Guardian Litem Ct For Sale

Description

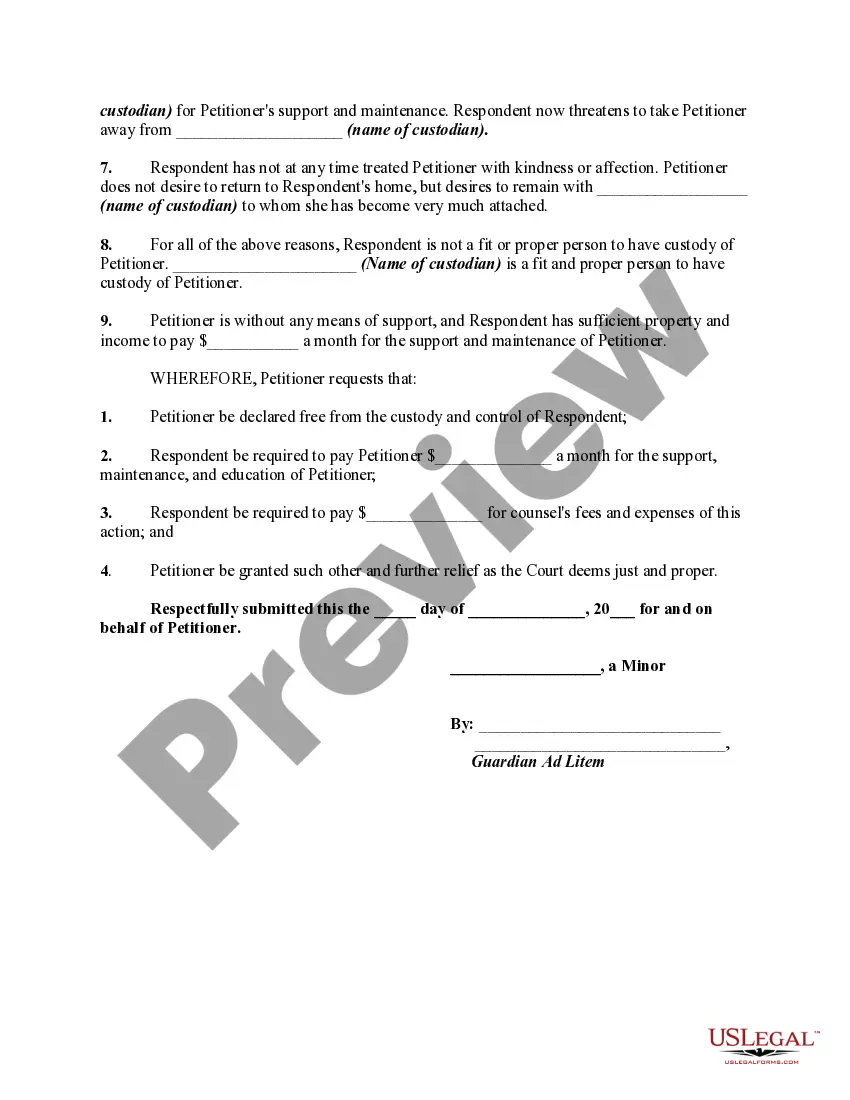

How to fill out Petition Of Minor By Guardian Ad Litem To Be Declared Free From Father's Custody Due To Cruel Treatment - Release Of Parental Rights?

Finding a reliable source for the latest and most suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires precision and meticulousness, which is why it's essential to obtain samples of Guardian Litem Ct For Sale solely from reputable providers, such as US Legal Forms.

