Deposit Box Form With Insurance

Description

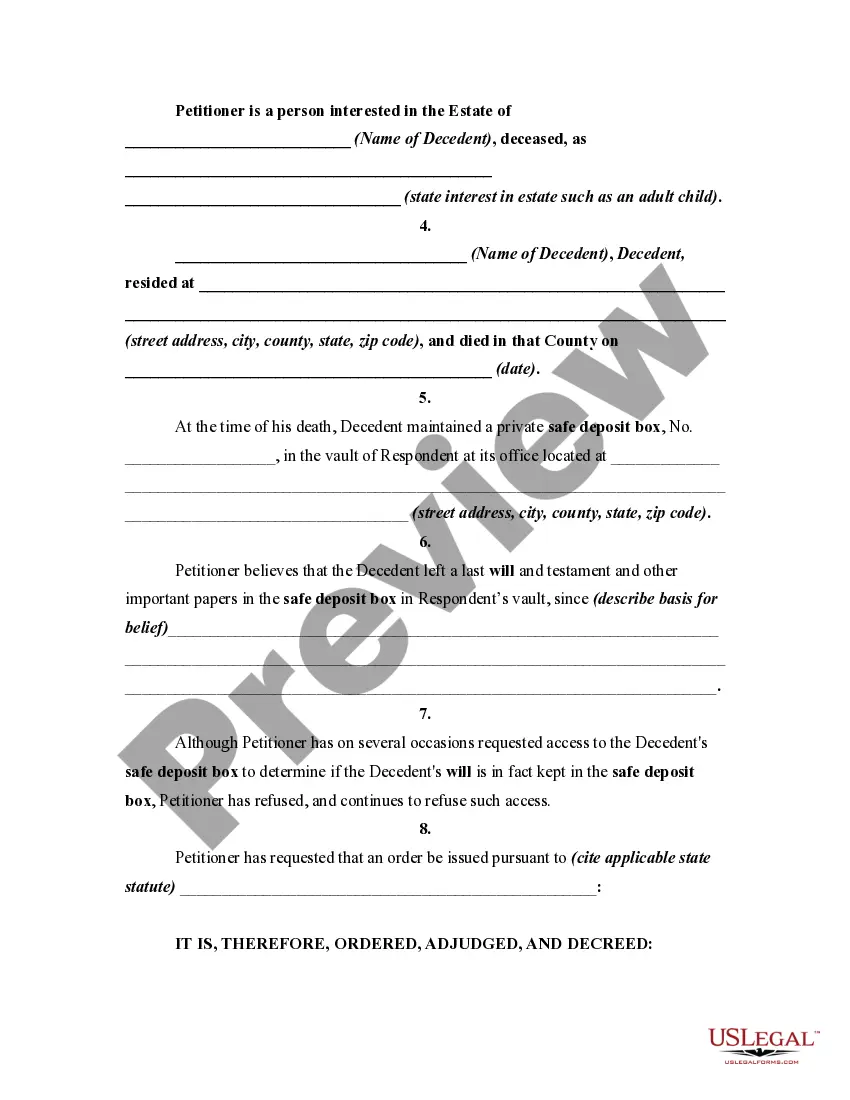

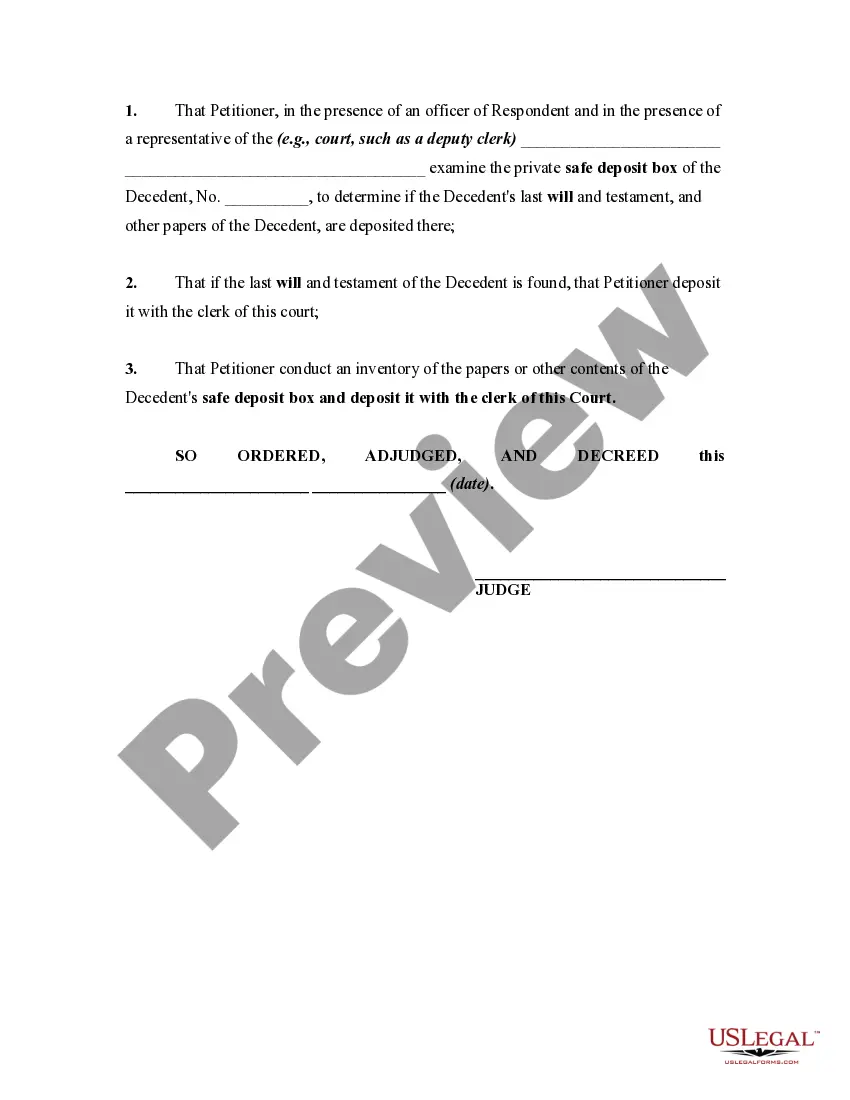

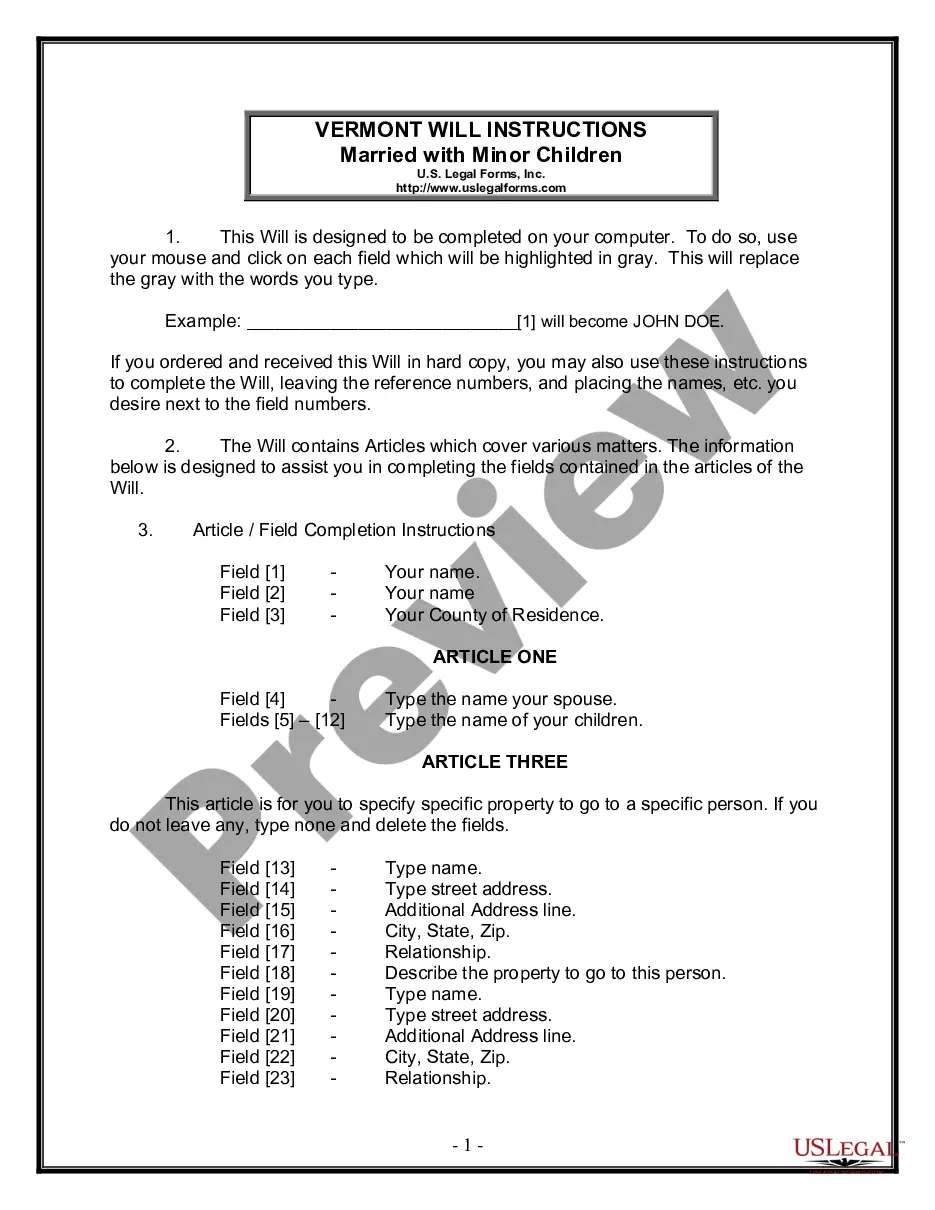

How to fill out Order Authorizing Petitioner To Open Safe Deposit Box Of Decedent?

Legal documents handling can be daunting, even for seasoned experts.

When you seek a Deposit Box Form With Insurance and lack the availability to search for the correct and updated version, the processes can be anxiety-inducing.

US Legal Forms fulfills any needs you might have, from personal to corporate documents, all centralized in one location.

Utilize cutting-edge tools to fill out and manage your Deposit Box Form With Insurance.

Here are the steps to follow after locating the required form: Verify that this is the correct document by previewing it and reviewing its description.

- Explore a rich repository of articles, guides, and resources tied to your circumstances and requirements.

- Conserve time and energy searching for the paperwork you need, and leverage US Legal Forms’ advanced search and Review tool to locate your Deposit Box Form With Insurance.

