Trust Change Beneficiary With Foreign

Description

How to fill out Amendment To Trust Agreement In Order To Change Beneficiaries?

Managing legal paperwork and processes can be a lengthy addition to your entire day.

Trust Change Beneficiary With Foreign and similar documents generally require you to locate them and figure out how to fill them out properly.

Therefore, if you are handling financial, legal, or personal issues, having a thorough and easy-to-use online directory of forms readily available will be tremendously beneficial.

US Legal Forms is the leading online resource for legal templates, providing over 85,000 state-specific forms and a variety of tools to help you complete your documents effortlessly.

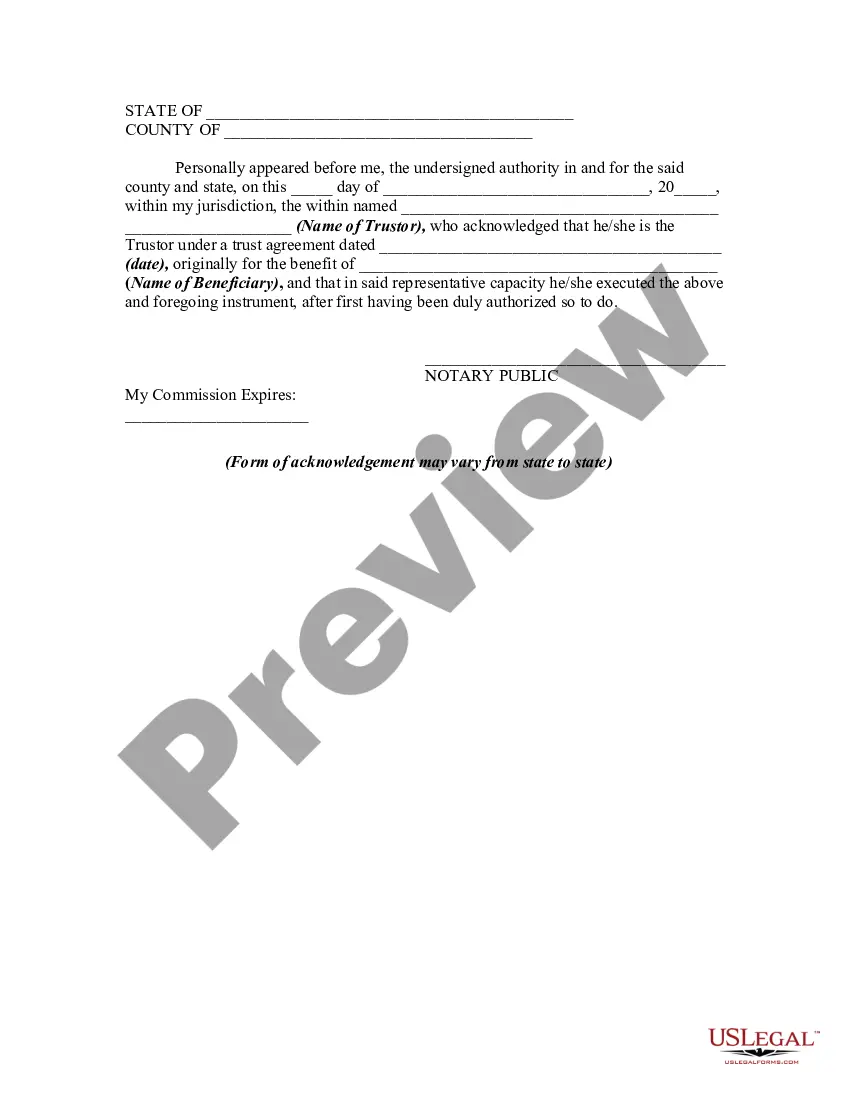

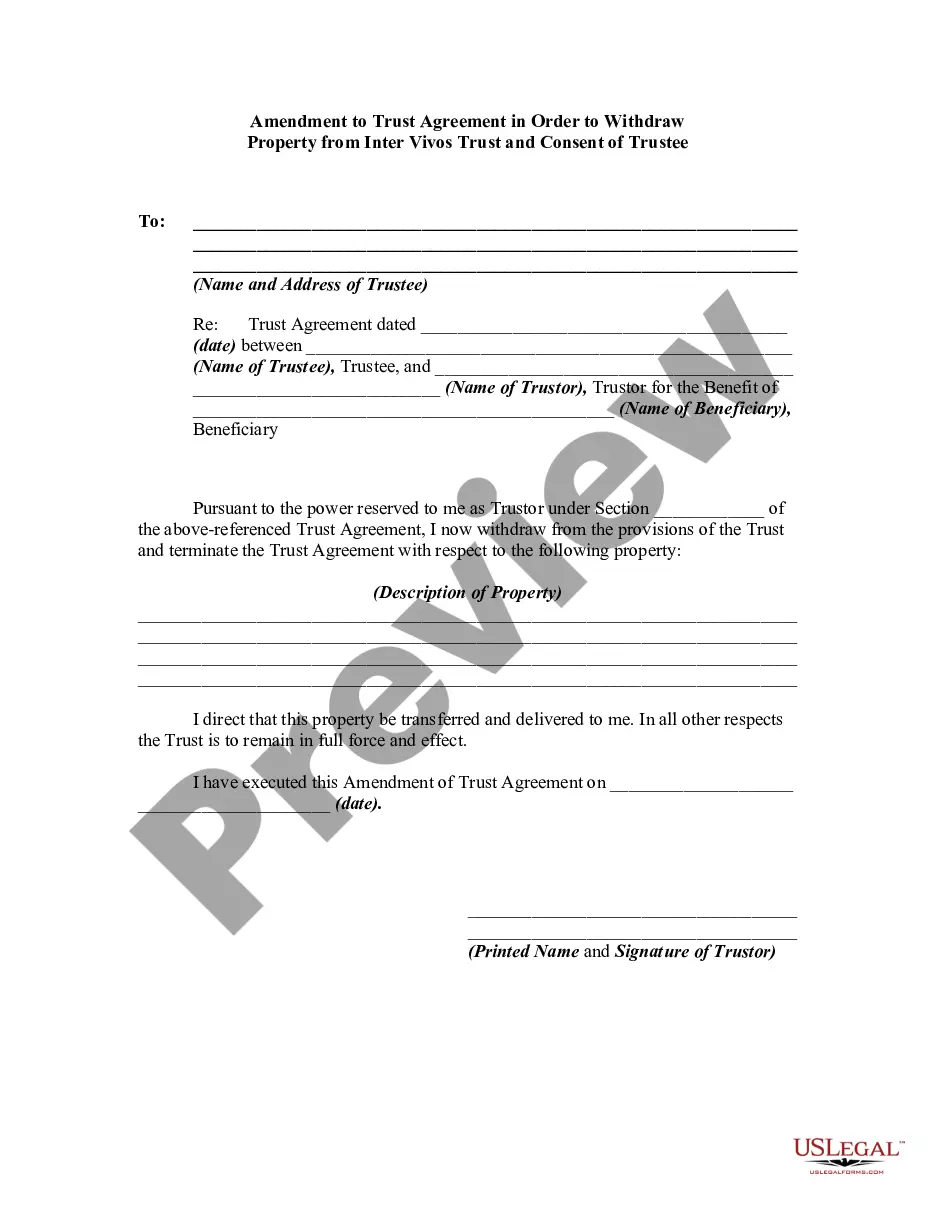

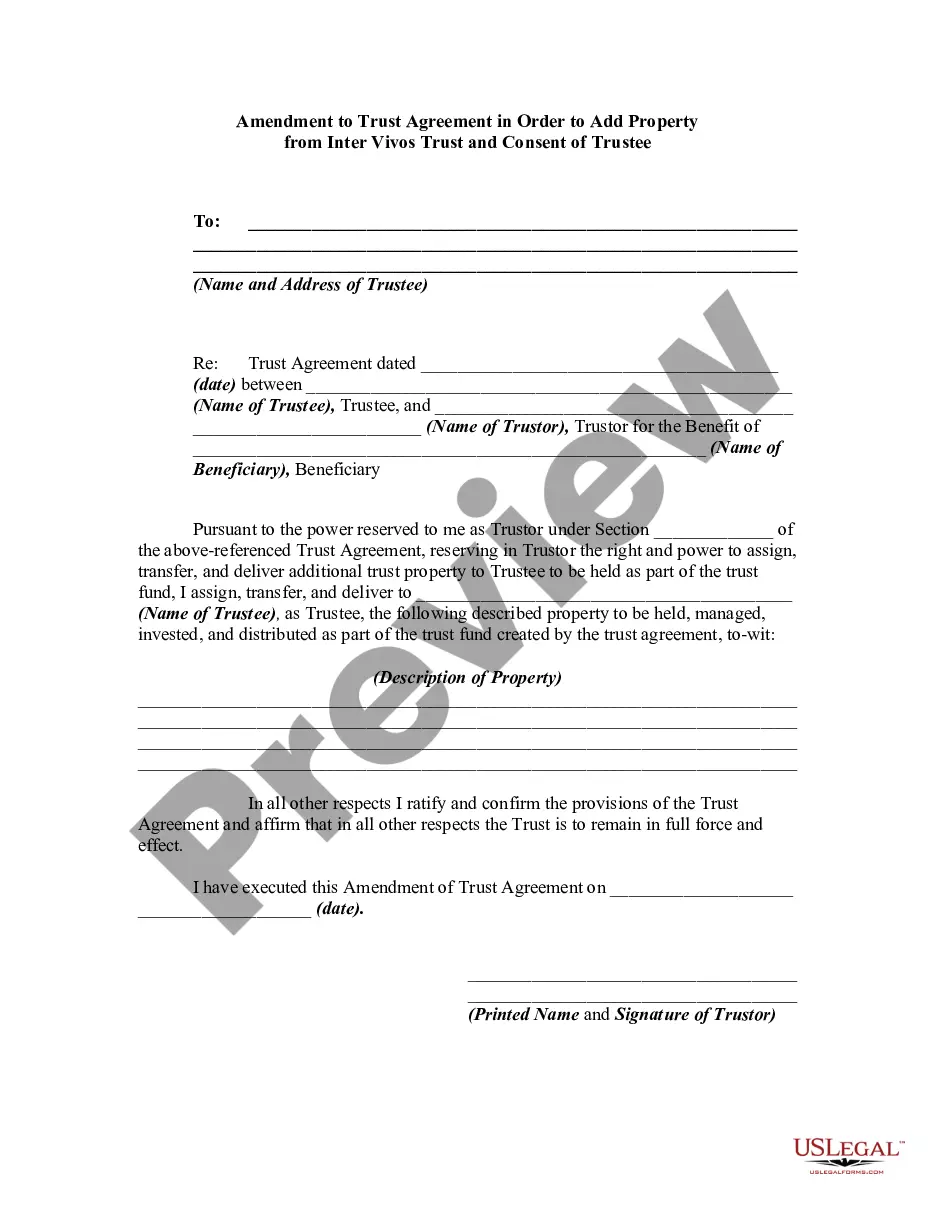

Is this your first experience with US Legal Forms? Register and create your account in a few minutes, and you’ll gain access to the form directory and