Adverse Possession Washington State Withholding Tax

Description

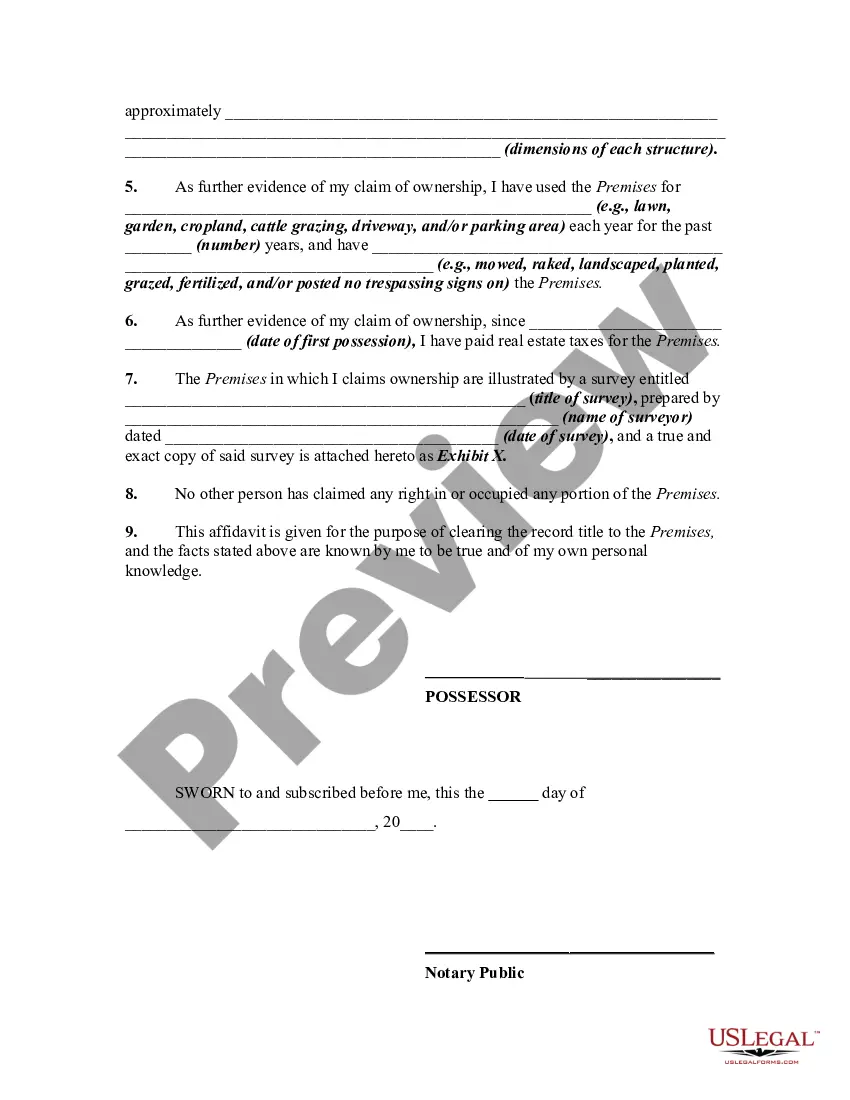

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

It’s common knowledge that you cannot instantly become a legal authority, nor can you swiftly understand how to draft Adverse Possession Washington State Withholding Tax without possessing a unique skill set.

Drafting legal documents is a lengthy process that necessitates a specific education and expertise.

So why not entrust the creation of the Adverse Possession Washington State Withholding Tax to the professionals.

You can re-access your documents from the My documents section whenever you wish. If you are a returning customer, you can simply Log In, locate and download the template from the same section.

Regardless of the reason for your documents—be it financial and legal, or personal—our website has you covered. Give US Legal Forms a try today!

- Find the document you need by utilizing the search bar at the upper part of the webpage.

- View it (if this feature is available) and read the accompanying description to determine if Adverse Possession Washington State Withholding Tax is what you need.

- Start over your search if you require another document.

- Sign up for a complimentary account and choose a subscription plan to purchase the form.

- Click Buy now. Once the payment is processed, you will be able to obtain the Adverse Possession Washington State Withholding Tax, fill it out, print it, and submit or mail it to the relevant parties or organizations.

Form popularity

FAQ

In Western Australia, where a person who is not the legal owner (the person whose name is on the Certificate of Title for the property) occupies land owned by someone else and does so for a period of 12 years or more, and against the wishes of the legal owner, that person is said to be adversely possessing the land. Adverse Possession (WA) - Armstrong Legal armstronglegal.com.au ? property-law ? adv... armstronglegal.com.au ? property-law ? adv...

Under the law of adverse possession, if you own property in Washington, you can lose your property if someone else finds a way to use it without your consent for a long enough period of time. If you think this sounds unfair, you are not alone. How To Identify Adverse Possession In WA | Bolan Law Group, PS bolanlawgroup.com ? blog ? october ? how... bolanlawgroup.com ? blog ? october ? how...

Under Washington State law, an adverse possessor can only claim right to the property after 10 years of use and possession. If the possessor is paying the property taxes on that piece of land, the time period can be reduced to 7 years. Display continuous and uninterrupted use. Adverse Possession in the State of Washington Holmquist + Gardiner ? news-and-insights ? adverse-... Holmquist + Gardiner ? news-and-insights ? adverse-...

Washington State law requires that the possession be: Actual: The adverse possessor must physically use the land as a property owner would. ... Exclusive: The adverse possessor must hold the land to the exclusion of the true owner for the statutory period, which is 10 years in Washington. Adverse Possession: When Trespassers Become Owners Deno Millikan Law Firm PLLC ? adverse-possession Deno Millikan Law Firm PLLC ? adverse-possession

Under Washington State law, an adverse possessor can only claim right to the property after 10 years of use and possession. If the possessor is paying the property taxes on that piece of land, the time period can be reduced to 7 years. Display continuous and uninterrupted use.