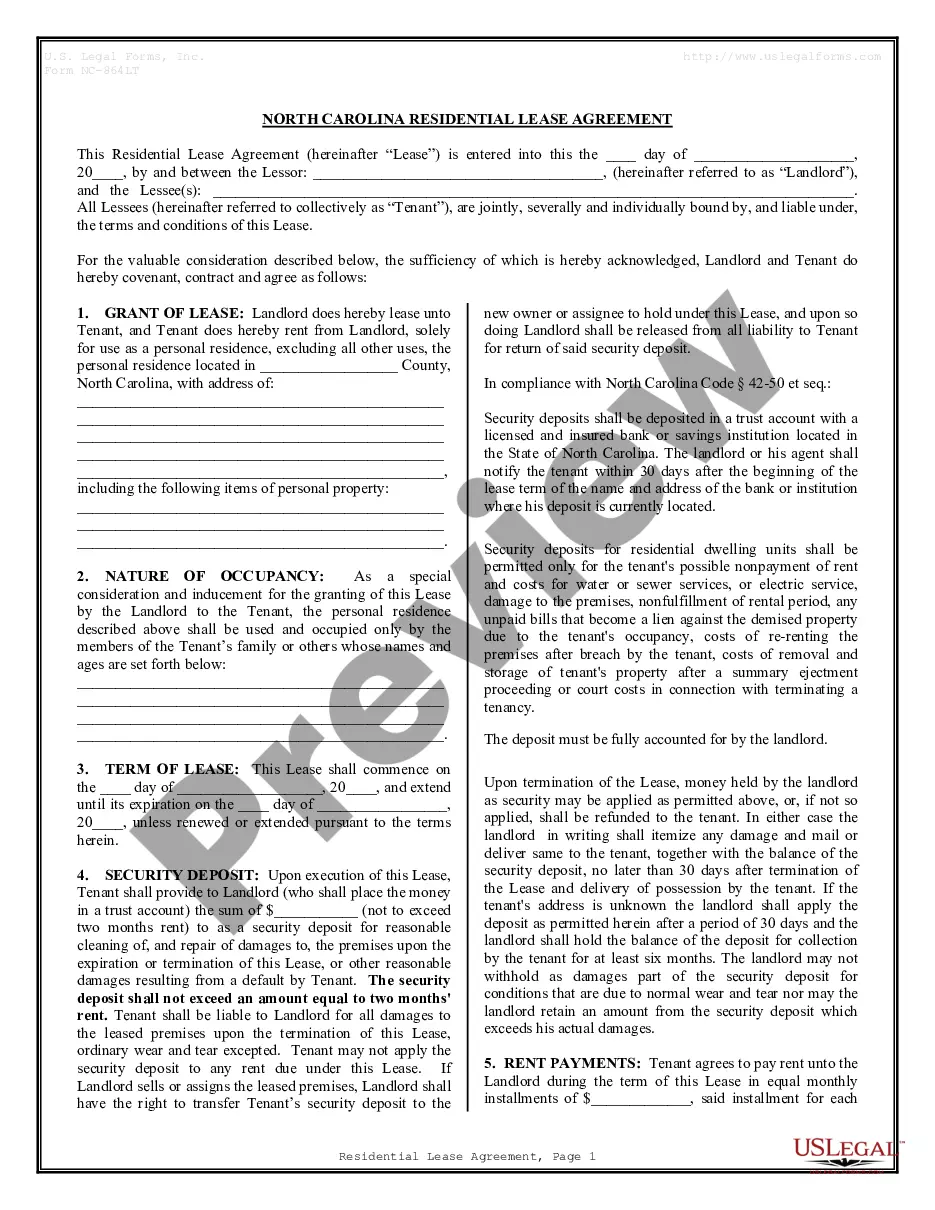

Managing legal documents and processes can be a lengthy addition to your schedule. Covered Loan For Hmda Reporting and similar forms typically require you to search for them and comprehend how to fill them out accurately.

Therefore, whether you are addressing financial, legal, or personal issues, having a comprehensive and accessible online repository of forms readily available will be immensely beneficial.

US Legal Forms is the leading online source of legal templates, offering over 85,000 state-specific forms and a variety of tools to help you complete your paperwork swiftly.

Explore the collection of pertinent documents available to you with just a single click.

Then, follow the steps outlined below to complete your form: Ensure you have located the correct form by utilizing the Preview option and reviewing the form description. Select Buy Now when ready, and choose the subscription plan that best fits your needs. Click Download and then complete, eSign, and print the form. US Legal Forms has twenty-five years of expertise assisting users manage their legal documentation. Acquire the form you need today and simplify any process effortlessly.

- US Legal Forms provides you with state- and county-specific forms accessible at any time for download.

- Protect your document management procedures by utilizing a premium service that allows you to assemble any form within minutes without extra or concealed charges.

- Simply Log In to your account, search for Covered Loan For Hmda Reporting, and download it directly from the My documents section.

- You can also access previously saved forms.

- Is this your first time using US Legal Forms? Register and create an account in a few minutes to access the form library and Covered Loan For Hmda Reporting.

Form popularity

FAQ

Covered loans are those that fall under the reporting requirements of HMDA, while uncovered loans do not require such reporting. Generally, covered loans are secured by residential properties and meet specific thresholds. In contrast, uncovered loans may not meet these criteria or involve other types of financing. For clarity on which loans to report, consider using US Legal Forms for guidance.

Under HMDA, a covered loan refers to any loan that financial institutions must report for data collection and analysis. This includes loans made for home purchases, home improvements, or refinancing. Identifying these loans accurately is crucial for transparency in lending practices. US Legal Forms can assist you in ensuring that your reporting is accurate and compliant.

A covered loan is a type of loan that meets specific criteria outlined by HMDA, which includes the loan amount, purpose, and property type. Typically, loans secured by residential properties and used for purchasing, refinancing, or improving a home qualify. Understanding these criteria is essential for effective HMDA reporting. Using a platform like US Legal Forms can simplify your compliance process.

A covered loan for HMDA is one that meets specific criteria outlined by the Home Mortgage Disclosure Act. Generally, this includes loans for purchasing or refinancing a dwelling, as well as home improvement loans that exceed certain thresholds. Accurate identification of these loans is vital for compliance, and using platforms like US Legal Forms can simplify your covered loan for HMDA reporting process. By leveraging our resources, you can ensure you meet all necessary requirements efficiently.

A covered loan is a closed-end mortgage loan or an open-end line of credit that is not a transaction specifically excluded from the reporting requirements of the regulation. Determine whether the transaction is a closed-end mortgage loan as defined in §1003.2(d)

There is no specific definition regarding a "purchased loan" or "purchasing entity" under Regulation C; however, this refers to the entity buying/acquiring the covered loan (unless it is the entity making the original credit decision) and not the entity selling the covered loan.

A covered loan is a closed-end mortgage loan or an open-end line of credit that is not a transaction specifically excluded from the reporting requirements of the regulation. Determine whether the transaction is a closed-end mortgage loan as defined in §1003.2(d) We encourage you to read the NCUA's exit link policies.

For purposes of § 1003.4(a), a purchase includes a repurchase of a covered loan, regardless of whether the institution chose to repurchase the covered loan or was required to repurchase the covered loan because of a contractual obligation and regardless of whether the repurchase occurs within the same calendar year ...

(b)"Covered loan" means a consumer loan in which the original principal balance of the loan does not exceed the most current conforming loan limit for a single-family first mortgage loan established by the Federal National Mortgage Association in the case of a mortgage or deed of trust, and where one of the following ...