Parent Child Support With Va Disability

Description

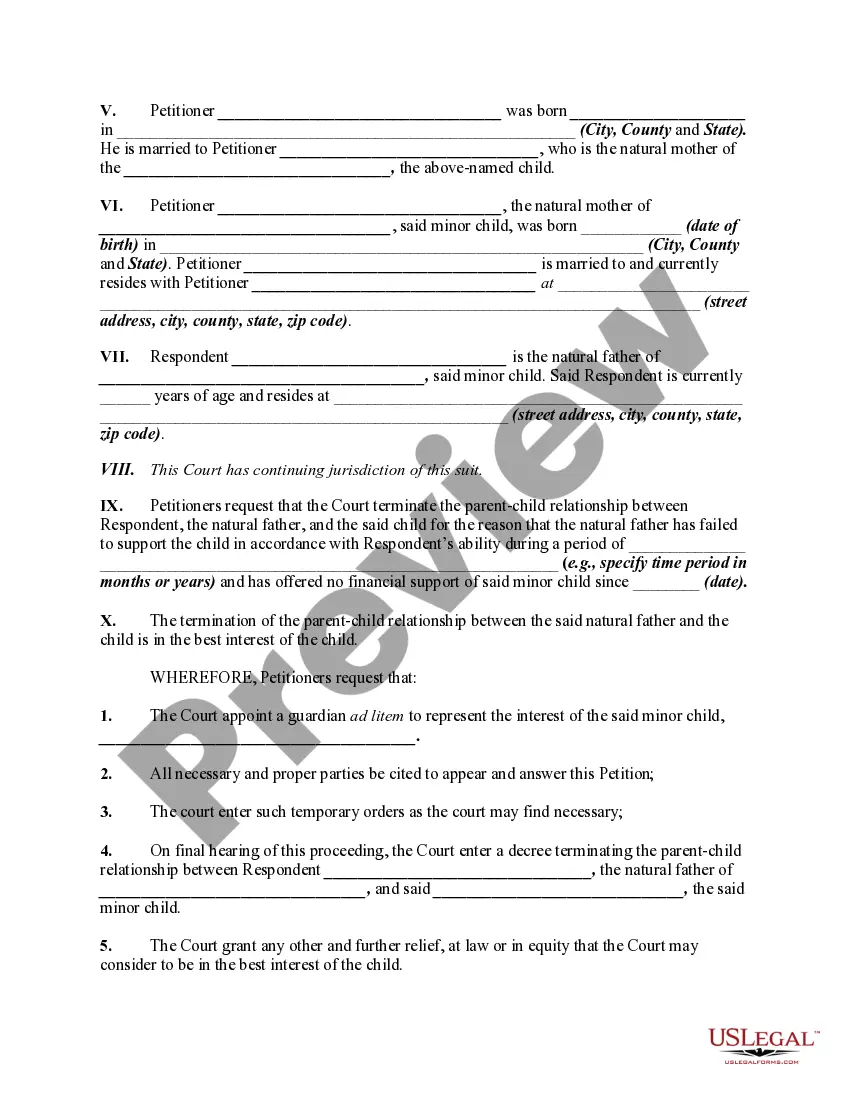

How to fill out Petition By Stepfather And Natural Mother To Terminate Natural Fathers Parent / Child Relationship For Failure To Support Child - Release Of Parental Rights?

Finding a reliable location to obtain the latest and most suitable legal templates is a significant part of managing administrative tasks.

Selecting the correct legal documents demands accuracy and meticulousness, which is why it is crucial to obtain samples of Parent Child Support With Va Disability exclusively from reputable sources, such as US Legal Forms. An incorrect template can squander your time and delay the matters you are dealing with.

Eliminate the stress associated with your legal documentation. Explore the extensive US Legal Forms catalog where you can locate legal templates, assess their pertinence to your situation, and download them immediately.

- Use the library navigation or search bar to locate your template.

- Examine the form’s description to verify if it aligns with the requirements of your state and region.

- Review the form preview, if available, to confirm that it is indeed the form you need.

- If the Parent Child Support With Va Disability does not meet your specifications, return to the search to find the right document.

- If you are confident about the form’s suitability, download it.

- As an authorized user, click Log in to validate and access your chosen forms in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that fits your needs.

- Complete the registration to finalize your purchase.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Parent Child Support With Va Disability.

- Once you have the form on your device, you can modify it with the editor or print it out and complete it by hand.

Form popularity

FAQ

Yes, the court can consider the VA compensation benefits as ?income? when deciding the amount of child support owed. Texas Family Code 154.062(b)(5) lists what the court may include as net resources when calculating child support, and service-connected VA compensation benefits are included in that list.

Texas law includes SSDI in a person's income for the purpose of calculating child support. The child of a parent who receives SSDI may also be eligible for benefits. If you can get SSDI for your child, the court will count that as part of your child support payment.

A service member's disability pay could be an income source for paying spousal maintenance or child support, but only when state law allows it to be. Arizona does not so allow if the disability was service-connected or combat-related under federal law.

Disability benefits received from VA, such as disability compensation, pension payments and grants for home modifications, are not taxable.

Disability benefits only generally cannot be garnished to pay child support. None or part of military retirement benefits and disability benefits, often only the amount of military retirement that is received may be garnished to pay child support.