Guardian Litem Ct For Incapacitated Adults

Description

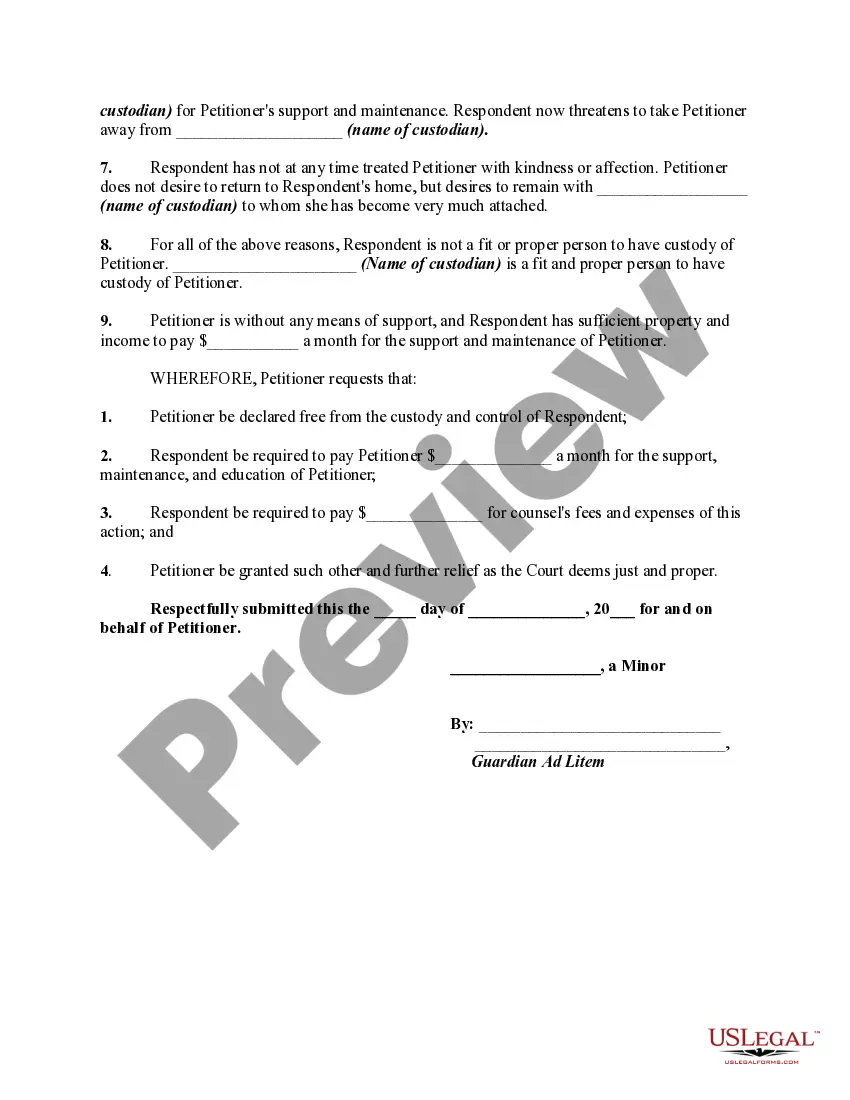

How to fill out Petition Of Minor By Guardian Ad Litem To Be Declared Free From Father's Custody Due To Cruel Treatment - Release Of Parental Rights?

Legal administration can be daunting, even for seasoned experts.

If you're looking for a Guardian Litem Court for Incapacitated Adults but lack the time to search for the proper and updated version, the tasks can be stressful.

Access a valuable resource library of articles, guides, and materials related to your situation and requirements.

Save time and energy in locating the documents you need, and make use of US Legal Forms’ advanced search and Preview feature to retrieve Guardian Litem Court for Incapacitated Adults and download it.

Enjoy the US Legal Forms online library, backed with 25 years of expertise and trustworthiness. Transform your daily document management into a smooth and user-friendly process today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents section to see the documents you previously downloaded and to manage your folders as you see fit.

- If this is your first experience with US Legal Forms, create an account for unrestricted access to all platform benefits.

- Here are the steps to take after acquiring the form you need.

- Confirm this is the correct form by previewing it and reviewing its details.

- Ensure the sample is valid in your state or county.

- Select Buy Now once you are ready.

- Choose a monthly subscription plan.

- Select the format you require, and Download, complete, eSign, print, and deliver your documents.

- Access state- or county-specific legal and business documents.

- US Legal Forms meets all your needs, whether they are personal or business-related, all in one place.

- Utilize sophisticated tools to complete and manage your Guardian Litem Court for Incapacitated Adults.

Form popularity

FAQ

Here we'll explore what you should cover when selling your business. Name the parties. Clearly state the names and locations of the buyer and seller. ... List the assets. ... Define liabilities. ... Set sale terms. ... Include other agreements. ... Make your sales agreement digital.

Commission Approved Contracts Other forms used by a broker shall not be prepared by a broker, unless otherwise permitted by law. The Division of Real Estate, on behalf of the Colorado Real Estate Commission, makes Commission-approved forms available to third-party vendors upon request.

sell agreement can: Keep stock away from undesirable owners (for example, exspouses of a divorcing owner or heirs of a deceased owner) Ensure a reliable process for how a business interest will be transferred. Establish a fair method to value the stock of the departing owner and for estate tax purposes.

Also, with their Forms 1040, sole proprietors may need to file: Form 4797, Sales of Business Property, if they sell or exchange property used in their business. ... Form 8594, Asset Acquisition Statement, if they sell their business. Schedule SE (Form 1040), if they're liable for self-employment tax.

Buy and sell agreements are commonly used by sole proprietorships, partnerships, and closed corporations in an attempt to smooth transitions in ownership when a partner dies, retires, or decides to exit the business.

The bill of sale is a legal document that transfers ownership of the business from the seller to the buyer. It lists the assets being sold, their value, and any conditions of the sale.

Negotiate everything for the sale of a sole proprietorship If your business is a sole proprietorship, a sale is treated as if you sold each asset separately. Most of the assets trigger capital gains, which are taxed at favorable tax rates. But the sale of some assets, such as inventory, produce ordinary income.

Overview. A sole proprietorship cannot be sold as a single entity like a corporation. Instead, when a sole proprietor sells the business, the sale is treated as the sale of the separate and identifiable assets of the business. The sale of a disregarded entity is also treated as the sale of the entity's assets.