Business Offering Letter Example

Description

How to fill out Sample Letter For Offer Of Assistance With Continued Education - Business To Employee?

Creating legal documents from the ground up can occasionally be daunting.

Particular situations may entail extensive research and significant costs.

If you're searching for a more straightforward and cost-effective method of generating Business Offering Letter Example or any other forms without the hassle, US Legal Forms is always readily available.

Our online collection of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal affairs.

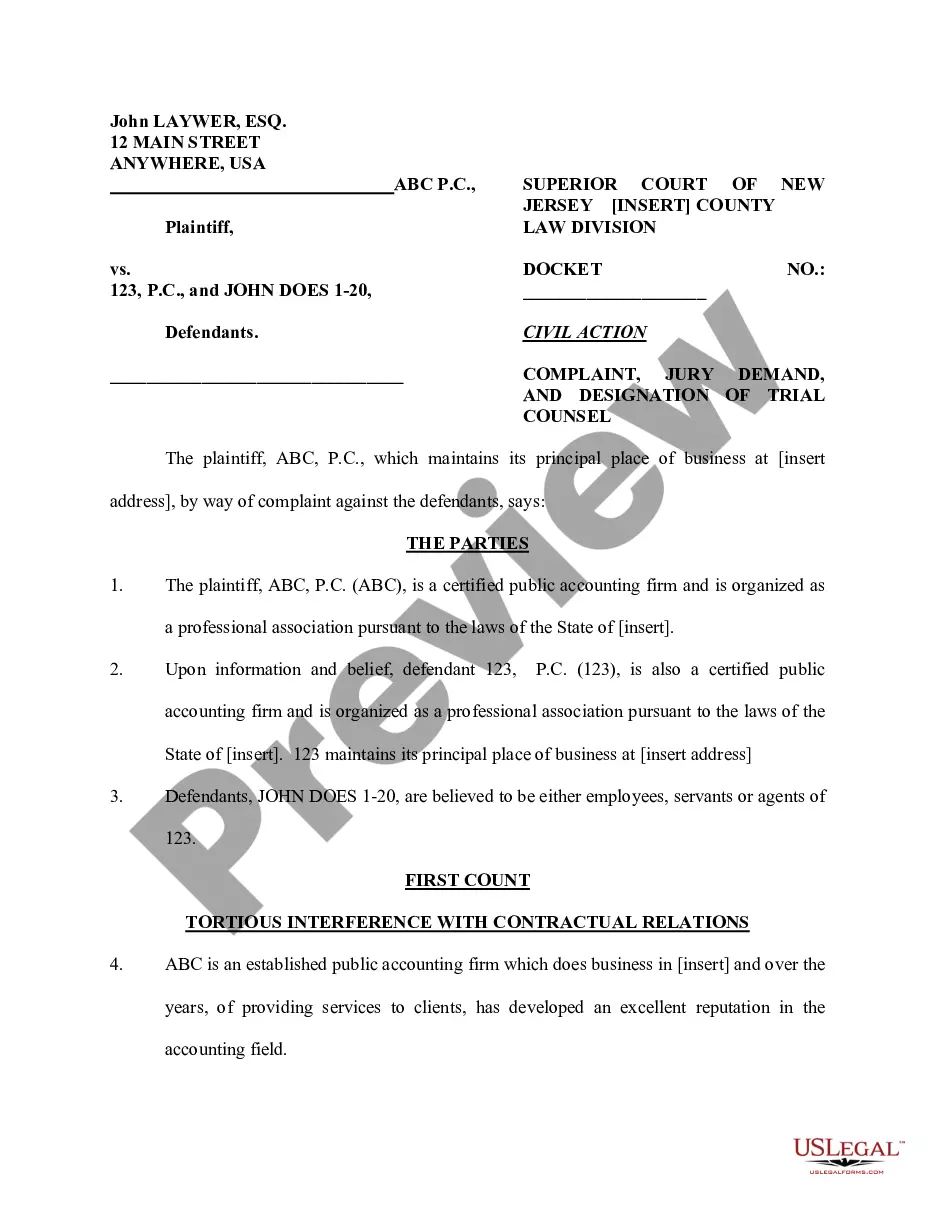

Examine the document preview and descriptions to ensure you are on the correct document you are looking for. Ensure the form you select meets the criteria of your state and county. Choose the most suitable subscription option to purchase the Business Offering Letter Example. Download the file, fill it out, certify it, and print it. US Legal Forms holds a flawless reputation and over 25 years of experience. Join us today and simplify the document completion process!

- With just a few clicks, you can immediately access state- and county-specific forms carefully prepared for you by our legal professionals.

- Utilize our platform whenever you require a trusted and dependable service to swiftly find and download the Business Offering Letter Example.

- If you're already familiar with our services and have previously established an account, simply Log In to your account, select the template, and download it or re-download it anytime in the My documents tab.

- Don’t possess an account? No worries. It takes minimal time to register and explore the catalog.

- However, before diving straight into downloading the Business Offering Letter Example, adhere to these suggestions.

Form popularity

FAQ

Gift deeds are one option in Texas for transferring real property to someone who is not included on the original deed. They can be either a special warranty deed or a general warranty deed. The gift deed transfers property ownership as a gift. The person making the gift, the grantor, wants nothing in return.

Ing to Texas Property Code § 5.021, a deed must be in writing, it must be signed by the grantor, it must include a legal description of the property, and it must be delivered, at which point the title immediately passes from the grantor to the grantee.

Do you have to pay taxes on a gift deed in Texas? Yes, gift taxes can be a factor when transferring ownership of real estate, but only if the property is valued over the federal gift limit.

Do you have to pay taxes on a gift deed in Texas? Yes, gift taxes can be a factor when transferring ownership of real estate, but only if the property is valued over the federal gift limit.

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

All transfers of real estate in Texas are either in exchange for something, such as money or services, or for no money or services, which is a Gift Deed. Using this deed to transfer real estate property is the same as any other deed, except there is no money or services given for the transfer. The property is free.

Gift Deed ? A gift deed is a special type of grant deed that ?gifts? ownership of real property interest to another person or entity. This deed is different from a standard grant deed because it specifically designates that the transfer was not subject to a sale, and the grantor received no monetary compensation.

Gift deeds in Texas are valid, but there are requirements above and beyond those of a regular deed. A gift deed is a document that transfers title to land. It can be informal, but the grantor's intent must be to immediately divest himself of the property where he no longer has control over the land.