Release Real Estate Form Withholding

Description

How to fill out Terminating Or Termination Of Easement By A General Release?

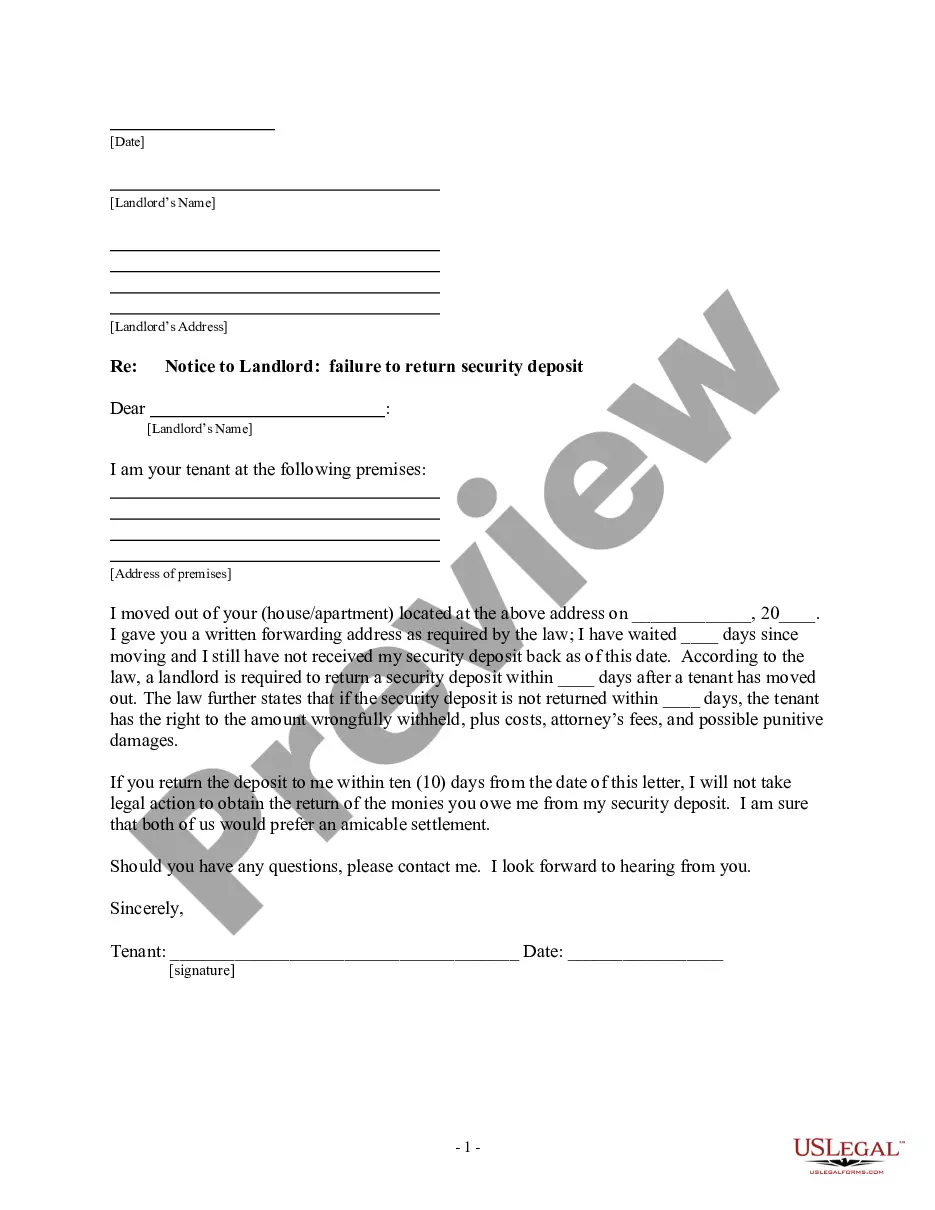

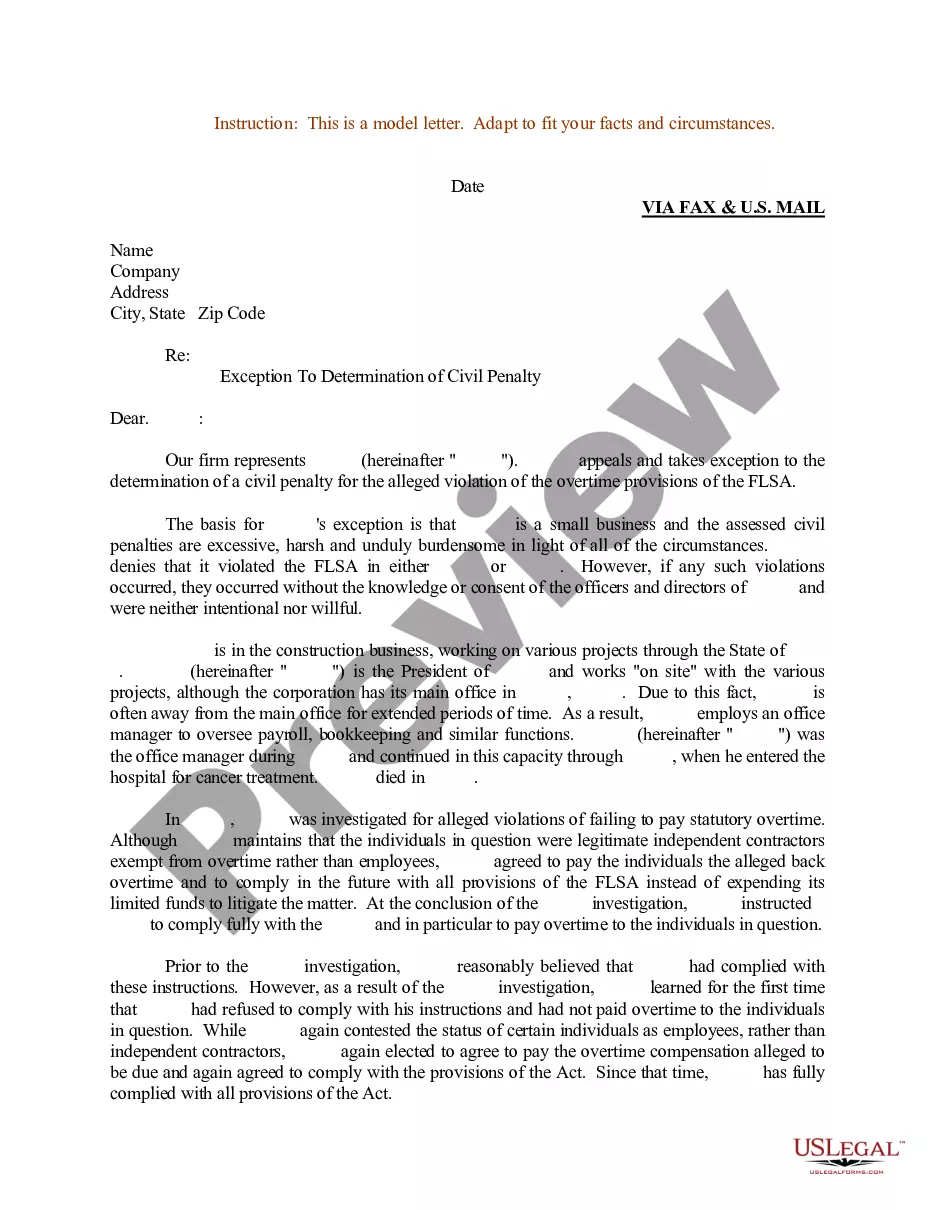

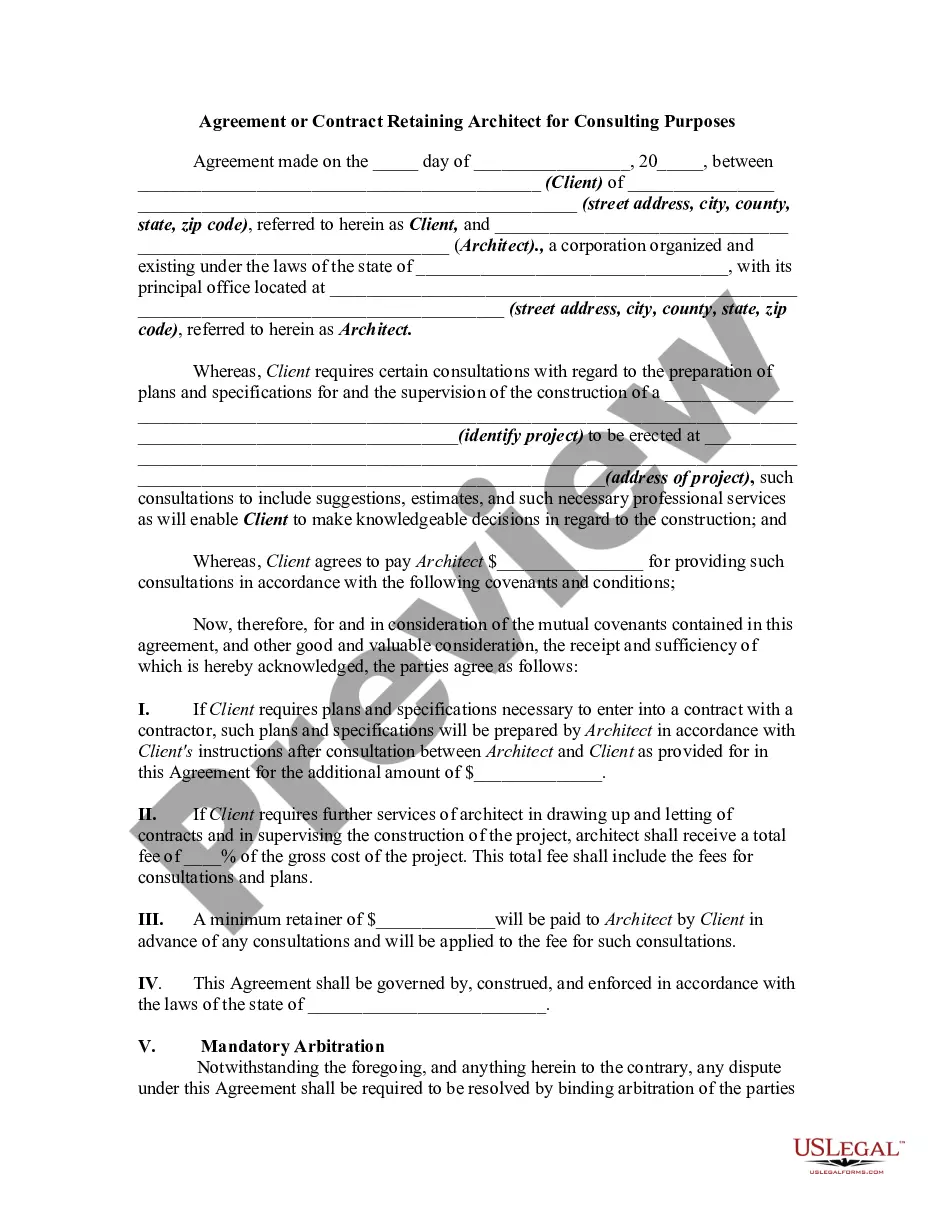

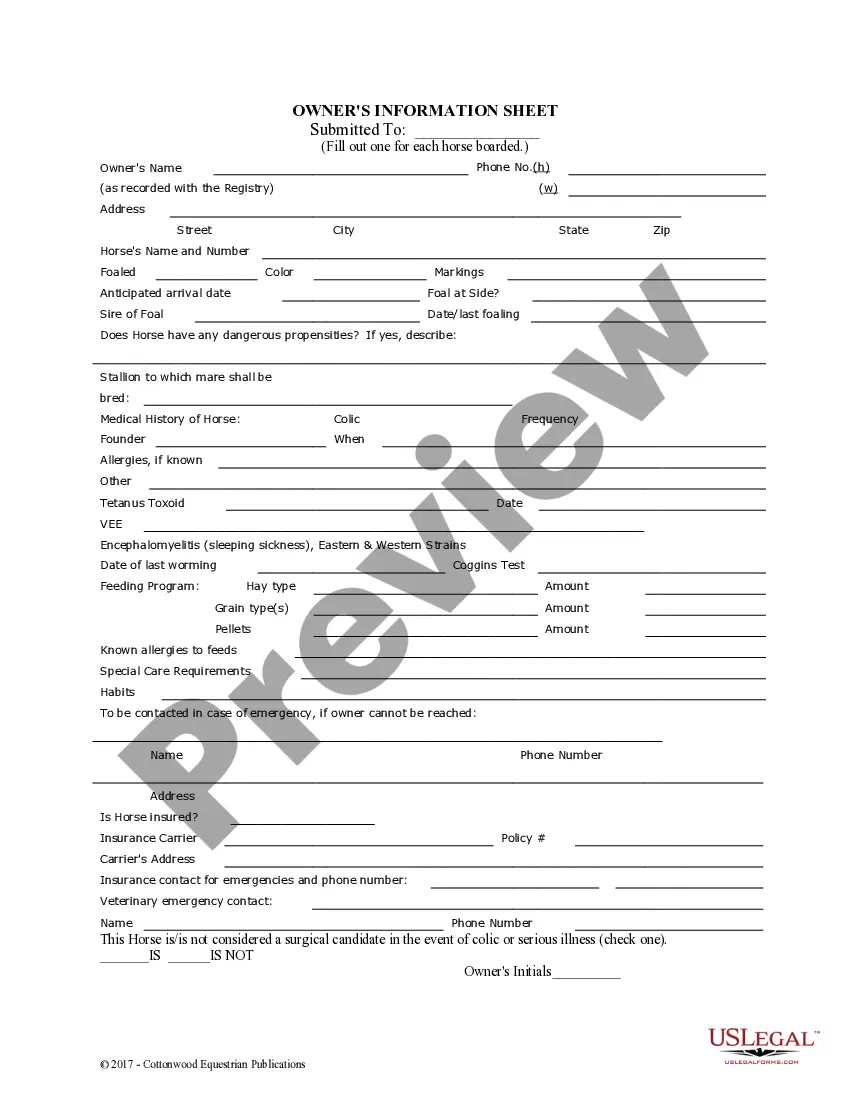

Whether for business purposes or for personal affairs, everyone has to deal with legal situations at some point in their life. Completing legal documents demands careful attention, beginning from choosing the right form template. For instance, if you choose a wrong version of a Release Real Estate Form Withholding, it will be turned down once you submit it. It is therefore essential to have a dependable source of legal documents like US Legal Forms.

If you need to obtain a Release Real Estate Form Withholding template, follow these simple steps:

- Get the sample you need using the search field or catalog navigation.

- Look through the form’s information to make sure it suits your situation, state, and region.

- Click on the form’s preview to view it.

- If it is the incorrect form, return to the search function to find the Release Real Estate Form Withholding sample you require.

- Get the template if it meets your needs.

- If you have a US Legal Forms account, click Log in to access previously saved templates in My Forms.

- In the event you do not have an account yet, you may download the form by clicking Buy now.

- Pick the proper pricing option.

- Finish the account registration form.

- Pick your transaction method: you can use a bank card or PayPal account.

- Pick the document format you want and download the Release Real Estate Form Withholding.

- Once it is downloaded, you are able to fill out the form with the help of editing applications or print it and complete it manually.

With a vast US Legal Forms catalog at hand, you don’t have to spend time seeking for the appropriate sample across the web. Use the library’s easy navigation to get the appropriate template for any situation.

Form popularity

FAQ

» California Real Estate Withholding is prepayment of estimated income tax due the State of California on gain from the sale of California real property. If the amount withheld is more than the income tax liability, the state will refund the difference when you file a tax return for the taxable year.

» California Real Estate Withholding is prepayment of estimated income tax due the State of California on gain from the sale of California real property. If the amount withheld is more than the income tax liability, the state will refund the difference when you file a tax return for the taxable year.

The standard withholding is 3.33% of the Sales Price. Sellers can pay more, but not less unless they take advantage of Part VI and request an Alternative Amount, like 12.3% on the gain amount for an individual or 8.84% or 13.8% for a corporation, depending on the type of corporation.

A seller/transferor that qualifies for a full, partial, or no withholding exemption must file Form 593. Any remitter (individual, business entity, trust, estate, or REEP) who withheld on the sale/transfer of California real property must file Form 593 to report the amount withheld.

What are the Actual Rates of Withholding ? The IRS requires 15% of the sales price be withheld on the sale of United States real property interests by foreign persons (on sales above $1,000,000), and either 15% or 10% on sales between $300,001 and $1,000,0000, and either 15% or $0 for sales of $300,000 and under.