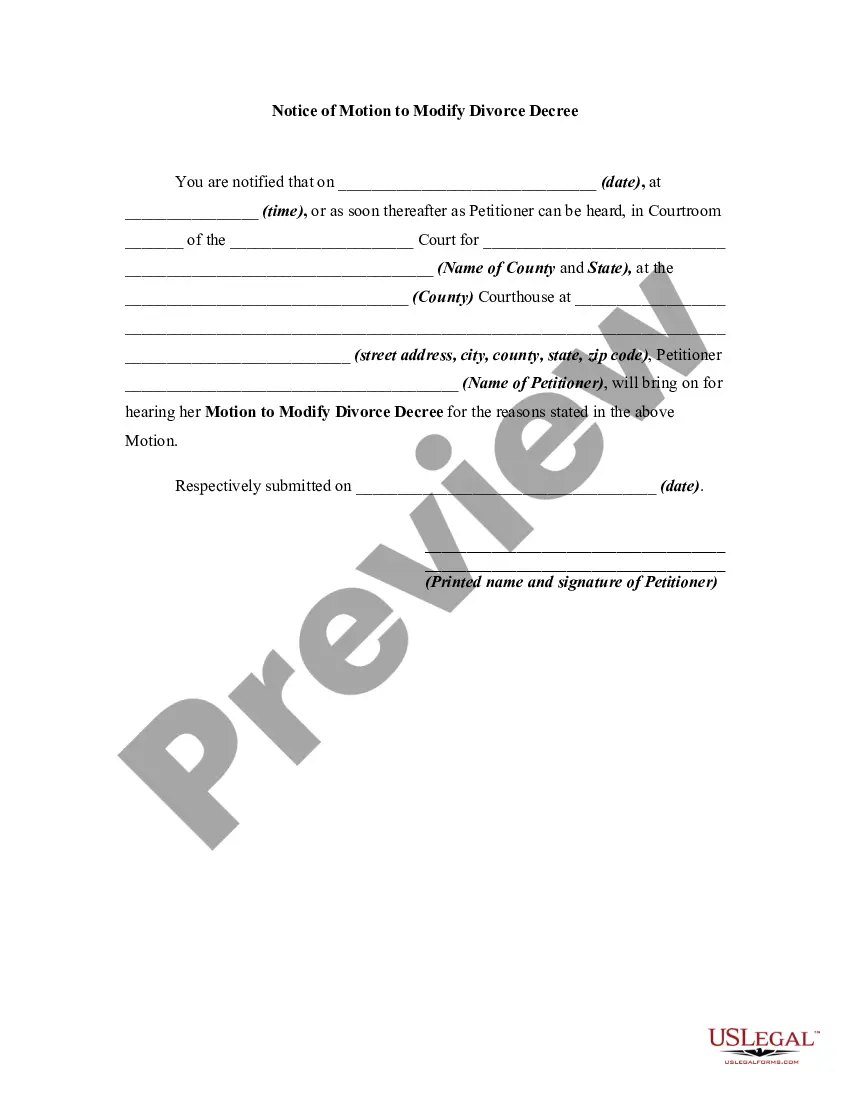

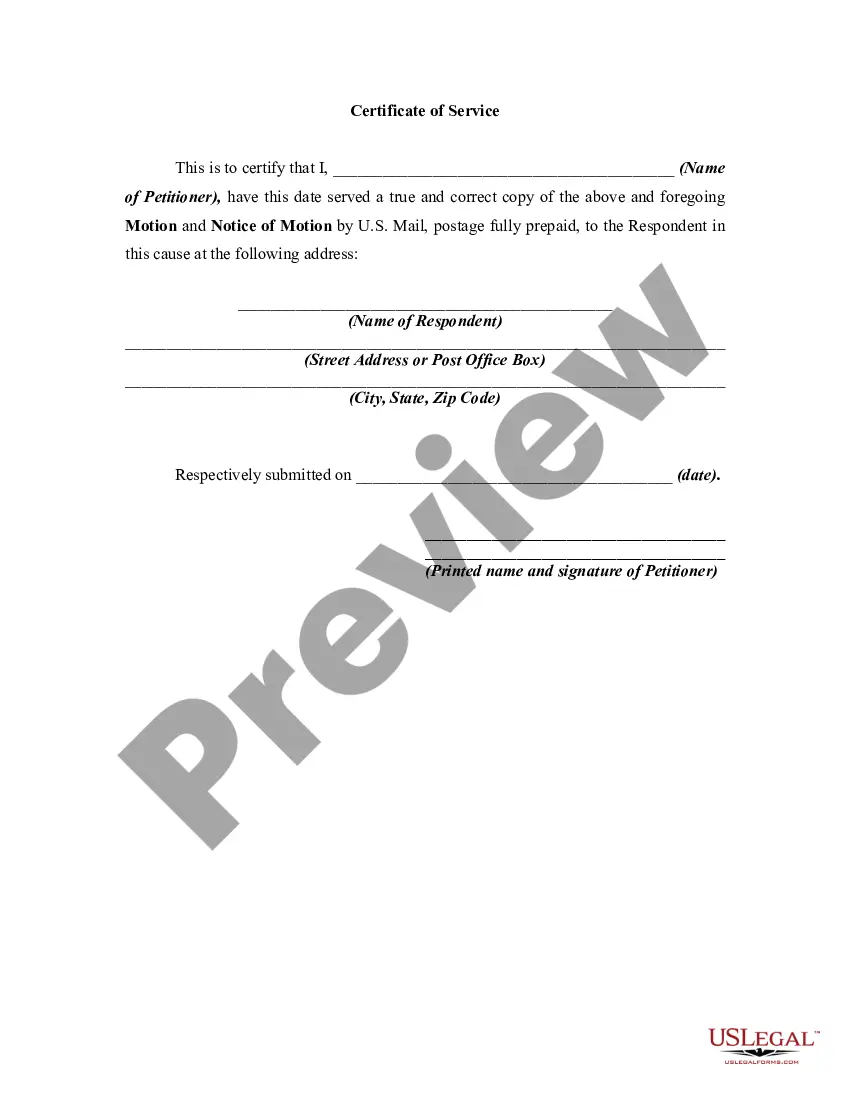

A judgment or decree in a divorce case may be modified for sufficient cause. This form is a sample of a motion of the petitioner in a divorce action seeking to modify a divorce decree and have her name changed back to her married name from her maiden name. This form is a generic motion and adopts the notice pleadings format of the Federal Rules of Civil Procedure, which have been adopted by most states in one form or another. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Change Name After Marriage With Hmrc

Description

How to fill out Motion To Modify Or Amend Divorce Decree To Change Name Back To Married Name?

Handling legal paperwork and tasks can be a lengthy addition to your schedule.

Changing Name After Marriage With Hmrc and similar forms typically necessitate searching for them and figuring out how to fill them out accurately.

Therefore, if you are addressing financial, legal, or personal issues, having a comprehensive and easy-to-use online repository of forms readily available will be very beneficial.

US Legal Forms is the premier online platform for legal templates, encompassing over 85,000 state-specific forms and an array of resources that will assist you in completing your documents seamlessly.

Simply Log In to your account, search for Change Name After Marriage With Hmrc, and obtain it immediately from the My documents section. You can also retrieve forms you’ve downloaded previously.

- Explore the collection of pertinent documents accessible with just one click.

- US Legal Forms offers you state- and county-specific forms that can be downloaded at any time.

- Safeguard your document management processes with a high-quality service that enables you to create any form within minutes without any additional or concealed fees.

Form popularity

FAQ

Some NDAs may have an expiration clause that lasts for a certain number of years after the agreement is signed, while others may specify an expiration date. In some cases, an NDA may have no expiration date, and the confidential information must be kept secret indefinitely.

