Notice Lien Contractor With Owner

Description

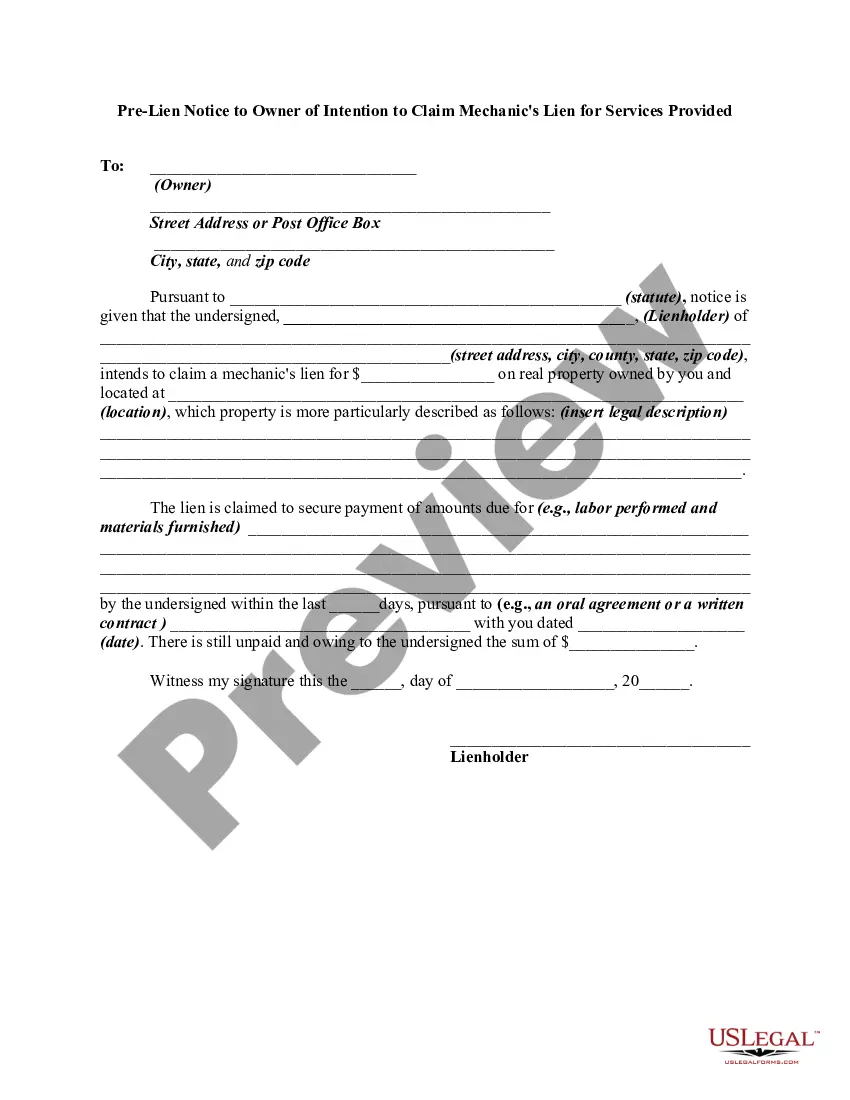

How to fill out Pre-Lien Notice To Owner Regarding Potential Mechanic's Lien For Services To Be Provided To General Contractor?

- Access your US Legal Forms account. If you have previously signed up, log in to retrieve your required templates quickly.

- For first-time users, browse our extensive online library. Review the preview mode and ensure you select the correct form that meets your jurisdiction's requirements.

- If the selected document doesn't fit your needs, utilize the Search tab to find a suitable alternative.

- Purchase the needed form by clicking the Buy Now button and selecting your preferred subscription plan. Registration is mandatory for accessing our vast library.

- Complete your purchase by entering your payment details, either through credit card or PayPal.

- Finally, download the form to your device. You can easily access it anytime in the My Forms section of your profile.

By following these steps, you can efficiently secure the necessary documentation to proceed with your legal requirements. US Legal Forms is dedicated to empowering users with precise and legally sound legal document solutions.

Don’t delay—visit US Legal Forms today and take advantage of our extensive resources!

Form popularity

FAQ

One disadvantage of a lien is that it can create a significant burden on the property owner, potentially affecting their ability to sell or refinance the property. Furthermore, a Notice Lien Contractor with Owner can lead to legal disputes if the lien is contested. It may also involve additional costs and legal fees if the matter goes to court. Understanding these risks is critical, and uslegalforms can provide assistance in managing and mitigating them.

In Texas, filing a Notice Lien requires specific information including the property owner's name, a description of the property, and the amount owed. Additionally, contractors must serve this notice to the owner within a set time frame, typically within 15 days after the project ends. Accurate and timely completion of this process is vital for enforcing your rights. Uslegalforms provides resources to help you navigate these requirements effectively.

In Indiana, a contractor must file a Notice Lien with the owner within 60 days after the last date of work performed or materials supplied. It's crucial to act swiftly to protect your rights. This time frame ensures that property owners are aware of potential claims against their property. Using a reliable platform like uslegalforms can streamline your lien filing process.

Writing a letter of intent for a lien involves clearly stating your claim against the property, including essential details like the amount owed and a description of the work performed. It is important to address this letter to the property owner and indicate your intention to file a Notice Lien if the debt remains unpaid. You can enhance the effectiveness of your letter by using templates available on platforms like US Legal Forms, which guide you through the process.

To enforce a lien, a contractor must file a Notice of Lien with the appropriate county office where the property is located. This document formally notifies the owner and others of the contractor's claim for unpaid work. After filing, the contractor can initiate a legal process if the debt remains unpaid. Utilizing resources like US Legal Forms can simplify drafting and filing liens effectively.

The statute of limitations for a lien in Minnesota typically spans four years. This period starts from the date the lien is recorded or the debt becomes due. After this time, the lien may become unenforceable unless appropriate actions are taken. Staying aware of these timelines allows both contractors and property owners to manage their rights effectively.

In Minnesota, various parties can file a lien on property, including contractors, subcontractors, and suppliers that provide labor or materials. A notice lien contractor with owner may be necessary to enforce a claim against the property. It enables these parties to secure a legal interest in the property for outstanding payments. Knowing who can file a lien helps property owners understand their obligations.

Yes, a lien can sometimes be placed on your house without your immediate knowledge. This situation can occur if a notice lien contractor with owner is filed due to unpaid bills, such as for repairs or construction. However, property owners typically receive a notification when a lien is filed against their property. Staying informed about any work done on your home is essential to avoid unexpected surprises.

In Minnesota, a notice lien contractor with owner must follow specific rules to be valid. The contractor must file the lien within 120 days after work is completed or materials are supplied. Additionally, the lien must be properly served to the property owner, ensuring they are aware of the claim. Understanding these rules helps protect the rights of both contractors and property owners.

A lien can remain on a property for an extended period, but it often depends on state laws and the nature of the lien. For example, in many states, a notice lien contractor with owner can last for several years unless the property owner resolves the debt. After this period, the lien may expire if not renewed or enforced. It is crucial to understand local regulations to determine the exact time frame.