- If you possess a membership, Log Into your US Legal Forms account, search for the document, and retrieve it.

- Check the My documents tab to review the documents you have previously obtained and organize your folders according to your preference.

- If this is your initial experience with US Legal Forms, establish a complimentary account to gain unrestricted access to all features of the library.

- Employ a powerful online form catalog to transform your approach to these scenarios.

- US Legal Forms stands out as a leader in digital legal forms, providing over 85,000 state-specific legal documents at your fingertips.

- Access legal and business forms tailored to state or county specifications.

Form popularity

FAQ

Yes, you can insure your safety deposit box through specialized policies. While banks often do not provide direct insurance for items within your box, you can acquire personal property insurance or specific policies tailored for deposit box content. By choosing a deposit box form with insurance, you safeguard your valuables against potential loss.

The safe deposit box is a storage space you rent from the bank. Its contents are kept private, and the bank doesn't know what you put in there.

A safe deposit box is not a deposit account. It is storage space provided by the bank, so the contents, including cash, checks or other valuables, are not insured by FDIC deposit insurance if damaged or stolen. Also, financial institutions generally do not insure the contents of safe deposit boxes.

A person can place just about anything that will fit in a safe deposit box in one. Holders of these boxes are granted complete privacy by the financial institutions where they're located. Someone could store cash, jewelry and other valuables, savings bonds, deeds to property and information about an inheritance there.

What if the bank has failed? If the bank recently failed, the FDIC or the bank that assumed the failed bank's business may have the account or safe deposit box contents. After a period of time, the FDIC or the bank must transfer unclaimed property to the state.

However, McGuinn warns, banks do not provide insurance for the contents of your safe deposit box, so you may want to add a scheduled personal property endorsement to your homeowners or renters insurance to make sure you're covered.