Trust Fund Agreement Template

Description

How to fill out Agreement To Renew Trust Agreement?

- If you are an existing user, log into your account and directly download your desired trust fund agreement template.

- If this is your first visit, start by checking the preview and description of the templates. Confirm that the selected template corresponds to your local jurisdiction.

- If the chosen template does not meet your needs, utilize the Search tab to locate another suitable option.

- Once you find the appropriate template, click on the Buy Now button and select the subscription plan that fits you best. You’ll need to create an account to access our extensive library.

- Complete your purchase by entering your payment details or using your PayPal account to subscribe.

- Download the template to your device for easy access. You can revisit and manage it anytime through the My Forms section of your profile.

In summary, US Legal Forms offers a robust collection of legal templates ensuring both precision and ease of access. With a variety of subscription options, you'll find it convenient to navigate through our comprehensive library.

Start your journey towards creating your trust fund agreement today!

Form popularity

FAQ

A lawyer usually prepares the trust agreement to ensure that all legal requirements are met. They will use a trust fund agreement template as a guideline to create a tailored document for your specific situation. Collaborating with a legal professional guarantees that your trust will be valid and enforceable, protecting your interests and those of your beneficiaries.

A certificate of trust is typically created by the trustee or the attorney overseeing the trust. This document provides a summary of the trust without revealing the full details contained in the trust fund agreement template. It serves as an official declaration of the trust's existence and essential details for financial institutions and other stakeholders.

A trust fund agreement is a legal document that outlines how assets placed in a trust will be managed and distributed. This agreement is crucial for protecting your wishes and guiding the trustee in their responsibilities. Utilizing a trust fund agreement template simplifies the process, ensuring all necessary information is included to create a binding and effective document.

While a trust agreement offers numerous benefits, some disadvantages exist. These may include the initial setup costs associated with creating a trust fund agreement template, as well as ongoing administrative expenses. Additionally, a trust can limit access to assets during the grantor's lifetime, which may not suit everyone's financial goals.

The person who creates a trust is known as the grantor or trustor. This individual outlines the terms and conditions of the trust in a comprehensive trust fund agreement template. Understanding your role as a grantor is essential, as it allows you to establish how your assets will be managed and distributed after your passing.

Setting up a trust usually involves a lawyer, as they provide the legal expertise necessary for drafting a trust fund agreement template. While an accountant can offer valuable financial advice, they typically do not handle the legal documentation. Therefore, working with a knowledgeable attorney ensures that your trust is created in compliance with state laws and meets your specific needs.

Certain assets are generally not recommended for placement in a trust, such as retirement accounts, personal residence, and life insurance policies. This is primarily due to tax implications and the potential for loss of benefits. When drafting your trust with a trust fund agreement template, it's wise to consult a financial advisor or attorney to identify the best strategy for your unique situation. They can help you optimize asset allocation effectively.

To draft a trust document, start by outlining your objectives for the trust. Using a trust fund agreement template can guide you through the necessary clauses related to asset management, beneficiaries, and trustee responsibilities. Make sure to use clear, specific language to prevent ambiguity. Finally, review the document carefully, and consider having a legal professional assist with finalizing it.

Yes, you can create your own certificate of trust, which serves as a summary of the trust's essential details. Using a trust fund agreement template can simplify this process by providing a structure for the information you'll need to include. This document helps verify the trust's existence without revealing the entire trust agreement. Just make sure it complies with your state's requirements.