Even the most well-written NDA can be invalidated if it's signed by the wrong person. For example, the representative may actually have no authority to bind the company to an NDA, or the company may require multiple people to all give their approval.

NDAs cannot be used to prevent the disclosure of information that is in the public interest. Limited protection: An NDA only provides protection for information that is specifically identified and defined in the agreement.

If your company discloses confidential information without having the NDA agreed to first, ensure that the NDA applies retroactively by setting the effective date as the date on which confidential information was first disclosed, not the date on which the agreement was signed.

There are several reasons why an NDA might be unenforceable, however. If the NDA is too broad, the information under the NDA is not actually confidential, or if the agreement requires the employee to do something illegal.

As to inclusion because of perceived best policy, the rationale could be that (a) it is too difficult to monitor restrictions over a long period, (b) the practice in a relevant industry (i.e., NDA's with investment bankers which are generally very short by industry custom), (c) consideration that financial and other ...

There are limitations on what an NDA can conceal. Courts won't enforce confidentiality agreements that prohibit signees from reporting on a crime. They'll also nullify NDAs that don't comply with public policy, or are otherwise unreasonable.

In addition, if information in a non-disclosure agreement is not confidential or if it requires something illegal, it is likely invalid. It's important to keep in mind that NDAs are specifically designed to safeguard confidential company information, and their enforceability is limited to such information.

Some NDAs may have an expiration clause that lasts for a certain number of years after the agreement is signed, while others may specify an expiration date. In some cases, an NDA may have no expiration date, and the confidential information must be kept secret indefinitely.

To get out of an NDA, you have to be sure that it is legally binding. For example, you cannot be liable for an NDA that covers up illegal activity by the issuer. A lawyer can help you assess your risks and determine how you should move forward.