Trust Funds And How They Work With Android

Description

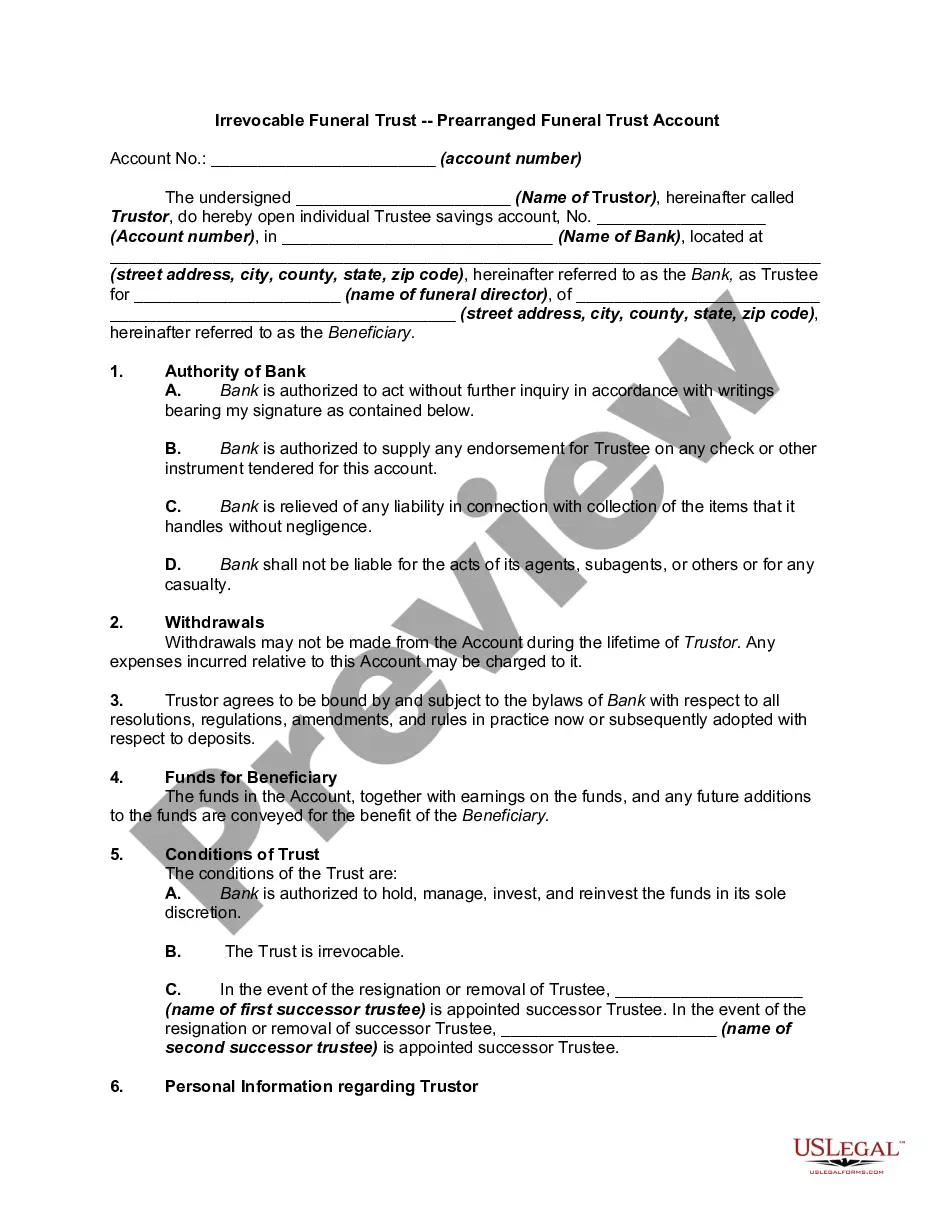

How to fill out Irrevocable Trust Funded By Life Insurance?

Legal managing can be overpowering, even for experienced experts. When you are looking for a Trust Funds And How They Work With Android and don’t get the time to commit trying to find the appropriate and up-to-date version, the operations can be stressful. A strong web form library can be a gamechanger for everyone who wants to deal with these situations successfully. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you may:

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you could have, from individual to business documents, in one location.

- Employ innovative tools to complete and control your Trust Funds And How They Work With Android

- Access a useful resource base of articles, guides and handbooks and materials highly relevant to your situation and requirements

Help save effort and time trying to find the documents you need, and make use of US Legal Forms’ advanced search and Preview tool to locate Trust Funds And How They Work With Android and download it. In case you have a subscription, log in in your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to see the documents you previously downloaded as well as control your folders as you see fit.

Should it be your first time with US Legal Forms, create an account and obtain unlimited use of all advantages of the platform. Here are the steps for taking after accessing the form you want:

- Validate it is the proper form by previewing it and reading through its information.

- Be sure that the sample is recognized in your state or county.

- Select Buy Now once you are all set.

- Select a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print out and deliver your document.

Benefit from the US Legal Forms web library, supported with 25 years of experience and stability. Transform your daily document managing in a easy and easy-to-use process right now.

Form popularity

FAQ

Less than 2 percent of the U.S. population receives a trust fund, usually as a means of inheriting large sums of money from wealthy parents, ing to the Survey of Consumer Finances. The median amount is about $285,000 (the average was $4,062,918) ? enough to make a major, lasting impact.

This usually includes allocating living expenses or even educational expenses, such as private school or college expenses, while they are alive. Or they can pay out a lump sum directly to the beneficiary. Trust funds provide certain benefits and protections for those who create them and to their beneficiaries.

Trustees are entitled to use trust funds to pay for certain things such as funeral expenses, repaying any debts, fees paid to professionals who help with administrative tasks, taxes owed, and expenses related to properties included in the trust.

When a trustee needs to withdraw money to fulfill their duties, they can use the bank account to write checks, withdraw cash, or complete wire transfers. It is imperative to note that trustees are responsible for managing all withdrawals of money from a trust account.

Then, when it comes to setting up the trust fund, it is relatively straightforward. 1 ? Decide which assets you want in the trust fund. ... 2 ? Choose a trustee. ... 3 ? Choose your beneficiaries. ... 4 ? Create a trust deed. ... 5 ? Settle and sign the trust. ... 6 ? Pay stamp duty.