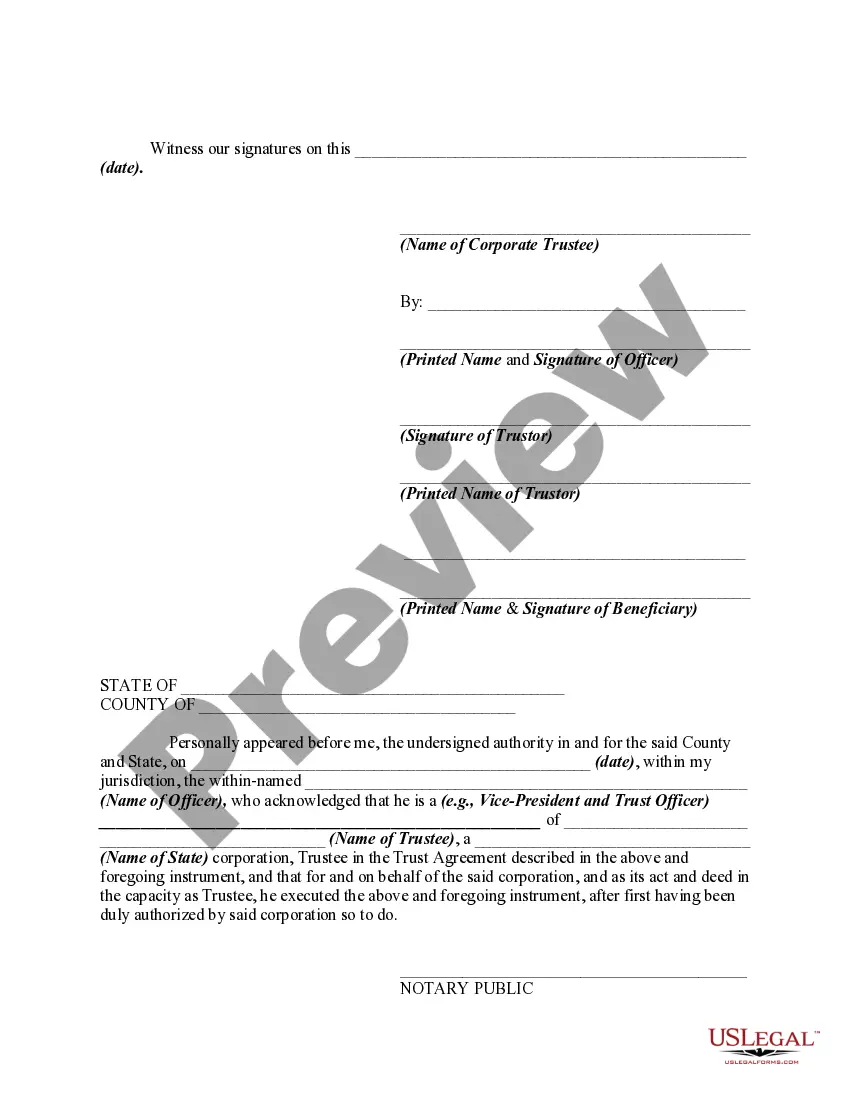

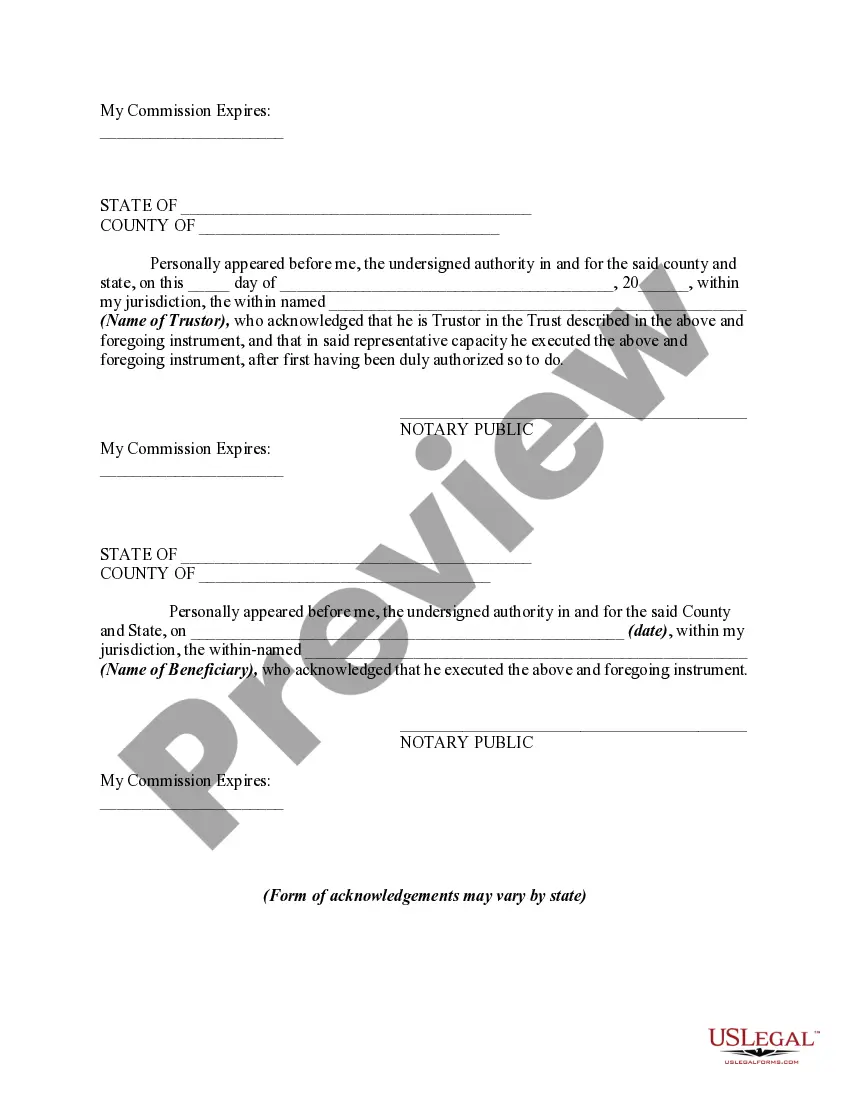

Filing a trust fund typically involves creating the trust document and designating a trustee. You may need to use a trust fund agreement template to help outline the terms and conditions of the trust. Once the document is complete and signed, file it with your local court if required. Consulting with a legal expert can ensure the process goes smoothly.