Trust Beneficiary Revocation Withdrawal Limit

Description

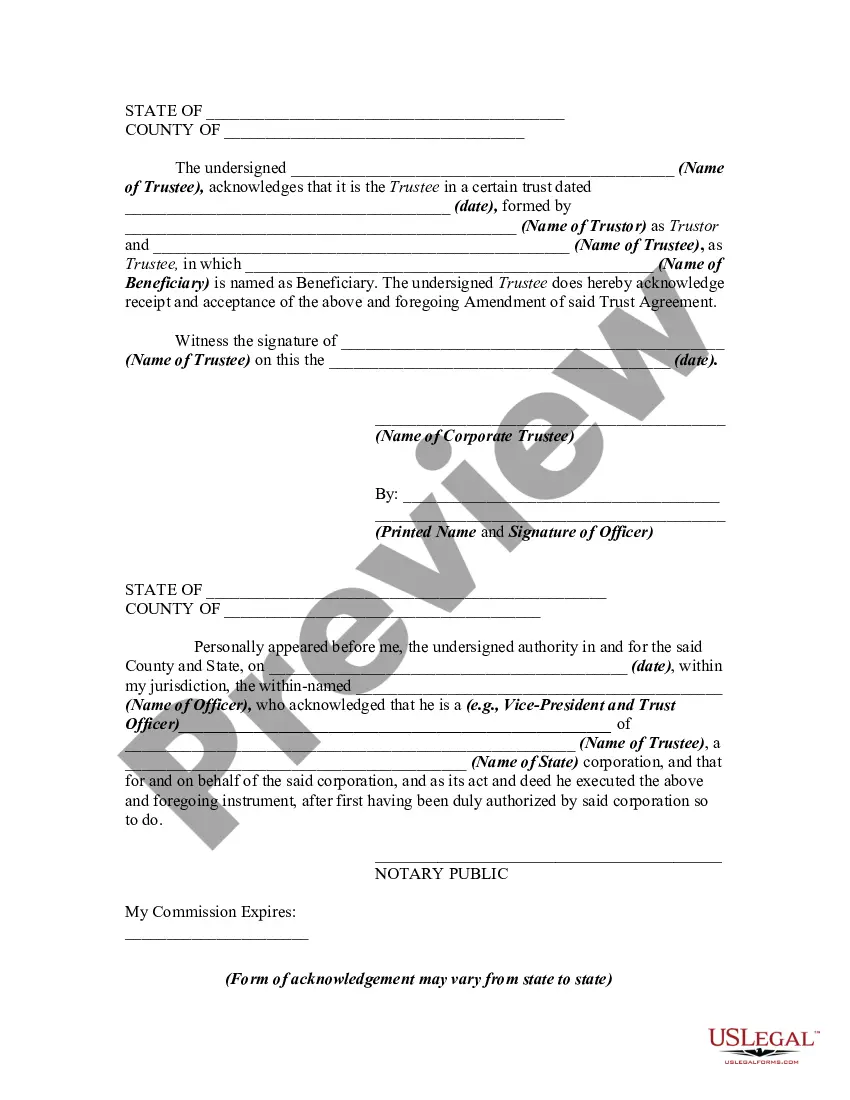

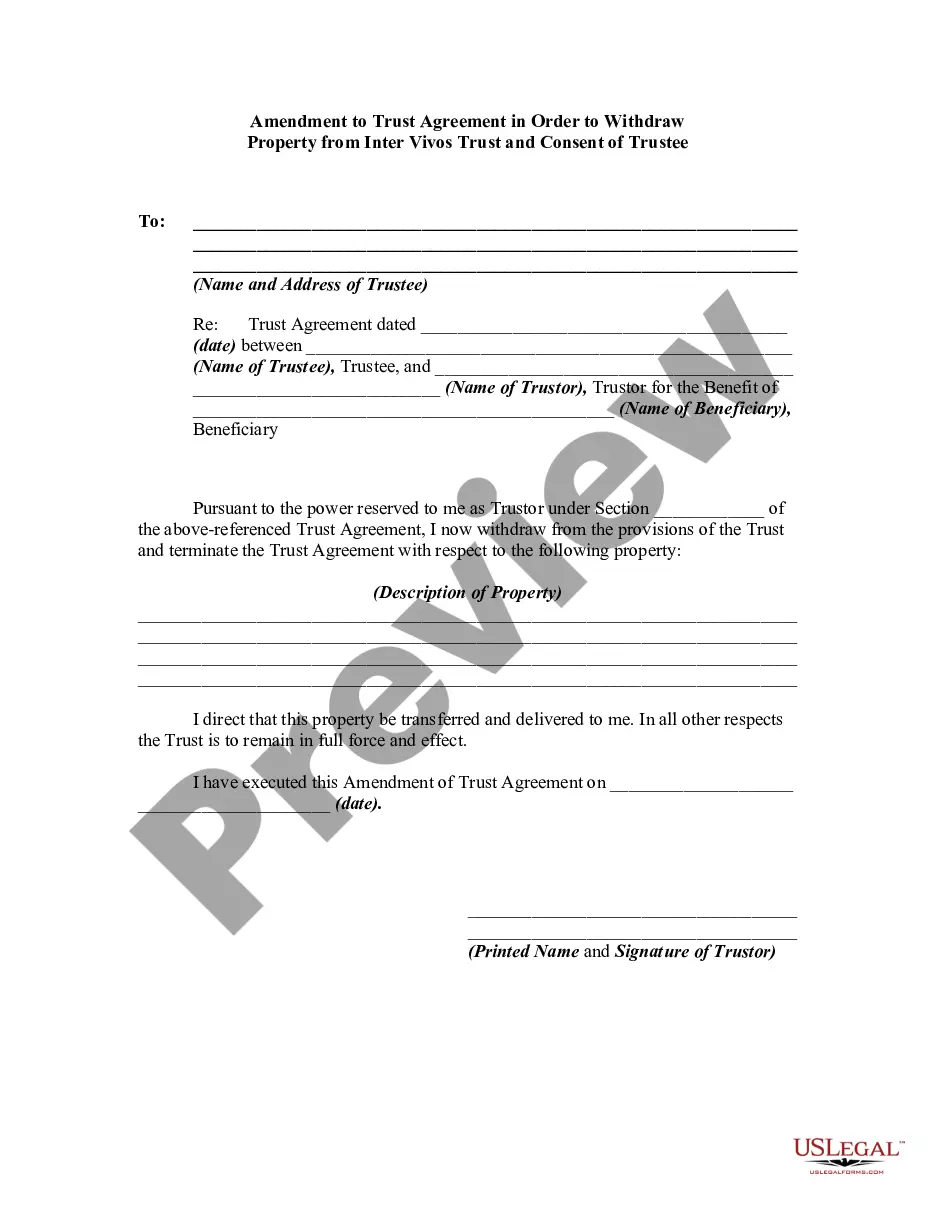

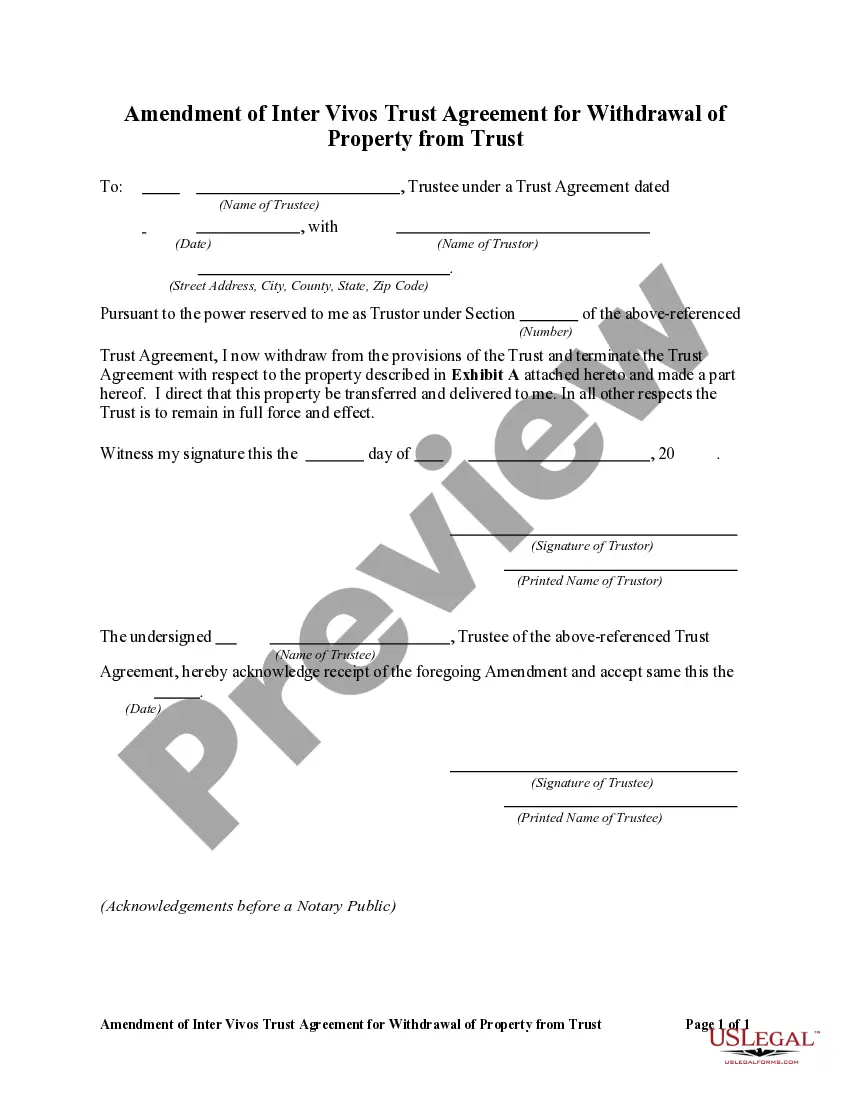

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

The Trust Beneficiary Revocation Withdrawal Limit you see on this page is a multi-usable legal template drafted by professional lawyers in compliance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most reliable way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Getting this Trust Beneficiary Revocation Withdrawal Limit will take you just a few simple steps:

- Browse for the document you need and check it. Look through the sample you searched and preview it or review the form description to confirm it fits your needs. If it does not, use the search bar to find the right one. Click Buy Now once you have located the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Obtain the fillable template. Pick the format you want for your Trust Beneficiary Revocation Withdrawal Limit (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

Usually there are two ways in which a beneficiary can be removed; The beneficiary can sign a legal document renouncing their interest in the Trust assets. The Trustee can use their discretionary power to remove an individual as a beneficiary by following the instructions in the Trust Deed.

In most cases, a trust deed generally offers two processes for the removal of a beneficiary. Most commonly, the beneficiary can sign a document to renunciate all interests as a beneficiary. Otherwise, the trustee may have discretionary power to revoke the beneficiary.

All of it is under the control of a dependable individual or entity (the trustee). The grantor determines what happens to the trust's assets and how they're to be distributed. The trustee carries out these directives. Again, this means you can't just withdraw from a trust fund.

All earnings that grow after the holder's death will be taxable to the beneficiary. The normal rules apply for reporting income or gains accrued after the date of death, depending on the specific characteristics of the deposit or annuity contract.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.