This form is used to justify a modification of a child support order, a court must find that there has been a change in the material circumstances of the parties or the children since the time of the original order. The burden of proving a change of circumstances is on the party seeking the modification.

Amount Child Support Withholding Calculator

Description

How to fill out Amount Child Support Withholding Calculator?

What is the most trustworthy service to obtain the Amount Child Support Withholding Calculator and other current versions of legal documentation? US Legal Forms is the solution! It boasts the largest collection of legal documents for any event. Each template is properly crafted and checked for adherence to federal and local regulations. They are organized by region and state of application, making it simple to find what you require.

Experienced users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Amount Child Support Withholding Calculator to retrieve it. Once saved, the template remains accessible for future use within the My documents tab of your account. If you don’t have an account yet, follow these steps to create one.

US Legal Forms is an excellent solution for anyone needing to manage legal documentation. Premium users enjoy even greater benefits, as they can fill out and approve previously saved documents electronically at any time using the integrated PDF editing tool. Give it a try today!

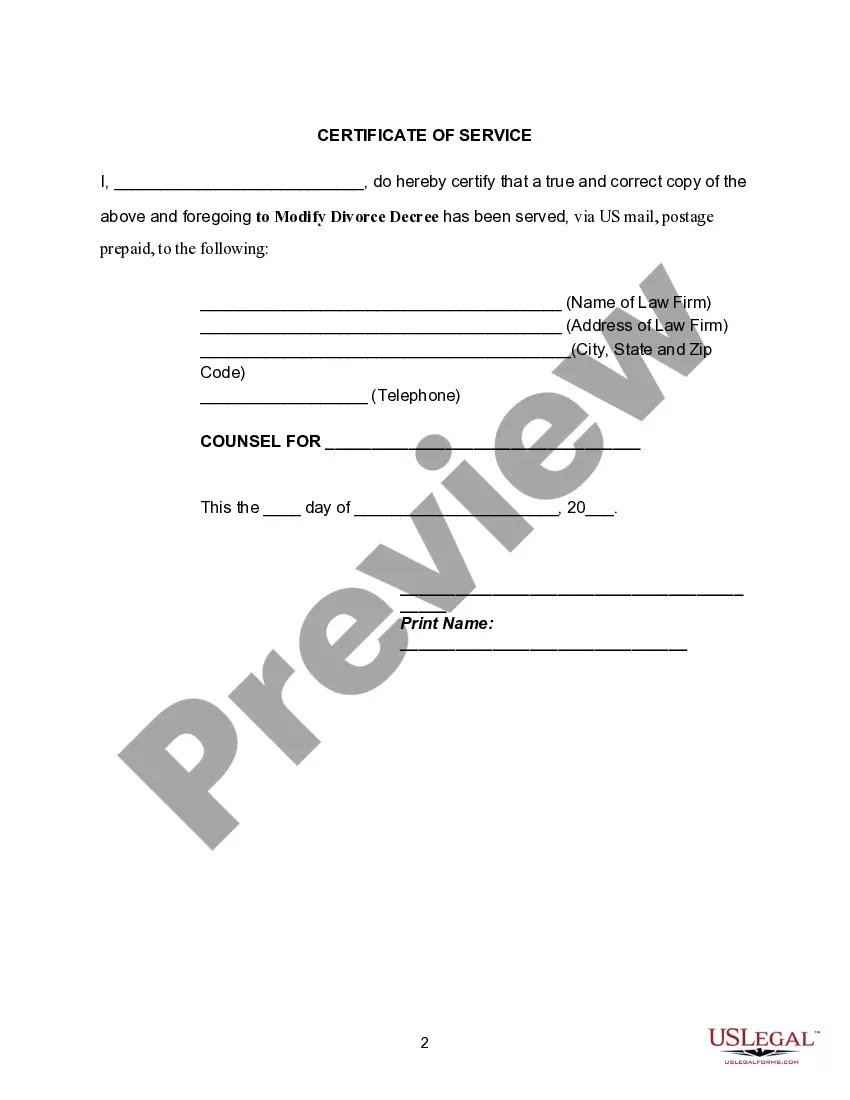

- Form compliance assessment. Before acquiring any template, you should confirm that it aligns with your usage requirements and complies with your state or county's regulations. Review the form description and utilize the Preview feature if it’s available.

- Alternative form search. If there are any discrepancies, use the search bar in the page header to find a different template. Click Buy Now to select the suitable one.

- Account registration and subscription purchase. Choose the most suitable pricing option, Log In or register for your account, and complete the payment for your subscription via PayPal or credit card.

- Downloading the documents. Select the format you wish to save the Amount Child Support Withholding Calculator (PDF or DOCX) and click Download to obtain it.

Form popularity

FAQ

Calculating your adjusted gross income is simple. Add up all income sources, including wages, rental income, and investments, then subtract applicable deductions. Using the amount child support withholding calculator allows you to streamline this calculation process, ensuring precision and clarity. With an accurate AGI, you can effectively plan your child support contributions.

Calculating a parent's adjusted gross income involves determining their total income and subtracting eligible deductions. Each parent may have different sources of income, including wages and self-employment earnings. With the help of an amount child support withholding calculator, you can quickly find the AGI for both parents, allowing for a straightforward assessment of child support obligations. This approach ensures a fair and equitable process for both parties involved.

To gross up your child support income, consider your tax situation and the percentage of income that goes to taxes. Adjust the net income figure using a formula that factors in taxes, ensuring you reflect the true financial situation. The amount child support withholding calculator can assist in this process, providing a clear view of what income to report. This adjustment ensures you calculate a support obligation that accurately meets your needs.

Adjusted gross income (AGI) for child support represents your total income after specific deductions. This figure is crucial when using the amount child support withholding calculator. Typically, it includes wages, tax returns, and other earnings, minus particular allowable expenses. Knowing your AGI helps determine a fair child support obligation.

The maximum amount that can be taken out for child support is generally capped by state law and is often a percentage of your income. Most states have guidelines that dictate how much can be withheld from your paycheck. The amount child support withholding calculator can help you determine the maximum withholding based on your income and local regulations, allowing you to plan your finances better.

Filling out a check for child support is straightforward. Start by writing the correct amount you owe in numbers and words, ensuring it's clear and legible. Then, include the payee’s name, typically your ex-partner or the child support agency. For convenience, you can also utilize the amount child support withholding calculator to confirm the exact payment amount before issuing a check.

The biggest factor in calculating child support is typically the income of both parents. Courts assess each parent’s financial resources to determine a fair support amount. However, factors like the number of children and special needs also play a significant role. The amount child support withholding calculator takes these variables into account, ensuring you receive an accurate estimate.

The maximum child support amount varies by state and is determined by several factors, including parental income, number of children, and mandated guidelines. To assist you in navigating these complexities, the amount child support withholding calculator can provide personalized estimates based on your situation. Using this calculator helps you understand the financial obligations required in your jurisdiction.

The percentage taken from a paycheck for child support generally falls between 50% to 60%, depending on whether the support is current or if there are back payments owed. These decisions are made in court based on your financial situation. For a better understanding of how these percentages applies to you, consider using an amount child support withholding calculator.

Yes, in New York, there is a cap on child support that revolves around the parent's gross income and the number of children involved. This ensures that both parents contribute fairly within reasonable limits. To gauge your financial responsibilities accurately, an amount child support withholding calculator is beneficial.