Chase Credit Card Death Of Account Holder

Description

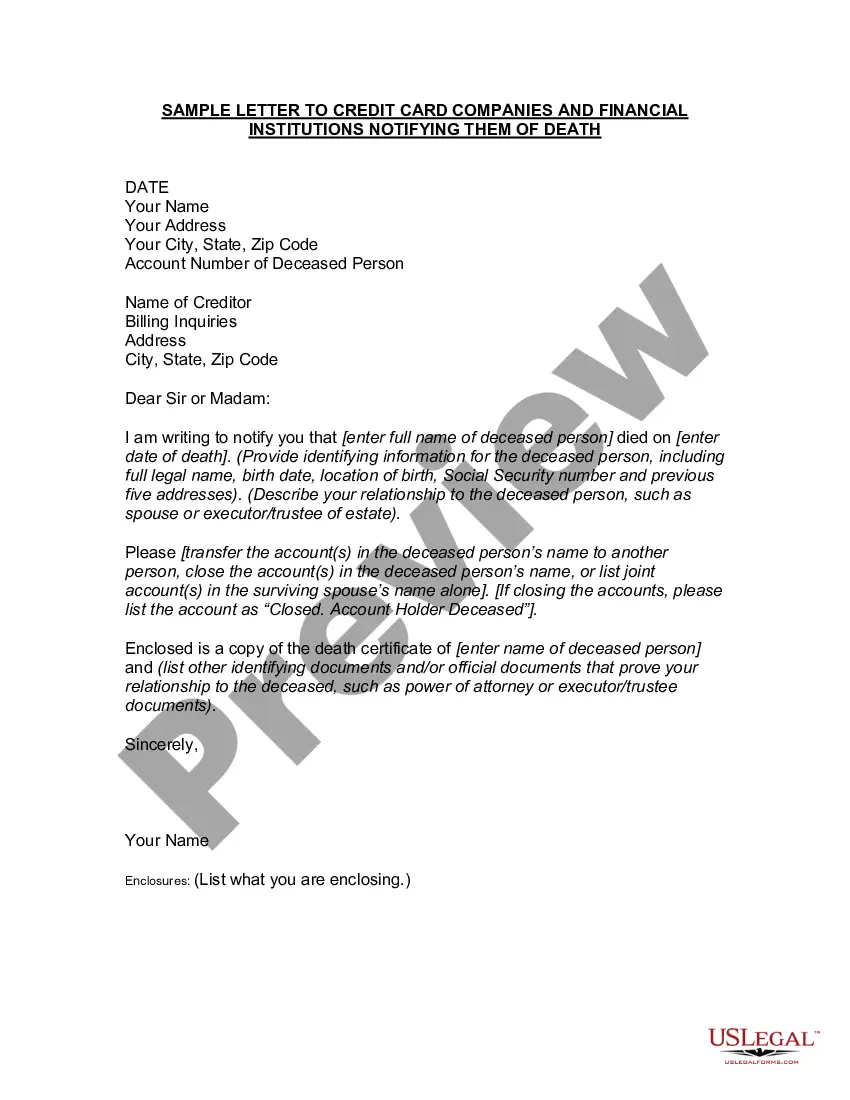

How to fill out Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

Locating a reliable source to obtain the latest and suitable legal documents is a significant part of navigating bureaucratic processes. Identifying the correct legal paperwork requires accuracy and careful attention, which highlights the necessity of sourcing **Chase Credit Card Death Of Account Holder** samples exclusively from trustworthy providers, such as **US Legal Forms**. An incorrect document will squander your time and prolong the issue at hand. With **US Legal Forms**, you can rest easy. You can retrieve and examine all relevant information regarding the document’s applicability to your circumstances and in your locale.

Follow these steps to complete your **Chase Credit Card Death Of Account Holder**.

Once the document is on your device, you can modify it using the editor or print it out to fill in manually. Eliminate the hassle of your legal documentation. Explore the extensive **US Legal Forms** library, where you can discover legal samples, assess their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search option to locate your document.

- Examine the form’s details to ensure it aligns with your state and county requirements.

