Trust Revocation Sample With No Experience

Description

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

It’s clear that you cannot become a legal specialist instantly, nor can you comprehend how to swiftly create a Trust Revocation Sample With No Experience without possessing a specialized background.

Drafting legal documents is a lengthy procedure that demands particular education and expertise.

So why not entrust the creation of the Trust Revocation Sample With No Experience to the experts.

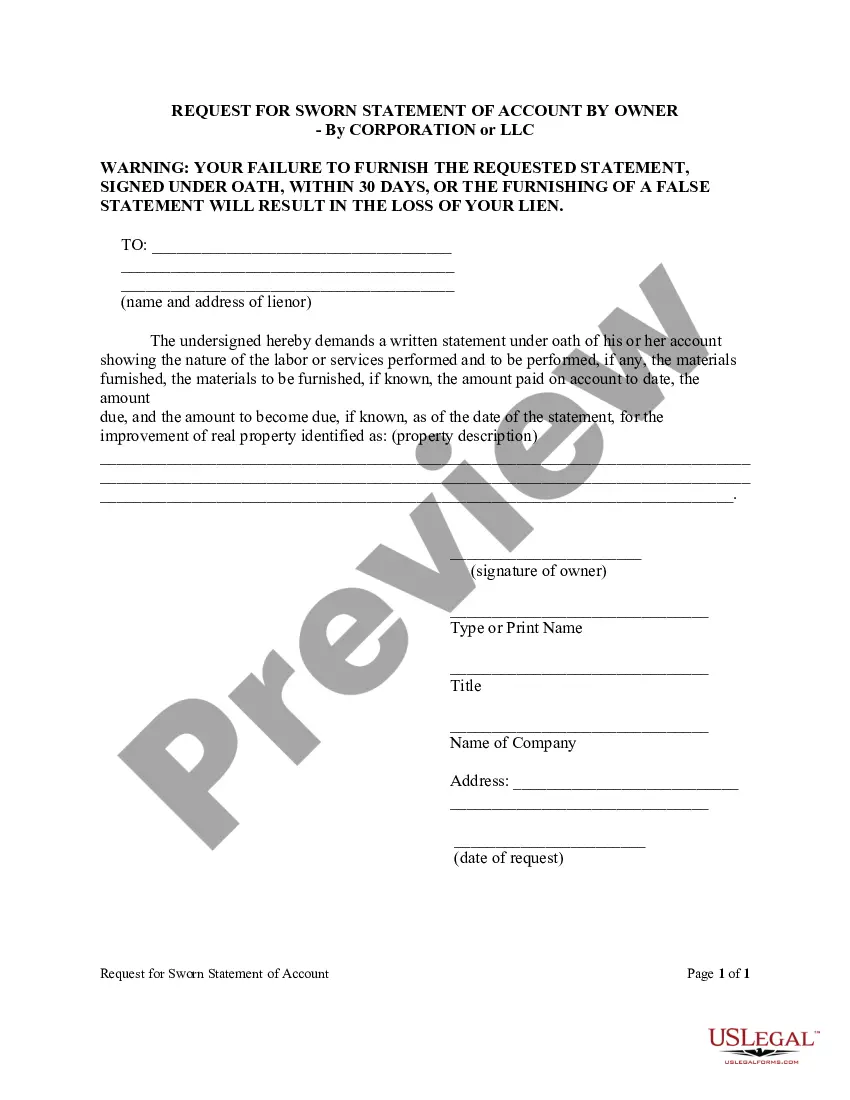

Preview it (if this option is available) and review the accompanying description to ascertain whether Trust Revocation Sample With No Experience is what you desire.

Initiate your search again if you require any other form. Set up a complimentary account and choose a subscription plan to buy the form. Click Buy now. Once the transaction is finalized, you can acquire the Trust Revocation Sample With No Experience, complete it, print it, and send or mail it to the required individuals or organizations.

- With US Legal Forms, one of the most comprehensive legal document collections, you can locate anything from court documents to templates for internal communication.

- We recognize how crucial compliance and adherence to federal and state laws and regulations are.

- That’s why, on our site, all forms are location-specific and current.

- Here’s how to get started on our website and acquire the document you require in just minutes.

- Find the form you need by utilizing the search bar at the top of the page.

Form popularity

FAQ

A revocation clause typically states that any previous trusts or documents are nullified upon signing a new document. For instance, it may read: 'This document revokes all prior trusts created by me.' Including such a clause can prevent any confusion about which documents are currently valid. A trust revocation sample with no experience can provide clarity on how to craft this clause effectively.

To revoke a trust document, you need to create a formal revocation document stating your intention to cancel the trust. Ensure you include the name of the trust and any relevant identification details. Sign the document and, if possible, have it witnessed or notarized to strengthen its legality. A trust revocation sample with no experience can serve as a helpful reference throughout this process.

An example of revocation is when a grantor decides to cancel a living trust they have established. This could occur due to changing family circumstances or a desire to create a new trust. The revocation document should clearly express the intention to nullify the original trust. Using a trust revocation sample with no experience will provide you with a clear template to follow.

To write a revocation, clearly state that you are revoking the previous document or trust. Include relevant details such as the name of the trust and the date it was established. After signing, consider having the document notarized for added validity. Referencing a trust revocation sample with no experience can help ensure you cover all essential elements.

Filling out a W9 form for a revocable trust requires you to list the name of the trust as the entity name. Include the trust's tax identification number, which is typically the Social Security number of the grantor. Be sure to check the box indicating that the entity is exempt from backup withholding. A trust revocation sample with no experience can guide you through the necessary paperwork.

To write a letter revoking Power of Attorney, begin with a clear title indicating your intention to revoke the authority granted. State your name, the agent’s name, and the date of the original Power of Attorney. Conclude the letter with your signature and the date. Utilizing a trust revocation sample with no experience can provide you with a structured format to follow.

Writing a revocation involves clearly stating your intention to cancel a previously established trust or document. Start with a title such as 'Revocation of Trust' and include your name, the date, and specifics about the trust being revoked. You should also sign and date the document in the presence of a notary. For guidance, a trust revocation sample with no experience can simplify the process for you.

Common mistakes when dealing with revocable trusts include not updating the trust after major life events, such as marriage or divorce. Additionally, failing to fund the trust properly can lead to complications later. It's also important to choose the right successor trustee, as this person will manage the trust after your passing. Using a trust revocation sample with no experience can help you avoid these pitfalls.