Trust Beneficiary Revocation Format

Description

How to fill out Amendment Of Trust Agreement And Revocation Of Particular Provision?

Drafting legal documents from scratch can often be intimidating. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re searching for a simpler and more affordable way of creating Trust Beneficiary Revocation Format or any other forms without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our online library of over 85,000 up-to-date legal forms covers almost every element of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-specific templates carefully prepared for you by our legal professionals.

Use our website whenever you need a trustworthy and reliable services through which you can quickly locate and download the Trust Beneficiary Revocation Format. If you’re not new to our website and have previously created an account with us, simply log in to your account, select the form and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to register it and explore the catalog. But before jumping directly to downloading Trust Beneficiary Revocation Format, follow these tips:

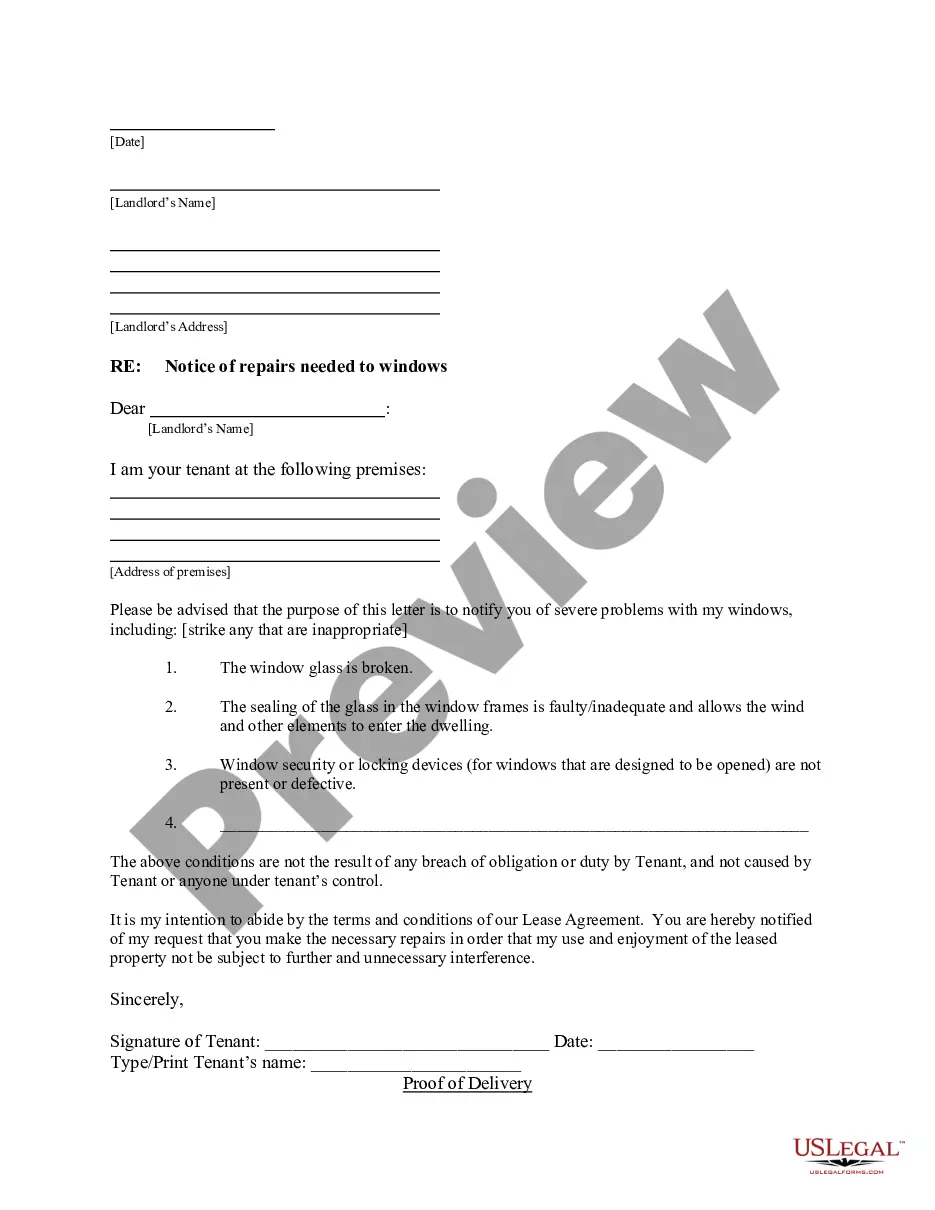

- Review the document preview and descriptions to make sure you have found the form you are searching for.

- Check if template you choose complies with the requirements of your state and county.

- Choose the right subscription option to buy the Trust Beneficiary Revocation Format.

- Download the file. Then fill out, sign, and print it out.

US Legal Forms has a spotless reputation and over 25 years of experience. Join us today and transform document execution into something easy and streamlined!

Form popularity

FAQ

The two most common ways to terminate and/or modify an irrevocable trust is to 1) argue that there has been a change of circumstances not anticipated by the settlors at the time they created the trust (for example changes in tax law, and 2) argue that all beneficiaries consent to the proposed termination and or ...

While irrevocable trusts are intended to be unchangeable, under the right conditions, settlors may be able to amend or even terminate the trust.

If you are looking to ?remove? a beneficiary because of tension between you, i.e., the successor Trustee and a Beneficiary, then in short, No, you cannot remove a Beneficiary.

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.

In most cases, a trust deed generally offers two processes for the removal of a beneficiary. Most commonly, the beneficiary can sign a document to renunciate all interests as a beneficiary. Otherwise, the trustee may have discretionary power to revoke the beneficiary.