Sample Guardian Ad Litem Report With Score

Description

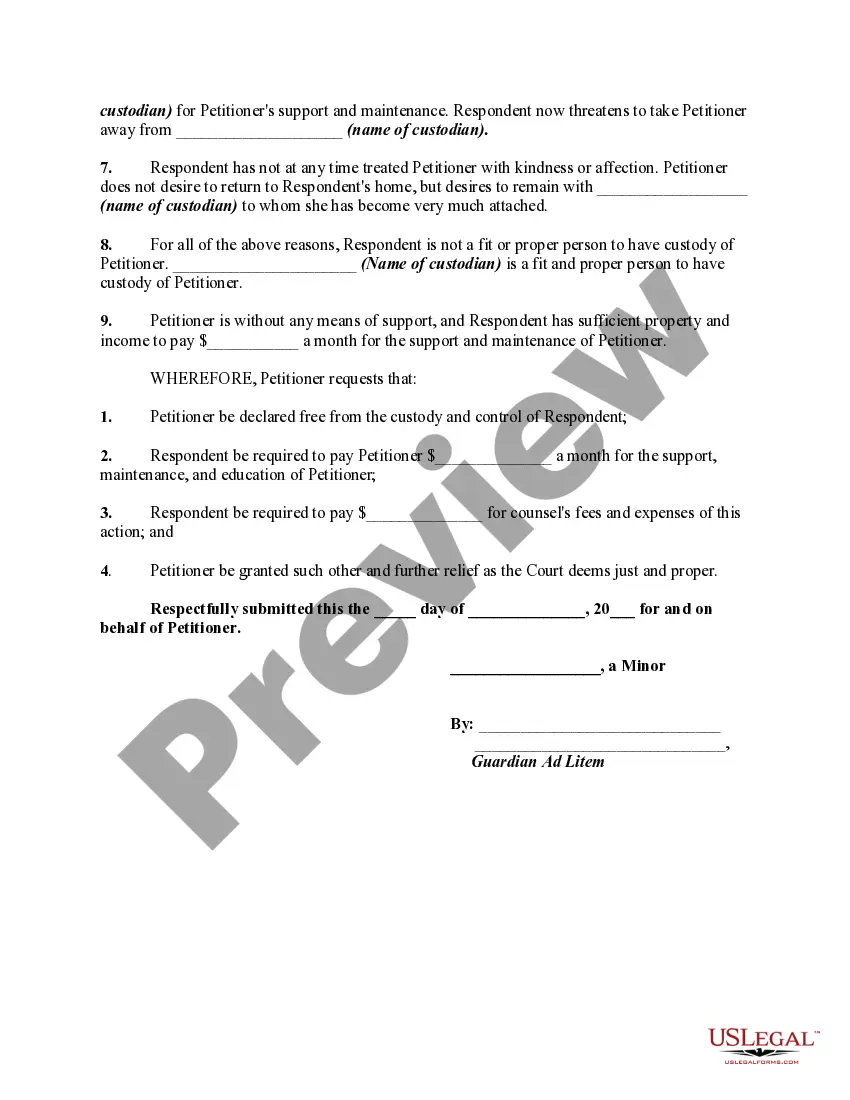

How to fill out Petition Of Minor By Guardian Ad Litem To Be Declared Free From Father's Custody Due To Cruel Treatment - Release Of Parental Rights?

Utilizing legal document examples that adhere to national and local regulations is essential, and the internet provides numerous choices to select from.

But what’s the use of spending time searching for the correct Sample Guardian Ad Litem Report With Score template online if the US Legal Forms digital library already houses such templates consolidated in one location.

US Legal Forms is the largest online legal repository with more than 85,000 fillable forms crafted by lawyers for any business and personal situation. They are straightforward to navigate, with all documents categorized by state and intended use.

All documents you access through US Legal Forms are reusable. To re-download and fill out previously purchased forms, go to the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- Our experts stay abreast of legal updates, ensuring your documents are always current and compliant when obtaining a Sample Guardian Ad Litem Report With Score from our site.

- Acquiring a Sample Guardian Ad Litem Report With Score is quick and easy for both existing and new customers.

- If you already have an account with an active subscription, Log In and download the document sample you require in the desired format.

- If you are a new visitor to our website, adhere to the instructions below.

- Review the template using the Preview option or through the text outline to confirm it meets your needs.

Form popularity

FAQ

When interacting with a guardian ad litem, avoid making emotionally charged statements or accusations about others involved in the case. Focus on factual information and describe your situation clearly. Remember, the guardian's goal is to assess the child's best interests, often reflected in a Sample guardian ad litem report with score. By maintaining a respectful tone, you can facilitate a more productive discussion.

Mortgage deeds are legal documents or instruments that pass over a property's legal rights to the loan provider, which they can exercise in case of a loan default. This document gives lenders the property rights to sell the foreclosed property and recoup their defaulted loan amount to protect their interest.

The purpose of the mortgage or deed of trust is to provide security for the loan that's evidenced by a promissory note. Loan Transfers. Banks often sell and buy mortgages from each other. An "assignment" is the document that is the legal record of this transfer from one mortgagee to another.

This Deed of Assignment of Loan covers the situation where a lender assigns its rights relating to a loan agreement to a new lender. Only the original lender's rights under the loan agreement (i.e. the right to receive repayment of the loan, and to receive interest) are assigned.

The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid. The lender does not have to inform the borrower that the mortgage is being assigned to another party.

This document was created when a mortgagee wished to recover his money, but the mortgagor could not pay it back. The mortgagee would assign the mortgage to another person, who would pay him the money he was owed.

Mortgages are assigned using a document called an assignment of mortgage. This legally transfers the original lender's interest in the loan to the new company. After doing this, the original lender will no longer receive the payments of principal and interest.

Assignments Generally: Lenders, or holders of mortgages or deeds of trust, often assign mortgages or deeds of trust to other lenders, or third parties. When this is done the assignee (person who received the assignment) steps into the place of the original lender or assignor.

An allonge to promissory note is different from an assignment. An assignment in this context is what gives a party the legal designation and right to move forward with legal action on a property, whereas an allonge is an endorsement that allows you to collect on the promissory note.