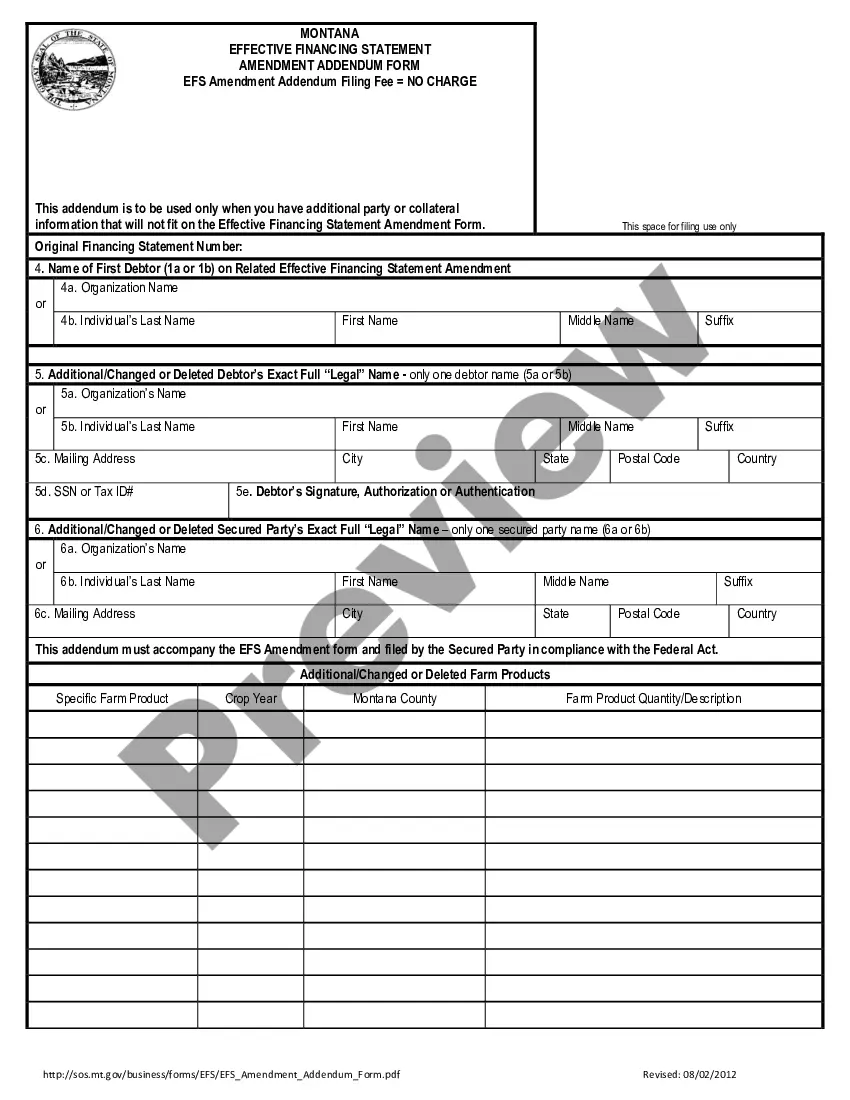

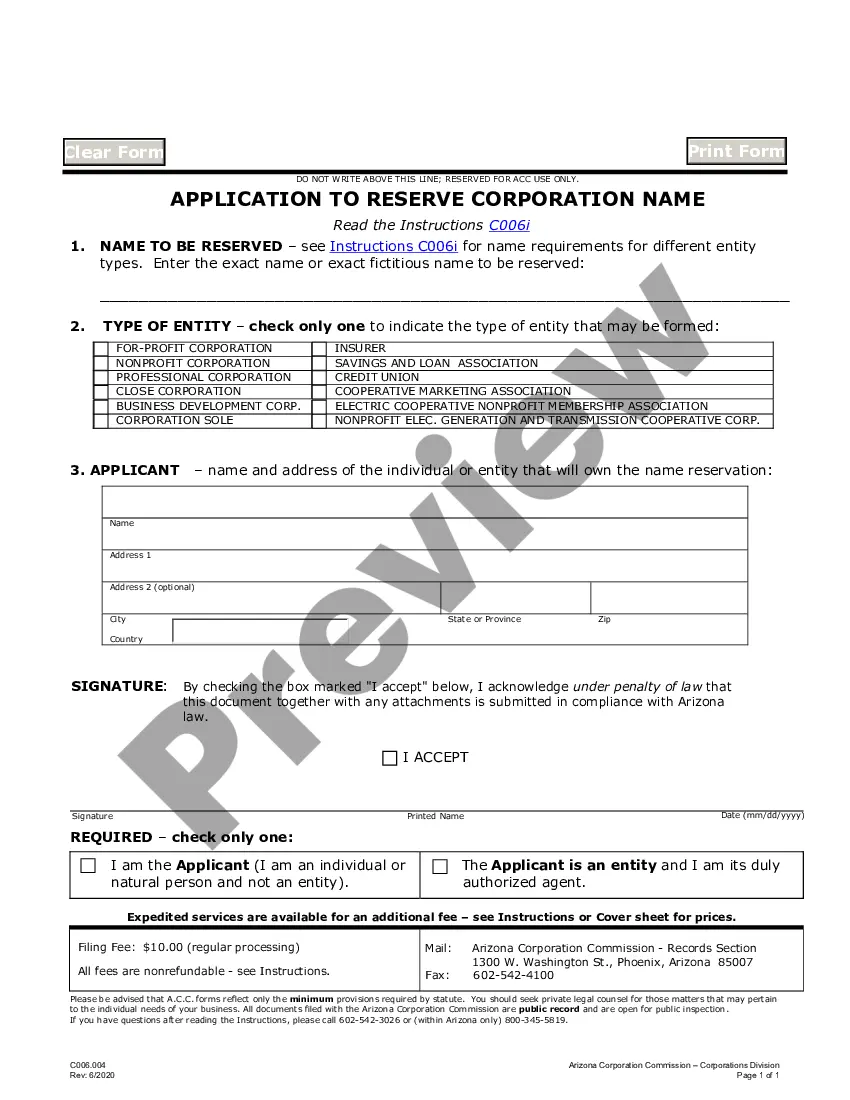

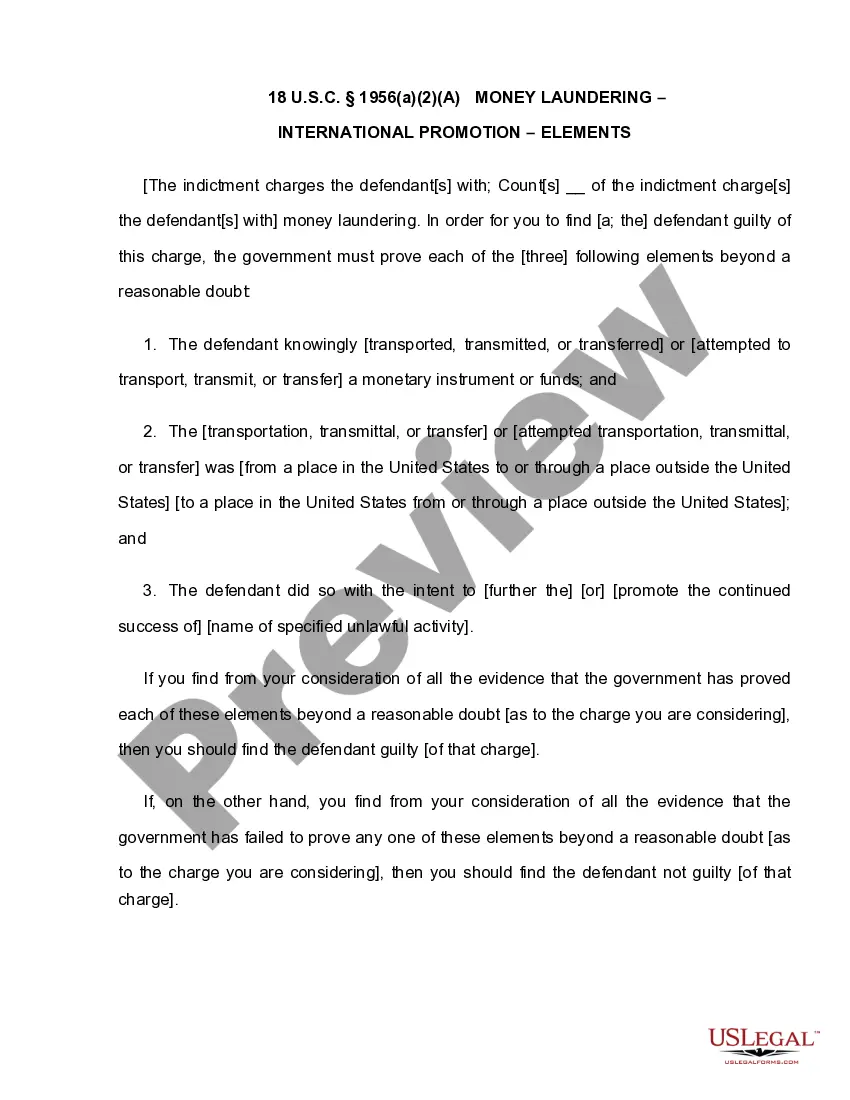

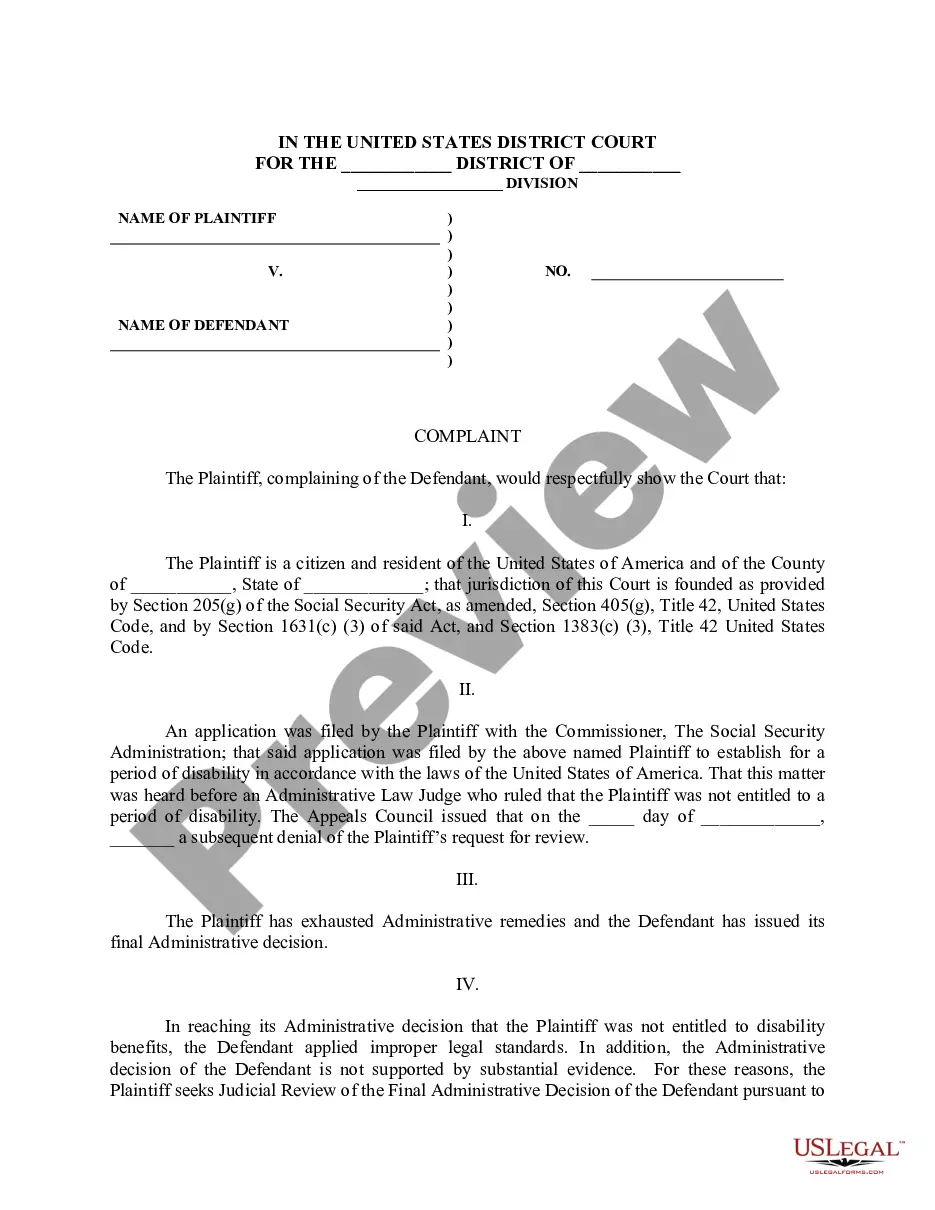

- Review the form preview, if available, to confirm the template is precisely what you need.

- Return to the search if the **Chase Credit Card Death Of Account Holder** does not fulfill your requirements and find the appropriate document.

- If you are confident about the form’s applicability, proceed to download it.

- If you are a registered user, click Log in to verify your identity and access your chosen templates in My documents.

- If you do not yet possess an account, click Buy now to obtain the document.

- Choose the pricing plan that suits your needs.

- Continue to the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Pick the file format for downloading your **Chase Credit Card Death Of Account Holder**.

Form popularity

FAQ

Closing a Chase account after the death of the account holder requires contacting Chase customer service. Be prepared to provide documentation, such as the death certificate and valid identification. The bank representative will