Homeowners Association Lien Foreclosure

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

- Access your account on US Legal Forms. If you've previously registered, simply log in. Ensure your subscription is active; if not, renew it to continue.

- Preview the form options. Verify that you select the correct homeowners association lien foreclosure template that aligns with your local regulations.

- Utilize the search tool if needed. Should you encounter any discrepancies, look for alternative forms to find one that fits your requirements.

- Purchase the selected document. Click on 'Buy Now' and pick a subscription plan that best suits your needs. Account registration is mandatory for library access.

- Complete your transaction. Enter your payment details, either via credit card or PayPal, to finalize the subscription purchase.

- Download your document. After payment, save the template to your device and access it anytime through the 'My Forms' section of your profile.

In conclusion, US Legal Forms streamlines the process of obtaining legal documents for homeowners association lien foreclosure. Their extensive library and support ensure that you can confidently tackle your legal requirements. Don't hesitate—start your journey towards a hassle-free legal experience today!

Visit US Legal Forms now for all your legal document needs!

Form popularity

FAQ

After a homeowners association lien foreclosure, the responsibility for HOA fees typically transfers to the new property owner. The new owner will have to start paying fees from the date of ownership. Additionally, any outstanding fees may lead to further liens against the property. Knowing the implications of a homeowners association lien foreclosure can help potential buyers avoid unexpected financial burdens.

Yes, HOA fees can be included in bankruptcies, but the treatment of these fees depends on the specific bankruptcy chapter. Under Chapter 7, homeowners may discharge certain debts, including prior HOA fees, while under Chapter 13, they might need to repay these fees through a repayment plan. It's essential to consult with a legal expert on how a homeowners association lien foreclosure may affect your bankruptcy options.

