Motion To Continue Trial Florida Sample

Description

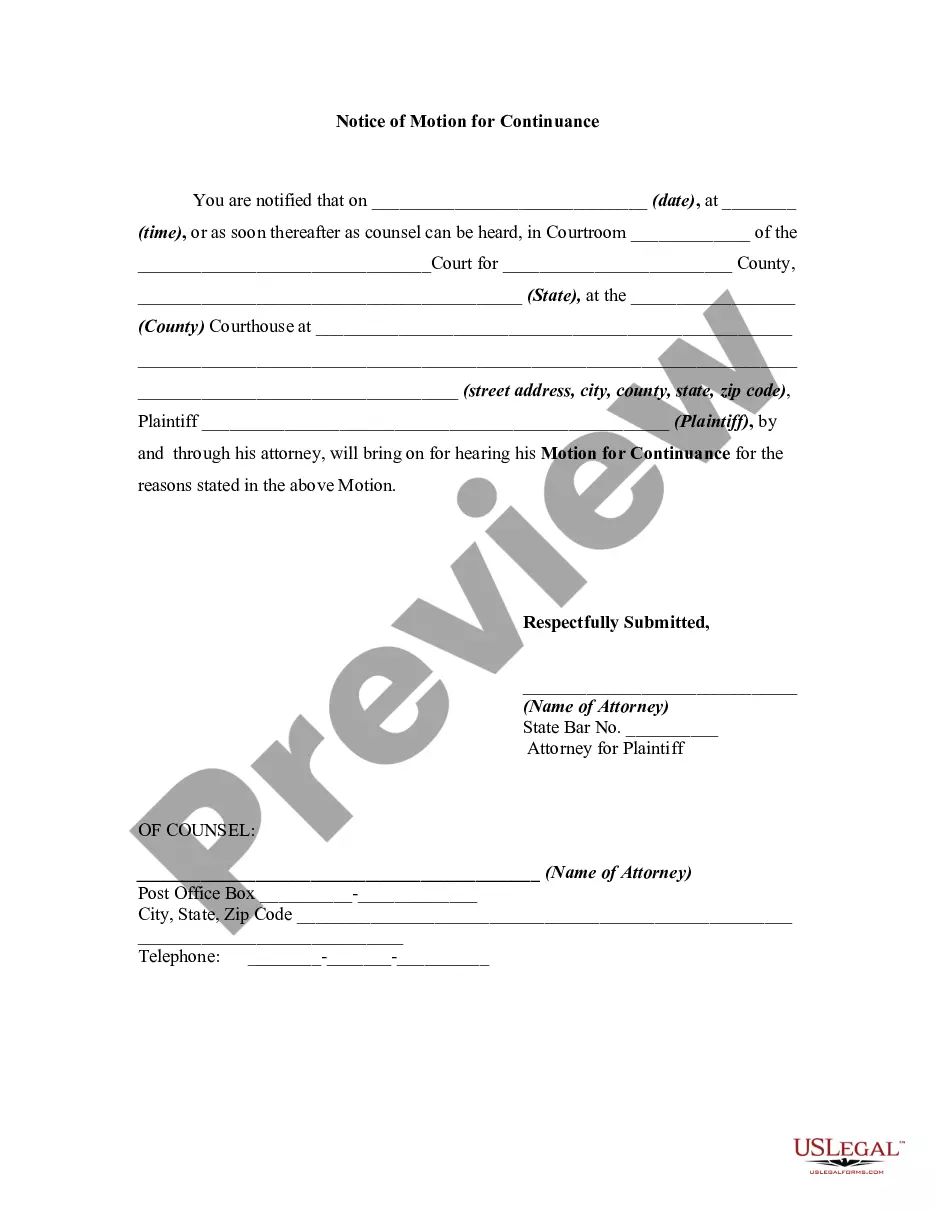

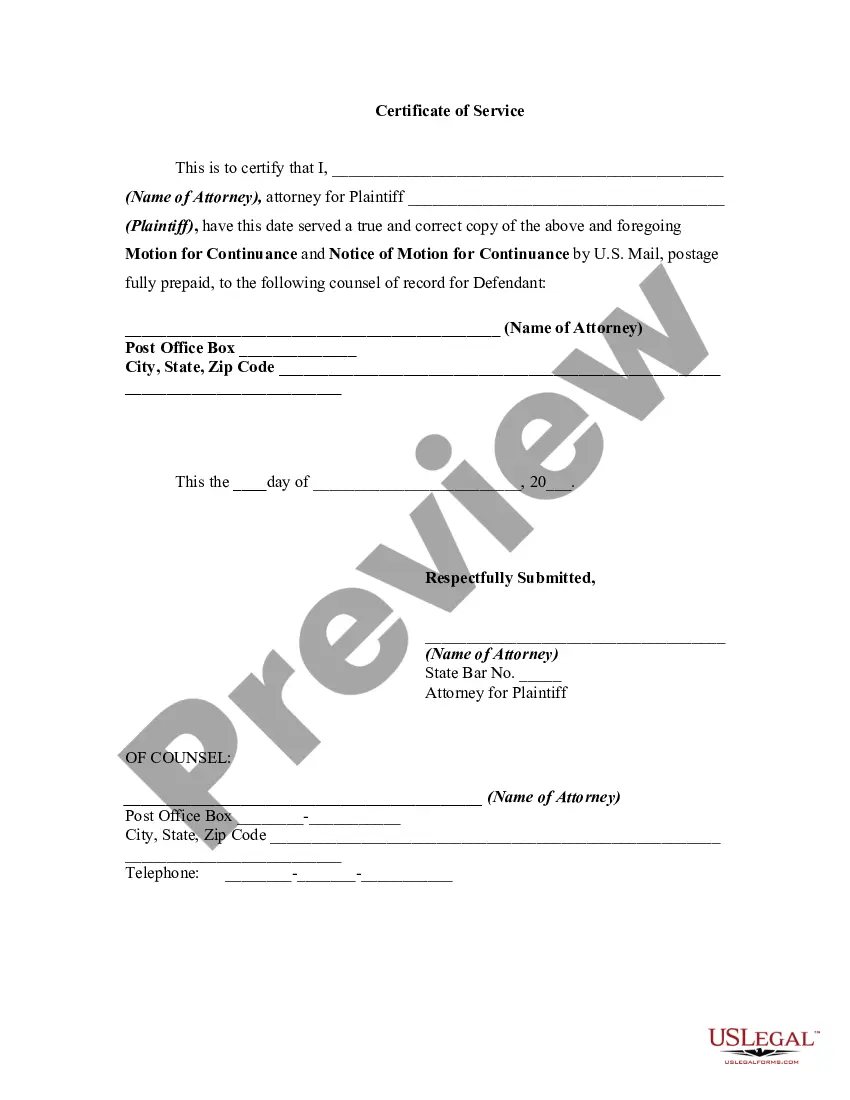

How to fill out Generic Motion For Continuance And Notice Of Motion?

Creating legal documents from the ground up can occasionally be overwhelming.

Certain situations may require extensive research and significant financial investment.

If you’re seeking a simpler and more cost-effective method for preparing Motion To Continue Trial Florida Sample or any other documents without unnecessary complications, US Legal Forms is readily available.

Our online library of more than 85,000 current legal documents covers almost every aspect of your financial, legal, and personal affairs.

Before directly downloading the Motion To Continue Trial Florida Sample, consider these recommendations: Review the document preview and descriptions to confirm that you are viewing the document you need. Ensure that the form you select complies with your state and county regulations. Choose the most suitable subscription plan to retrieve the Motion To Continue Trial Florida Sample. Download the file, then fill it out, sign it, and print it. US Legal Forms boasts a solid reputation and over 25 years of expertise. Join us today and make document completion a straightforward and efficient process!

- With just a few clicks, you can promptly access state- and county-specific forms carefully assembled for you by our legal professionals.

- Utilize our website whenever you require a dependable and trustworthy service to swiftly locate and download the Motion To Continue Trial Florida Sample.

- If you’ve previously used our services and created an account, simply Log In, select your desired form, and download it immediately or retrieve it at any time from the My documents section.

