Second Trust Deed Form California

Description

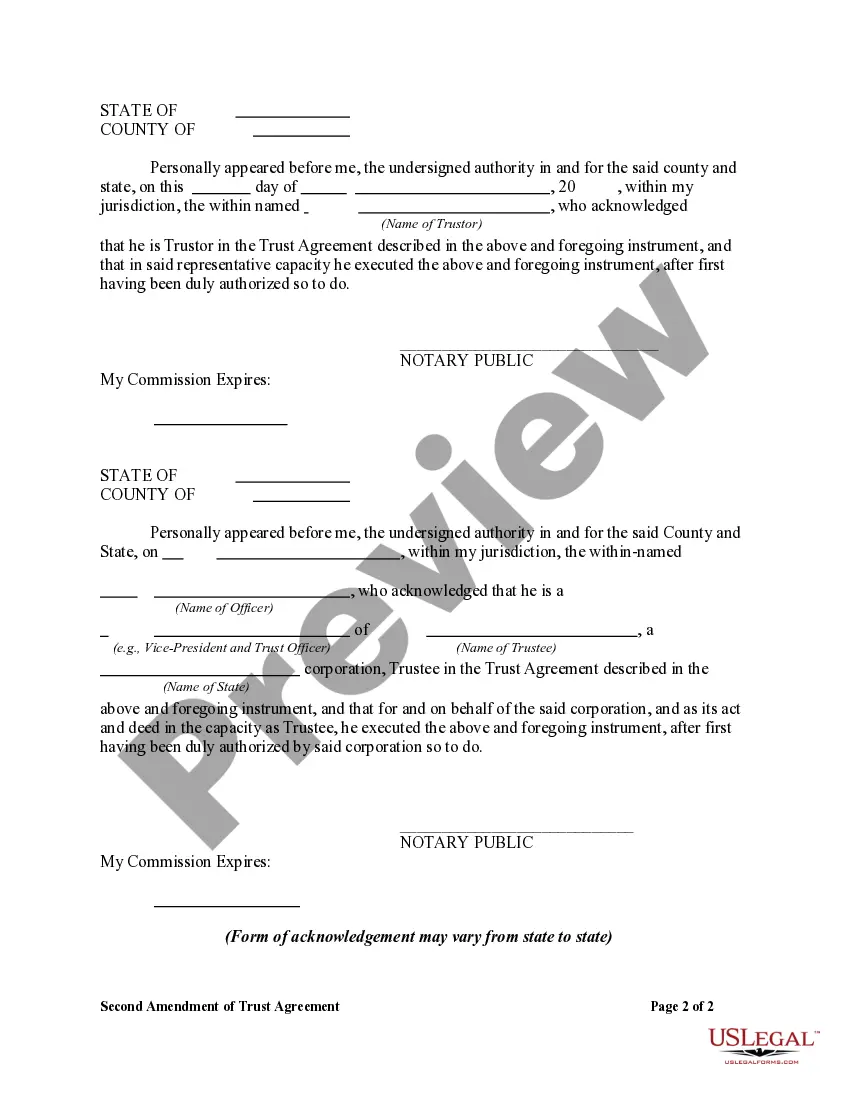

How to fill out Second Amendment Of Trust Agreement?

The Second Trust Deed Form California displayed on this page serves as a reusable legal template created by experienced attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 verified, state-specific documents for any personal or business need. It’s the fastest, easiest, and most dependable method to acquire the forms you require, as the service ensures bank-level data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have verified legal templates for all of life's circumstances at your fingertips.

- Examine the document you need and review it.

- Search through the file you looked for and preview it or check the form description to confirm it meets your requirements. If it doesn't, use the search bar to find the suitable one. Click Buy Now when you have found the template you need.

- Register and sign in.

- Choose the pricing option that works for you and create an account. Pay via PayPal or a credit card for swift payment. If you already possess an account, Log In and check your subscription to continue.

- Retrieve the editable template.

- Select your preferred format for the Second Trust Deed Form California (PDF, DOCX, RTF) and save the document on your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form with an electronic signature.

- Re-download your document as needed.

- Utilize the same document again whenever necessary. Access the My documents tab in your account to redownload any previously saved templates.

Form popularity

FAQ

To transfer ownership, disclaim ownership, or add someone to title, you will choose between a ?grant deed? and a ?quitclaim deed.? Spouses/domestic partners transferring property between each other may choose an ?interspousal deed.? Blank deeds are available at saclaw.org/forms.

How to Write Step 1 ? Obtain The California Deed Of Trust Form For Your Use. ... Step 2 ? Determine And Present Where This Deed Must Be Returned. ... Step 3 ? Report The Assessor's Parcel Number. ... Step 4 ? Record The Effective Date Of This Deed. ... Step 5 ? Produce The Debtor's Identity As The Trustor.

A second trust deed is a loan recorded against real estate when the property already has an existing loan or mortgage. Second trust deed loans let the borrower take out an additional loan against the property while keeping the existing mortgage on the property as well.

Some of the most common reasons trusts are invalid include: Legal formalities were not followed when executing the trust instrument. The trust was created or modified through forgery or another type of fraud. The trust maker was not mentally competent when they created or modified the trust.

In California, a deed of trust must come with security, typically a promissory note. To `be valid, a deed of trust must be (1) in writing, (2) with a description of the property, and (3) signed by the trustor of the deed of trust.