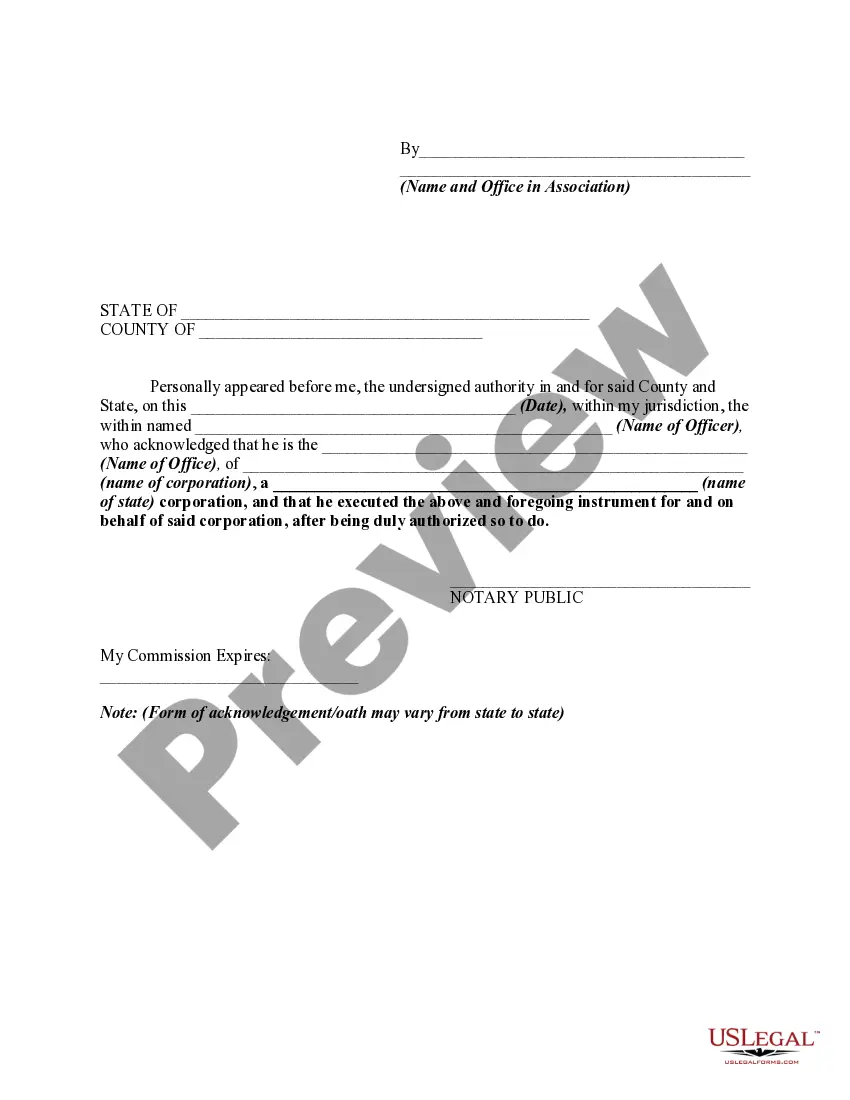

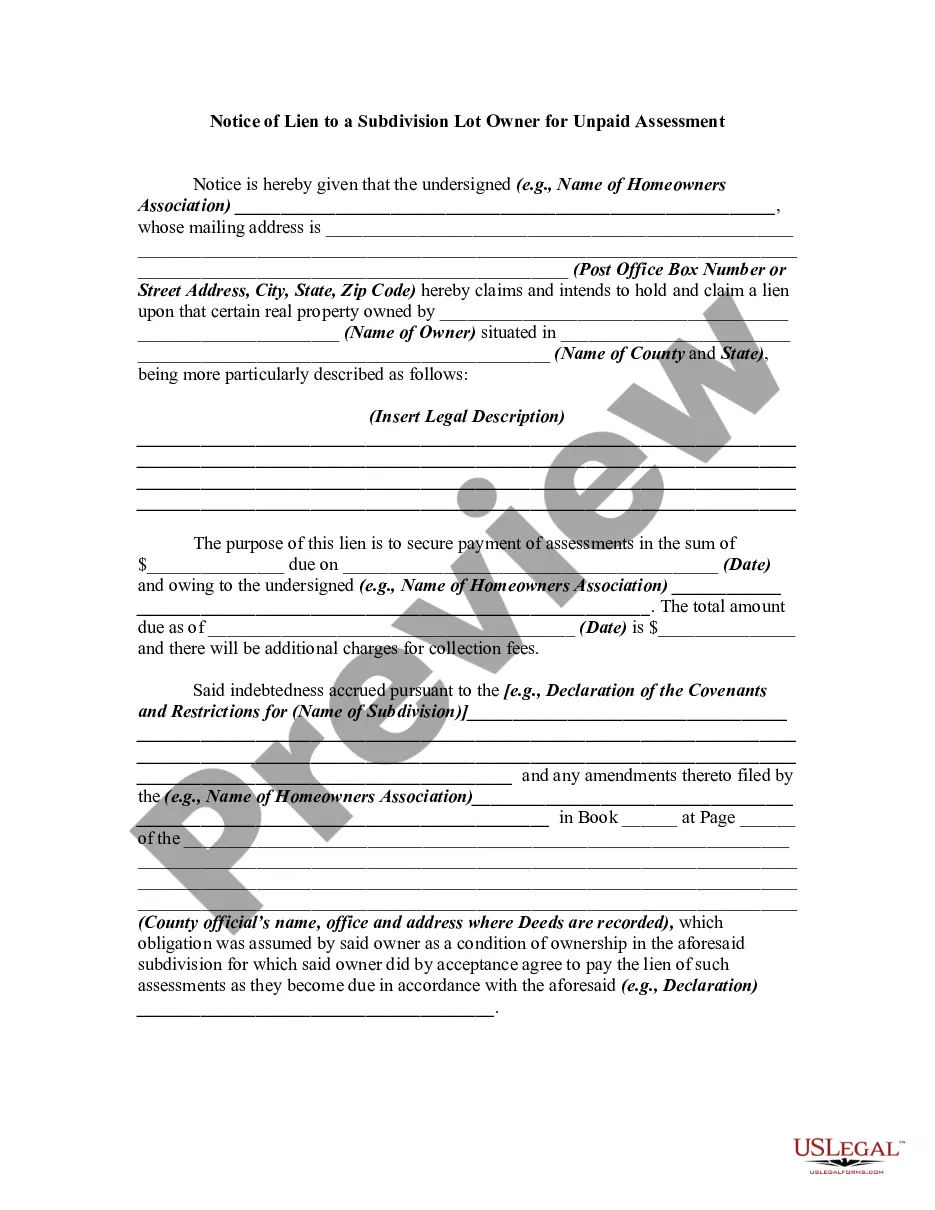

Filing an HOA lien begins with ensuring the homeowner is truly in violation of community rules or has unpaid dues. Gather necessary documents, such as proof of the debt and relevant association agreements. Next, prepare the lien document following state and local regulations. Once complete, file it with the county recorder's office to make it official and secure your position in any potential homeowners association lien foreclosure situation.

To file against an HOA, begin by documenting your concerns thoroughly. Gather evidence such as meeting minutes, correspondence, and any relevant rules or regulations. Once organized, you may send a formal complaint to the HOA board. If issues persist and involve homeowners association lien foreclosure, consider consulting a legal expert to explore further actions.

Homeowners associations in Illinois are regulated by the Illinois Condominium Property Act and the Illinois Common Interest Community Association Act. These laws outline the rights and responsibilities of both homeowners and the associations. If a dispute arises related to homeowners association lien foreclosure, residents can seek assistance from local government agencies or legal professionals to understand their rights.

Yes, an HOA can initiate homeowners association lien foreclosure even if there is no mortgage on the property. The key factor is the unpaid dues and the lien placed by the HOA. This process underscores the importance of prompt payment to avoid losing your home. Understanding your HOA's regulations helps you navigate these responsibilities more confidently.

To prevent homeowners association lien foreclosure, it's important to stay current on your dues and communicate with your HOA. If you're facing financial difficulty, consider negotiating a payment plan or seeking assistance. Being proactive can help you avoid costly legal actions. Utilizing platforms like US Legal Forms can provide essential resources to manage your obligations.

After a foreclosure, responsibility for HOA dues usually transfers to the new owner of the property. However, the original owner may still be liable for any unpaid fees before foreclosure. This situation can complicate financial matters, making it essential to understand the implications of homeowners association lien foreclosure. Seeking legal guidance can clarify your responsibilities.

In the context of homeowners association lien foreclosure, liens typically survive a foreclosure process. This means that if the property is sold at auction, the HOA may still retain a financial interest. Understanding this aspect is vital, as it can affect future property ownership. Consult a legal expert to address specific scenarios related to liens.

No, a homeowners association cannot directly force you to sell your house. However, they can pursue homeowners association lien foreclosure if you default on dues. This process can lead to a loss of ownership if you do not settle your debts. Knowing your rights can empower you to manage your relationship with the HOA effectively.