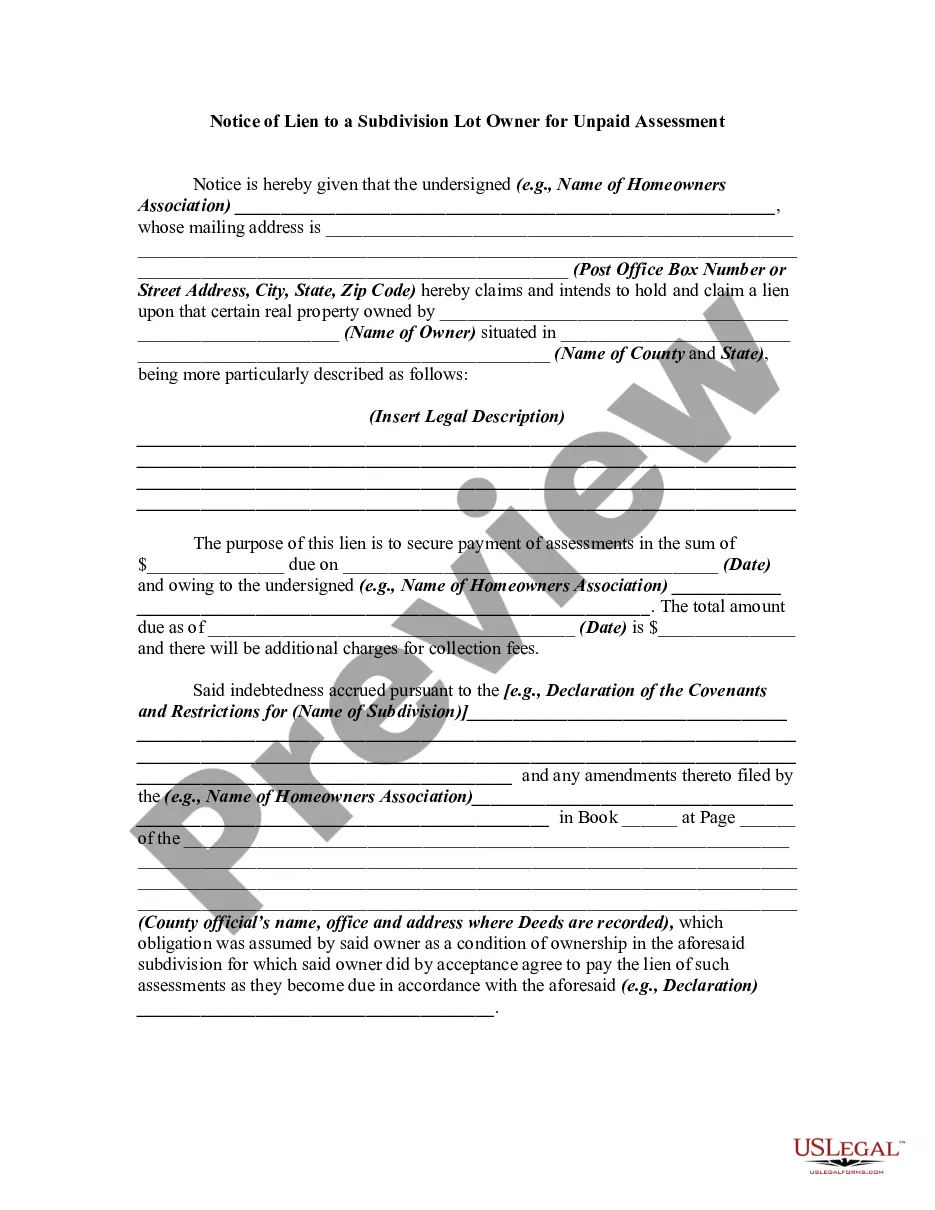

Assessment Lien With The Irs

Description

How to fill out Notice Of Lien To A Condominium Unit Owner For Unpaid Assessment Fees?

Creating legal documents from the ground up can occasionally feel overwhelming.

Some situations may require extensive research and considerable financial investment.

