Revocation Receipt Trustee For Trust Deed

Description

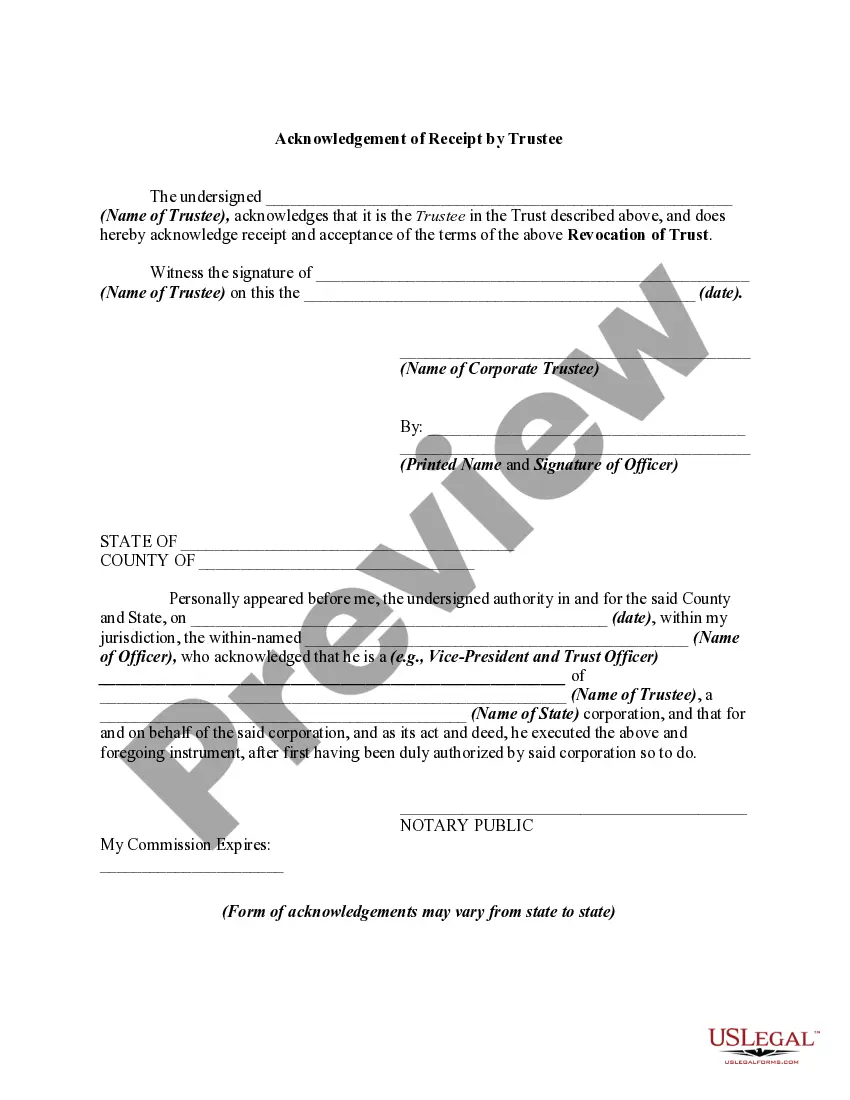

How to fill out Revocation Of Trust And Acknowledgment Of Receipt Of Notice Of Revocation By Trustee?

- If you are a returning user, log in to your account at US Legal Forms and download the required form template by clicking the Download button. Ensure your subscription is up to date; renew if necessary.

- For first-time users, start by reviewing the preview mode and reading the form description to ensure the selected document meets your needs and complies with local jurisdiction requirements.

- If the current form isn’t suitable, use the Search tab to find another template that fits your needs.

- Once you find the right document, click the Buy Now button and select your preferred subscription plan. An account registration is required for access.

- Complete your purchase by providing payment details through credit card or PayPal.

- Finally, download your form and save it to your device for easy access. You can also revisit it anytime from the My Forms section in your profile.

In conclusion, US Legal Forms provides a streamlined approach to securing vital legal documents like revocation receipts for trustees. With a vast collection of forms and expert guidance, your legal documentation needs are efficiently met.

Explore US Legal Forms today and take the hassle out of your legal documentation!

Form popularity

FAQ

A trustee has substantial powers, including managing trust assets, making investment decisions, and distributing funds to beneficiaries according to the trust's terms. However, these powers come with fiduciary duties, demanding that the trustee act in the best interest of the beneficiaries. In instances of trust revocation, using a revocation receipt trustee for trust deed simplifies the process of transferring responsibilities. Always ensure your trustee understands their obligations to avoid mismanagement.

A trust can become null and void for several reasons, including lack of a legal purpose, failure to meet legal requirements, or if the trust was established under duress or fraud. It’s crucial to ensure that all trust documents, including the revocation receipt trustee for trust deed, meet these requirements to maintain validity. Additionally, if the trust’s terms violate public policy, it also risks becoming void. Careful planning can help avoid these issues.

In California, a revocation of trust does not necessarily need to be notarized; however, having it notarized can enhance its acceptance in legal contexts. When you create a revocation receipt trustee for trust deed, it’s wise to follow the state's legal requirements to prevent future disputes. Even though notarization is not mandatory, it serves as proof of authenticity. Always consult a legal professional to ensure compliance with all local laws.

A trust can be terminated in three primary ways: revocation by the grantor, expiration of its terms, or through court action. Revocation by the grantor is the most common method, and using a revocation receipt trustee for trust deed streamlines this process. Additionally, if the purpose of the trust has been fulfilled or the grantor passes away, the trust can automatically dissolve. Understanding these options helps you manage your trust more effectively.

Removing a trustee from a family trust generally requires a written notice, along with a formal amendment to the trust document. It’s essential to follow the guidelines set forth in the trust agreement. Using a revocation receipt trustee for trust deed can help formalize this action, providing clarity and legal backing to the change.

Revoking a revocable trust in California involves drafting a clear revocation document that outlines the decision. This document must be signed and dated by the trust creator to be valid. Consider obtaining a revocation receipt trustee for trust deed to ensure that the revocation is accurately recorded and recognized.

Invalidating a trust in California usually requires demonstrating that the trust did not meet legal requirements or was created under undue influence. You may need to gather evidence, and it is advisable to consult with a legal expert to navigate the complexities. A revocation receipt trustee for trust deed can facilitate this process by formally documenting the invalidation.

To remove someone from a revocable trust, you typically need to amend the trust document. This process involves creating a formal amendment that specifies the removal, which must then be signed and dated. Utilizing a revocation receipt trustee for trust deed can also ease the transition by providing clear documentation of the changes made.

In California, a revocable trust does not necessarily need to be notarized, but it is highly recommended. Notarization helps to verify the identity of the trust creator and ensures the document’s authenticity. Ultimately, having a revocation receipt trustee for trust deed adds an extra layer of security, making the process smoother in case disputes arise.

Changing the trustee of a trust can be easy or challenging based on the trust's terms. If the trust document allows for trustee changes without court intervention, you can follow the specified procedure. Including a revocation receipt trustee for trust deed can simplify the legal process, ensuring that the transition is smooth and well-documented.