Adverse Possession Guide Without Paying Taxes

Description

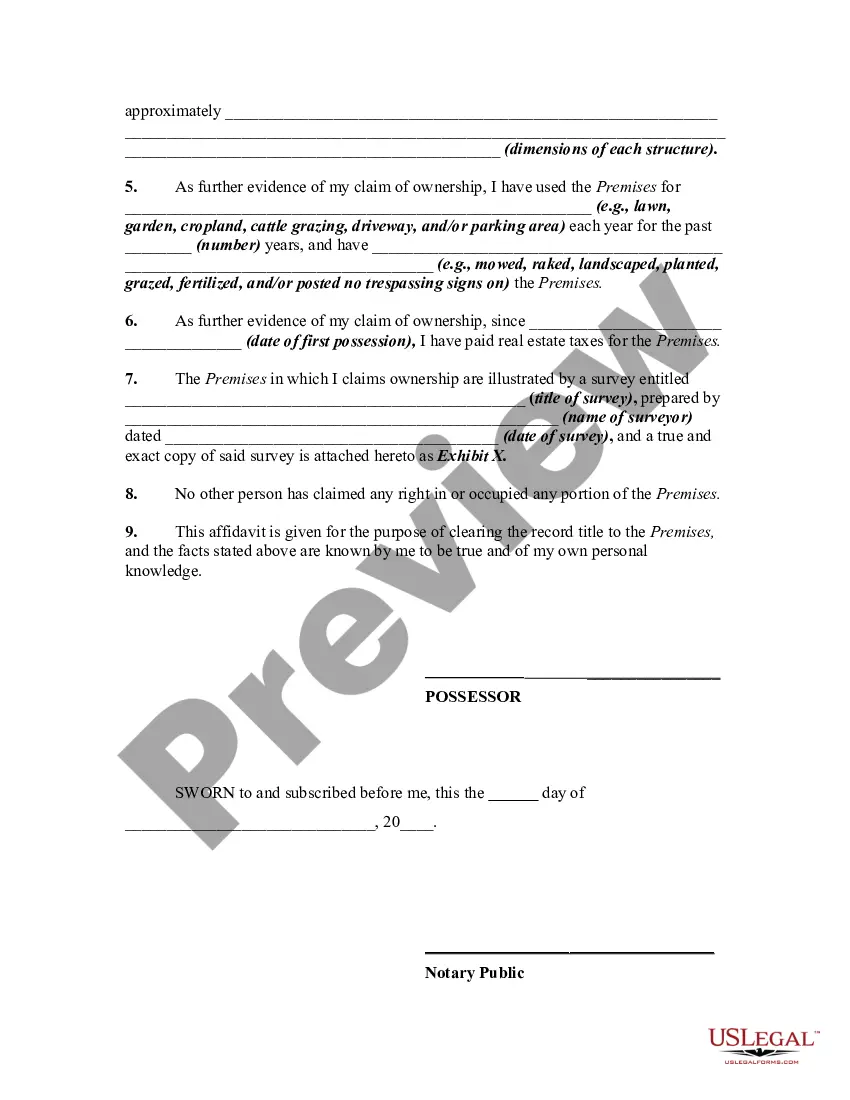

How to fill out Affidavit By Adverse Possessor That Property Held Adversely And Claim Of Title Is Based On Grant Of Ownership From Previous Owner - Squatters Rights?

It’s clear that you cannot transform into a legal expert in a short span, nor can you quickly acquire the knowledge required to prepare an Adverse Possession Guide Without Paying Taxes without a specialized education.

Drafting legal documents is an extensive process that demands particular instruction and expertise. So why not entrust the creation of the Adverse Possession Guide Without Paying Taxes to the experts.

With US Legal Forms, which boasts one of the most comprehensive libraries of legal templates, you can access everything from court documents to corporate communication templates.

If you need a different form, initiate your search again.

Create a free account and choose a subscription option to acquire the template.

- We recognize how vital adherence to federal and state laws and regulations is.

- Therefore, all forms on our site are location-specific and updated.

- To begin, access our platform and obtain the document you need in just minutes.

- Find the document you require using the search bar at the top of the page.

- Preview it (if available) and review the accompanying description to confirm that the Adverse Possession Guide Without Paying Taxes is what you need.

Form popularity

FAQ

To claim a piece of property through adverse possession, you must demonstrate several key factors. Firstly, you need to show your continuous and exclusive use of the property for a certain period, which varies by state. Secondly, your use must be open and notorious, meaning it is visible to others, and without permission from the true owner. Understanding these elements is crucial, and our Adverse Possession Guide without Paying Taxes can help you navigate this complex process.

1. The absence of the tenant from the dwelling unit, without notice to the landlord for at least seven days, if rent for the dwelling unit is outstanding and unpaid for ten days and there is no reasonable evidence other than the presence of the tenant's personal property that the tenant is occupying the residence. 2.

Learn How to Complete the Arizona Form 285, General Disclosure ... YouTube Start of suggested clip End of suggested clip Available in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for theMoreAvailable in the department. Website at WWE CDO arrgh of section 1 of the form 285 is for the taxpayer. Information. There is space to enter the taxpayers. Name address and a time telephone.

This form should only be used to claim property of which you are the original owner. If you are claiming property as the heir or beneficiary of a deceased owner (Form 600B), the agent of an entity (Form 600C) or the agent of a living owner (Form 600D), you must complete the appropriate form.

To claim money or property that was yours, you need to provide a copy of your photo identification or have a notary sign the claim form. You must provide proof of your Social Security number and address as listed on the website.

Individuals can find all tax forms and instructions on the ADOR website or visit our local offices. Please note that the Arizona tax package and Arizona Booklet X Volumes 1, 2, and 3 are now available to download from our website. Taxpayers can also find fillable and non-fillable tax forms online.

Ing to ARS 8-531, ?'Abandonment' means the failure of a parent to provide reasonable support and to maintain regular contact with the child, including providing normal supervision. Abandonment includes a judicial finding that a parent has made only minimal efforts to support and communicate with the child.

Who must use Arizona Form 140NR? File a Form 140NR if you were not an Arizona resident but earned income from an Arizona source in 2021.

Use Form 210 to notify the Arizona Department of Revenue of a fiduciary relationship for a decedent's estate. A fiduciary for a decedent's estate may be any of the following: ? an executor; ? an administrator; ? a personal representative; or ? a person in possession of property of a decedent.