Form For Abandoned Property

Description

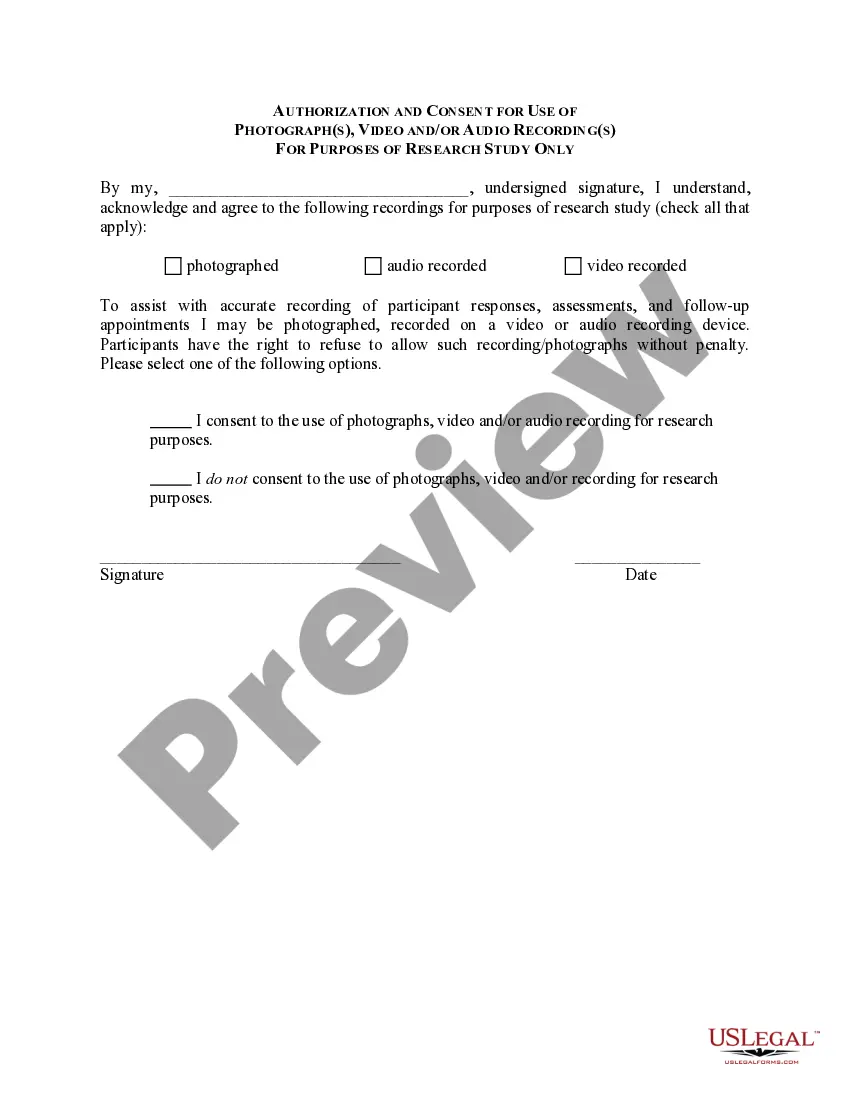

How to fill out Notice Of Sale Of Abandoned Or Unclaimed Personal Property At Public Auction - Abandonment?

Accessing legal documents that adhere to federal and state regulations is essential, and the web provides numerous alternatives to select from.

However, what's the benefit of spending time searching for the properly composed Form For Abandoned Property example online when the US Legal Forms digital library already has such documents compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 customizable documents created by attorneys for various business and personal scenarios.

Utilize the Preview option or the text outline to review the template to confirm it fits your requirements.

- They are simple to navigate with all papers organized by state and intended use.

- Our experts keep up with legal updates, so you can always be sure your documents are current and compliant when obtaining a Form For Abandoned Property from our site.

- Acquiring a Form For Abandoned Property is straightforward and fast for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document sample you require in the appropriate format.

- If you are visiting our site for the first time, follow the steps outlined below.

Form popularity

FAQ

The timeframe for someone's property to become yours depends on state laws regarding adverse possession or abandonment. This period can range from a few months to several years, depending on the circumstances. If you believe you have a claim, it is wise to complete a Form for abandoned property to document your intentions and protect your rights effectively.

To be considered a resident, an individual typically must stay in your home for an extended period, which often starts at 30 days. Factors like emotional attachment and presence of personal belongings also play a role in this consideration. To help clarify residence status, you might want to fill out a Form for abandoned property to formalize the situation when disputes arise.

The duration for a tenant's absence to classify their property as abandoned varies significantly between states. Generally, a tenant must be gone for a specified timeframe, often 14 to 30 days, depending on local laws. If you find yourself in this situation, using a Form for abandoned property can help simplify the process of reclaiming the belongings left behind.

Abandoned property typically becomes yours after you have demonstrated continuous possession for the legally required time in your state. You must show intent to possess the property and treat it as your own during this period. Utilizing a Form for abandoned property can help you document this intent and streamline the ownership transfer process.

To claim ownership of abandoned property, an individual generally needs to possess it openly and continuously for a specific period. This period varies by state and can range from a few months to several years. To ensure you follow the correct legal guidelines, consider using a Form for abandoned property. This form helps formalize the process and clarifies ownership claims.

Generally, you cannot claim unclaimed property that does not belong to you unless you have rightful permission from the original owner. However, if you are a legal heir or have power of attorney, you may be able to claim property on behalf of the owner. In these cases, using the correct Form for abandoned property is essential to ensure a smooth process. Be aware of legal implications before proceeding with such claims.

In Tennessee, abandoned property can refer to items like bank accounts, safe deposit box contents, and uncashed checks that have not been used for a specified period. Generally, if the owner does not actively manage their property or contact the holder for three to five years, it may be deemed abandoned. To reclaim such items, you will need to submit a Form for abandoned property to the state. Understanding these definitions can help you identify and recover lost assets.

Yes, you can claim unclaimed property belonging to your deceased father, but you typically need to prove your relationship to him. This often involves providing necessary documentation, such as a death certificate and proof of your identity. You should use the Form for abandoned property specific to your state to initiate the claim process. Make sure to check state laws for any additional requirements.

In Minnesota, unclaimed property includes various items such as bank accounts, insurance policies, and personal property. The state requires companies to report unclaimed property after a certain period of inactivity, typically three to five years. To reclaim your unclaimed property, you need to complete a Form for abandoned property through the appropriate state agency. This process can help you recover forgotten assets effectively.

While no single tax form can erase your debt outright, filing a bankruptcy petition may provide relief from tax liabilities. Additionally, certain forgiven debts might be reported on a 1099-C, which can also relate to a form for abandoned property in some circumstances. USLegalForms can assist you in navigating these processes for a better financial outcome.