- Don't have an account? No worries. Registration takes only minutes, enabling you to browse through the catalog.

Form popularity

FAQ

To register a business as an S corporation, Articles of Incorporation (sometimes called a Certificate of Incorporation or Certificate of Formation), must be filed with the state and the necessary filing fees paid. After incorporation, Form 2553 must be filed with the IRS in order to elect S corporation status.

How to create an S-Corp. in Massachusetts Choose a name for the corporation. ... Appoint a Registered Agent. ... File Articles of Organization. ... Articles of Organization Signed by Incorporator(s) or Authorized Agent. ... Submit Appropriate Filing Fees for Articles of Organization. ... Secure an Employer Identification Number.

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

An S-corp annual report details an S-corporation's activities during the previous year. S-corporations and other companies must file an annual report each year on the state level, typically through the Secretary of State's office in their state.

You can fill out the Massachusetts Certificate of Organization (called ?Articles of Organization? in many states) and mail it in or use the online portal to submit your paperwork. You'll be responsible for paying a $500 filing fee if you file by mail and a filing fee of $520 if you file online.

Entities that are S corporations for federal purposes are S corporations for Massachusetts purposes, with the exception of security corporations. An S corporation's income, losses, and deductions are passed through to the shareholders, and are reported and taxed on the shareholders' individual returns.

The annual tax for S corporations is the greater of 1.5% of the corporation's net income or $800.

In order to become an S corporation, the corporation must submit Form 2553, Election by a Small Business Corporation signed by all the shareholders.