guide you through the necessary steps to close the account appropriately. This action is essential in dealing with the Chase credit card death of account holder circumstances.

To cancel a Chase credit card after someone passes away, you must contact Chase directly. Provide them with the necessary information about the deceased, including their account details. You may also need to submit a copy of the death certificate. This process helps resolve any concerns relating to the Chase credit card death of account holder efficiently.

It is important to notify Chase as soon as possible following the death of the account holder. This timely action helps prevent unauthorized charges and protects the estate. Typically, you should reach out to the bank within a few days. Handling the Chase credit card death of account holder situation quickly ensures that everything is managed properly.

When a credit card holder dies, the credit card account typically goes into a sort of limbo. The outstanding balance does not simply vanish. Instead, creditors may seek payment from the deceased's estate, and authorized users may find themselves in a complicated position. Addressing the Chase credit card death of account holder quickly and efficiently helps ensure a smoother transition during this difficult time.

Yes, it is often advisable to cancel credit cards when someone dies. This helps prevent unauthorized use of the account and protects any remaining assets. Properly addressing the Chase credit card death of account holder is crucial to managing finances post-passing. It can also help begin the process of settling the deceased's estate.

To cancel a Chase credit card after the death of the account holder, start by gathering the necessary documents, such as the death certificate. You should contact Chase customer service directly and inform them of the account holder's passing. They will guide you through the process to ensure all outstanding balances are addressed in light of the Chase credit card death of account holder.

In general, you may not be directly responsible for your husband's credit card debts if he passes away, especially if the credit cards are solely in his name. However, if you are a co-signer or an authorized user, the situation changes. In such cases, you may have to address the debts tied to the Chase credit card death of account holder. Consulting with a financial advisor or legal professional can help clarify your obligations.

Generally, you do not need to send a death certificate to credit bureaus directly. However, credit card companies like Chase might require it when settling the account. It’s wise to keep your documentation organized and consult with legal professionals to understand any specific needs based on individual circumstances.

When a credit card holder dies, the account may be frozen to prevent further transactions. The estate becomes responsible for any outstanding balances, and the executor should manage these debts. If there are co-signers, they may be held accountable as well. Communicating with organizations like Chase is crucial during this time.

If a credit card holder dies, the first step is to notify the credit card issuer, like Chase. The bank will guide you through the procedures, which usually involve freezing the account and reviewing the outstanding balances. It's important to manage this process properly to protect the estate and settle debts appropriately.