Trust Change Beneficiary With Foreign. Then, follow the steps below to finalize your form: Ensure you have the correct form using the Preview feature and reviewing the form description. Click Buy Now when ready, and choose the subscription plan that fits your needs. Click Download, then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience helping clients manage their legal paperwork. Locate the form you need today and streamline any process effortlessly.

- Browse the collection of relevant documents accessible to you with just one click.

- US Legal Forms offers state- and county-specific forms available for download at any time.

- Protect your document management procedures with a high-quality service that enables you to prepare any form in just a few minutes without any extra or hidden fees.

- Simply Log In to your account, locate Trust Change Beneficiary With Foreign, and download it instantly from the My documents section.

- You can also access previously saved forms.

Form popularity

FAQ

Interest income earned by the trust is deductible if distributed to a foreign beneficiary but because the beneficiary is a nonresident alien, he will not be subject to U.S. income tax on the distribution. Therefore, the income is not subject to withholding tax (see Rev. Rul.

In addition to the withholding requirement, naming a beneficiary who resides in a foreign country may allow the foreign country to tax the property and accounts of the trust. In most cases, a foreign person is subject to US tax on its US source income.

This form is required by the Trustee of the foreign trust, to provide the IRS with information as to which US Beneficiary received a foreign trust distribution.

A statement that the trust will permit either the IRS or the U.S. beneficiary to inspect and copy the trust's permanent books of account, records, and such other documents that are necessary to establish the appropriate treatment of any distribution or deemed distribution for U.S. tax purposes.