Pay Child Support In Florida

Description

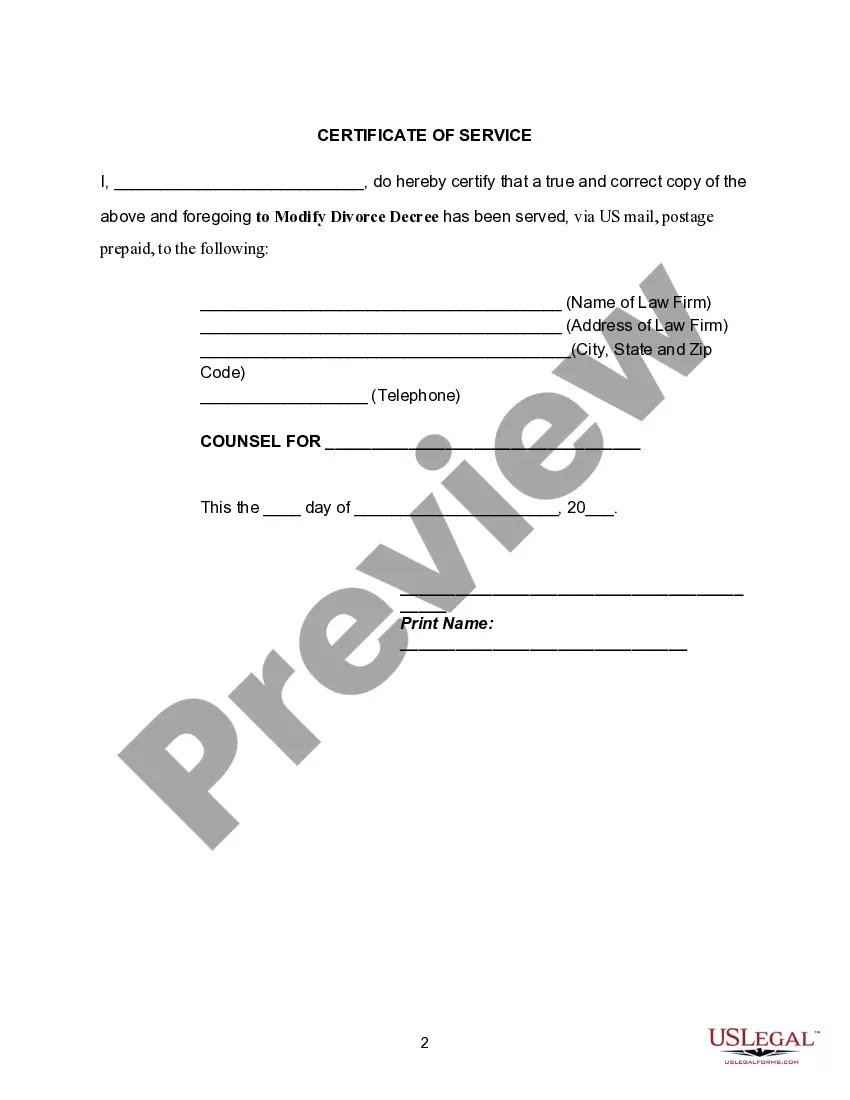

How to fill out Motion To Modify Or Amend Divorce Decree To Provide For Increase In Amount Of Child Support?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain situations may require extensive research and significant financial investment.

If you are seeking a more direct and economical approach to prepare Pay Child Support In Florida or any other documentation without the hassle of unnecessary obstacles, US Legal Forms is perpetually accessible to you.

Our online repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

However, before proceeding to download Pay Child Support In Florida, keep these guidelines in mind: Verify the document preview and descriptions to ensure you have located the document you need. Ensure the template you select adheres to the regulations of your state and county. Select the appropriate subscription option to obtain the Pay Child Support In Florida. Download the form. Then complete, authenticate, and print it. US Legal Forms has a solid reputation and over 25 years of expertise. Enroll with us today and make form completion an effortless and efficient process!

- With only a few clicks, you can swiftly obtain state- and county-compliant forms meticulously crafted for you by our legal experts.

- Utilize our website whenever you require a dependable and trustworthy service through which you can efficiently find and download the Pay Child Support In Florida.

- If you’re familiar with our services and have previously registered with us, simply Log In to your account, identify the template, and download it immediately or access it later in the My documents section.

- Don’t have an account? No worries. It requires minimal time to establish one and explore the collection.

Form popularity

FAQ

The average child support payment for one child in Florida typically ranges from $500 to $800 per month. This figure can vary based on factors such as income level and parenting time. When considering how to pay child support in Florida, it is essential to understand the guidelines set by the state, which ensure fair and adequate support for children. If you need assistance navigating this process, US Legal Forms offers resources and forms to help you effectively manage your child support obligations.

To modify child support payments in Florida, you must file a petition with the court demonstrating a significant change in circumstances. This could include changes in income, employment status, or the needs of your child. Modifications ensure that payments remain fair and reflective of current situations. For assistance in navigating this process, consider the user-friendly resources on US Legal Forms.

Different types of partnerships Unlike corporations, a general partnership is not required to pay a formation filing fee, ongoing annual state fees, hold an annual meeting, issue shares, or separate personal assets from business assets. Further, no state filing is required to form a general partnership.

A General Partnership is a formal agreement between two or more people to operate a business together. The partners share the business assets, profits, and debts. Illinois's Uniform Partnership Act (Title 805, Chapter 206 of the Illinois Statutes) governs General Partnerships in the state.

Step 1: Select a business name. Any Illinois partnership must operate with a unique name. ... Step 2: Register the business name. ... Step 3: Complete required paperwork. ... Step 4: Determine if you need an EIN, additional licenses, or tax IDs. ... Step 5: Get your day-to-day business affairs in order.

A General Partnership is a formal agreement between two or more people to operate a business together. The partners share the business assets, profits, and debts. Illinois's Uniform Partnership Act (Title 805, Chapter 206 of the Illinois Statutes) governs General Partnerships in the state.

Unlike corporations, general partnerships are not considered separate business entities. This means the partners are not protected from lawsuits brought against the business. Additionally, personal assets may be seized to cover unpaid debts. Partners are liable for each other.

How to form a limited partnership Name of the business (typically must end in ?Limited? or ?Ltd.?). Registered agent of the business who will accept legal documents on the business's behalf. Name and address of each general partner. Signature of general partner or person filling out the form.

Even though owners do not have to formally file or register for a general partnership with the secretary of state, partners legally have to comply with registration, filing, and tax requirements applicable to any business.

You must register with the Illinois Department of Revenue if you conduct business in Illinois, or with Illinois customers. This includes sole proprietors (individual or husband/wife/civil union), exempt organizations, or government agencies withholding for Illinois employees.