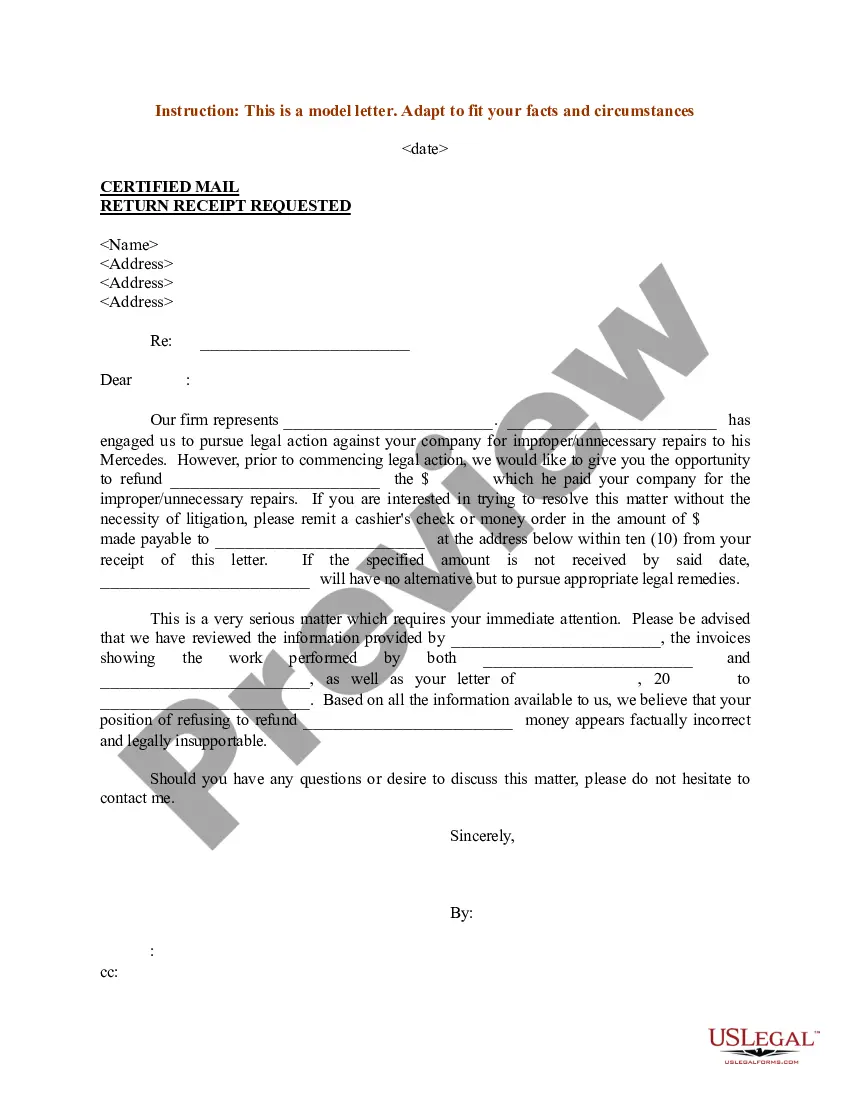

If you're in search of a straightforward and more budget-friendly method to generate an Assessment Lien With The Irs or any other documents without unnecessary complications, US Legal Forms is perpetually accessible.

Our online repository of over 85,000 current legal documents encompasses nearly every aspect of your financial, legal, and personal affairs.

However, before proceeding to download the Assessment Lien With The Irs, consider these recommendations: Review the document preview and descriptions to confirm you have located the correct document. Ensure the template you choose adheres to the laws and regulations of your state and county. Select the most appropriate subscription plan to acquire the Assessment Lien With The Irs. Download the file, then complete, validate, and print it. US Legal Forms boasts a strong reputation and over 25 years of experience. Join us today and make form completion an easy and efficient process!

- With just a few clicks, you can swiftly obtain state- and county-specific forms meticulously crafted for you by our legal professionals.

- Utilize our platform whenever you require dependable and trustworthy services that allow you to effortlessly locate and download the Assessment Lien With The Irs.

- If you’re already familiar with our services and have set up an account previously, simply Log In to your account, choose the form, and download it or re-download it at any moment through the My documents section.

- Not signed up yet? No worries. It requires minimal time to register and explore the library.

Form popularity

FAQ

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

When the credit reporting time limit does expire for a debt, it should drop off your credit report automatically. If for some reason, an old debt remains on your credit report, you can use the credit report dispute process to have it removed.

A Nonresident withholding and Composite Income Tax Return is filed on form 740NP-WH (with copy A of PTE-WH completed for each partner, member, or shareholder) by the 15th day of the fourth month following the close of the tax year. The withholding rate is at the maximum rate provided in KRS 141.020 or KRS 141.040.

You Call Us Call 270-782-5740 or 866-452-9243 (toll free) to apply for help.

When it comes to suing for credit fraud, the statute of limitations is 5 years, and creditors pursuing people who owe money from judgments, contracts, or bonds, are limited to 15 years. Any other form of debt that is not specifically outlined in the Kentucky statute of limitations has a 10-year limit.

In general, you cannot go to jail for a bad debt. [1] But a creditor can sue you in court and ask for a judgment. [2] If the creditor wins in court and you can't pay what you owe, the creditor may try to take some of your income or property to the pay the debt.

Kentucky Resident Debt Relief. InCharge provides free, nonprofit credit counseling and debt management programs to Kentucky residents. If you live in Kentucky and need help paying off your credit card debt, InCharge can help you.

Statute of Limitations by State Statute of Limitations by State (in years)Indiana66Iowa55Kansas33Kentucky5550 more rows ?