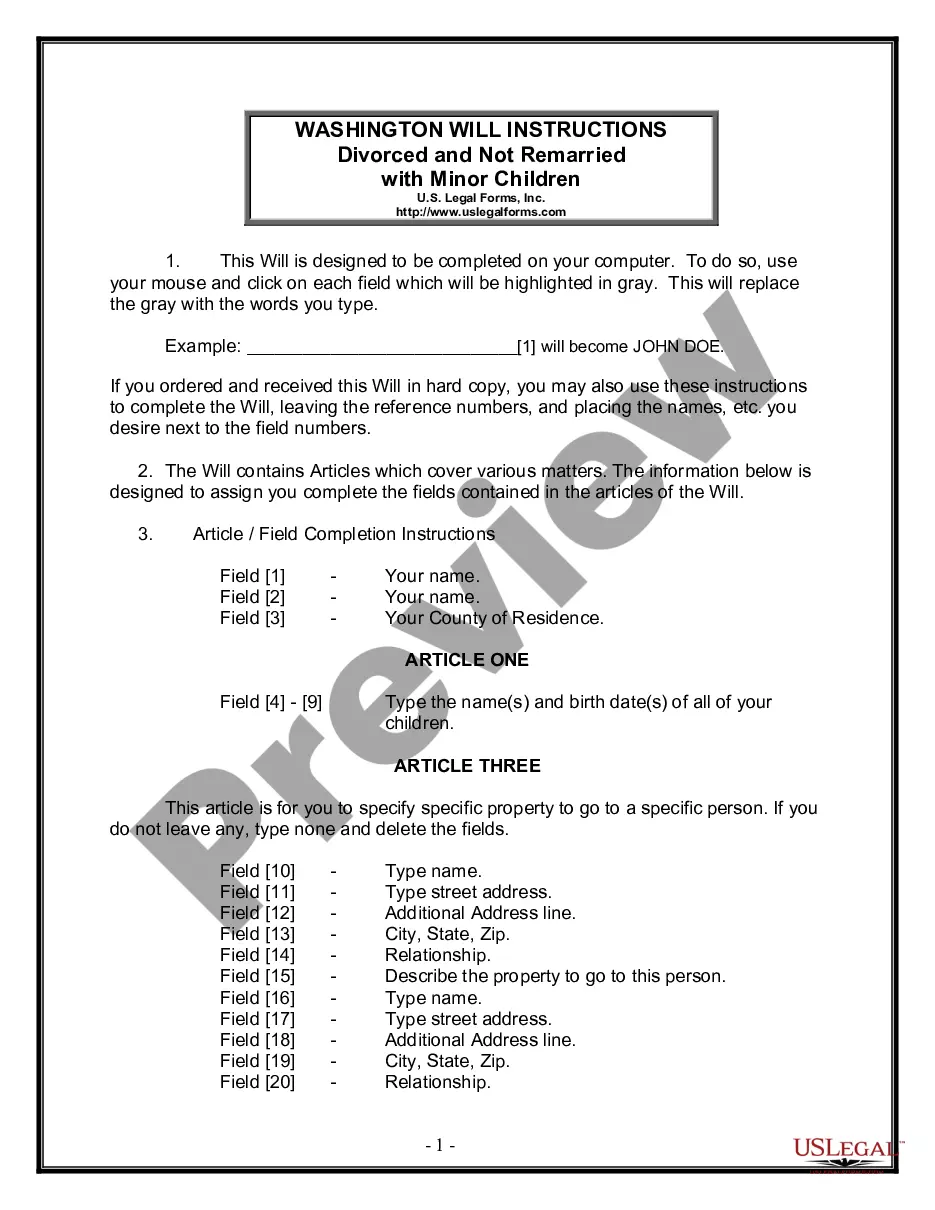

Once you have the form on your device, you can modify it using the editor or print it out to complete it manually. Remove the stress associated with your legal documentation. Browse the extensive US Legal Forms library to discover legal templates, verify their applicability to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your sample.

- Review the form’s specifications to ensure it aligns with the demands of your state and region.

- Access the form preview, if available, to confirm that the template is indeed what you seek.

- If the Guardian Litem Ct For Sale does not fit your requirements, continue your search to find the appropriate template.

- If you are confident about the form’s suitability, initiate the download.

- If you are a registered member, click Log in to verify your credentials and access your chosen templates in My documents.

- If you haven’t created an account, click Buy now to acquire the form.

- Select the pricing option that best suits your needs.

- Continue with the registration process to finalize your purchase.

- Finish your transaction by selecting a payment method (credit card or PayPal).

- Choose the desired file format for downloading Guardian Litem Ct For Sale.

Form popularity

FAQ

Ing to the rule, if you spend at least 183 days of a year in a state ? even if you have established your domicile in another state ? you are considered a resident of the state for tax purposes.

Owning property in the state of Colorado does not in itself establish residency. forces personnel who maintain Colorado as their ?home of record? are eligible to purchase/apply for ?resident? hunting/fishing licenses.

Examples Computer Generated Bill (utility, credit card, doctor, hospital, etc.) Bank Statement. Pre-Printed Pay Stub. First-Class Mail (government agency or court) Current Homeowner's, Renter's, or Motor Vehicle Insurance Policy. Mortgage, Lease, or Rental Contract. Transcript or Report Card from an Accredited School.

Colorado residency is established when one of the following criteria is met: You obtain a Colorado driver's license. You obtain employment in Colorado. You own or operate a business in Colorado.

Evidence of intent to make Colorado your permanent home and legal residence is demonstrated by giving up all your legal ties with your prior state and establishing them with Colorado for 12 continuous months.

You can establish residency in one of the following ways: Own or operate a business in Colorado. Are gainfully employed in Colorado. Reside in Colorado for 90 consecutive days.

¶15-120, Part-Year Residents Part-year residents are subject to Colorado income tax that is apportioned in the ratio of that part of the taxpayers' federal adjusted gross income during their Colorado residence to their total federal adjusted gross income, both subject to modifications under Sec.

How long must I live in Colorado before I can be considered "in-state" for tuition purposes? By law, an "in-state" student, or student's parents, must be domiciled in Colorado for 12 or more continuous months immediately preceding the first day of classes.