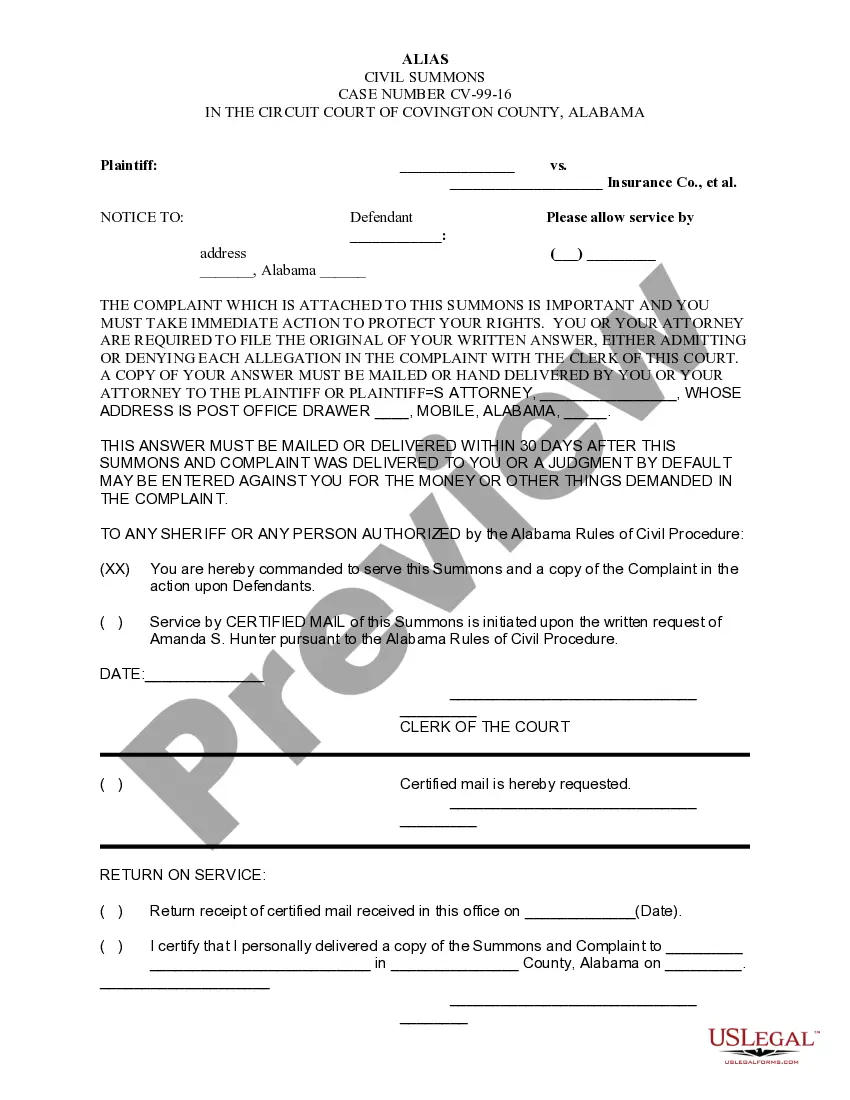

Rabbi Trust Example

Description

How to fill out Nonqualified Deferred Compensation Trust For The Benefit Of Executive Employees - A Rabbi Trust?

It’s clear that becoming a legal authority instantly is impossible, nor can one quickly learn to draft a Rabbi Trust Example without a unique set of capabilities.

Drafting legal documents is a lengthy process that necessitates specific education and expertise. Therefore, why not entrust the development of the Rabbi Trust Example to the specialists.

With US Legal Forms, which boasts one of the most extensive libraries of legal documents, you can acquire everything from court forms to templates for internal business correspondence. We understand how vital it is to comply with and follow federal and state regulations.

Select Buy now. Once the payment is processed, you can download the Rabbi Trust Example, fill it out, print it, and deliver or mail it to the intended recipients or organizations.

You can revisit your documents anytime from the My documents section. If you're a current client, simply Log In to locate and download the template from the same section. Regardless of the reason for your documents—be it financial or legal, or personal—our site has everything you need. Explore US Legal Forms today!

- Visit our website and obtain the document you need in just minutes.

- Find the document you're looking for by utilizing the search tool at the page's top.

- View a preview (if available) and examine the accompanying description to see if the Rabbi Trust Example fits your requirements.

- If you require a different document, restart your search.

- Create a complimentary account and choose a subscription plan to purchase the form.

Form popularity

FAQ

Similarly, the parent corporation will be treated as the grantor and owner of assets other than Parent Stock that are contributed by the parent corporation to a rabbi trust if the assets are both subject to the claims of the creditors of the parent corporation and subject to the requirement that any such assets not ...

Rabbi trusts allow employees' assets to grow without them having to pay tax on any gains until they withdraw their money. In this sense, a rabbi trust is similar to a qualified retirement plan. A rabbi trust does not provide any tax benefits for companies that make its use limited compared to other types of trusts.

The first IRS letter approving this sort of trust involved a Rabbi, hence the name Rabbi Trust. The employer's contribution to the trust is tax-deductible, and the employee does not have to pay tax on that sum until he/she receives it from the trust.

How Do You Establish a Rabbi Trust? You as settler or grantor establish a rabbi trust by entering into a trust agreement with a trustee (usually a bank or trust company). The trustee then holds the NQDC plan contributions and investment earnings. A single rabbi trust can benefit more than one employee.

The Disadvantage of Rabbi Trusts If the founding company declares bankruptcy or otherwise becomes insolvent, its creditors will have unbridled access to the rabbi trust's funds?potentially depriving employees of their own earnings.